Tax Outlook Series: Election Scenarios

June 4, 2024

Lawmakers are gearing up to take on major tax issues, as several key provisions of the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire after 2025.

- In the coming weeks, CREFC will cover political and policy dynamics shaping the conversation, starting with how the election’s outcome will shape the tax debate.

- CREFC Forums will be considering key tax policies impacting commercial real estate. An email will go out to all forum members after the annual June conference to solicit interest in a tax-focused working group. Click here to ensure you’re registered with a Forum.

Why it matters: Overall, races for the Presidency, Senate, and House could break for either party. Major issues like top corporate and individual tax rates may turn more sharply on the mix of party control, but more targeted tax policy could be nuanced regardless of party dynamics.

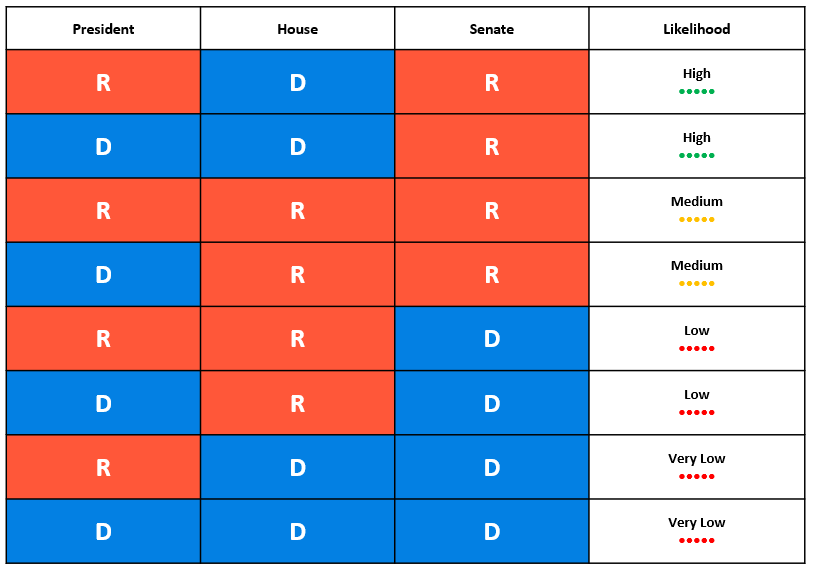

Scenarios: The chart below maps out all possible scenarios with a “likelihood” rating from National Journal. Note that while some scenarios may be more likely, the narrow margins in each chamber make any mix of control plausible.

Republicans are currently favored to win the Senate. Democrats are thought to have a slight edge in the House, though many swing district retirements have been Dems, not the GOP. The presidency is essentially a toss-up.

One-Party Control Scenarios: Even with complete party control, a President can have difficulty getting priorities passed.

A tax bill can be passed more easily through the “reconciliation process,” which lowers the Senate threshold to a simple majority rather than the 60 votes needed to overcome a filibuster. The GOP used reconciliation to pass the TCJA and Democrats used it to pass the Inflation Reduction Act (IRA).

- GOP Control: House Republicans have indicated they intend to move quickly on extending the TCJA, possibly as early as February. There could be rollbacks on some IRA-related tax provisions, both on the revenue and spending side. Still, a growing number of populist GOP senators could push for reviving the Child Tax Credit.

- Dem Control: President Biden is running on raising taxes on corporations and the wealthy, and a unified government would give him some runway to tweak capital gains and wealth taxes. The administration also consistently seeks to roll back 1031 like-kind exchanges for real estate. Housing, climate, and sustainability tax incentives could also be priorities. Even then, moderates Dems in the House and Senate could water down or nix some of the more progressive provisions.

- In either scenario, the margins in both chambers will matter. A narrow Senate majority could elevate a moderate senator as a key dealmaker. However, Sen. Joe Manchin (I-WV) and Kyrsten Sinema (I-AZ) are retiring, which means a Dem majority will likely be more progressive. Recall that Sinema was a deciding vote on preserving the carried interest tax treatment.

Divided Government: Any scenario with a divided government will both slow down and moderate tax policy.

- However, the expiration of key TCJA provisions incentivizes action on both sides of the aisle (the Bush Tax Cuts were extended in 2012 with a divided government). Note, the State and Local Tax (SALT) deduction limitation will expire without action. Expect Blue state moderates to leverage their positions to allow its expiration.

- Beyond the expiring provisions, there is hope for bipartisan action on key priorities. The Smith-Wyden tax bill passed the House this year; it is languishing in the Senate partly due to the GOP senators being cut out of deal-making and partly due to election dynamics.

- But the strong support in the House, in a sharply partisan Congress, demonstrates there is political appetite for advancing key priorities, even if they are limited in scope.

Expiring Provisions: The mix of expiring TCJA provisions is heavy on the individual side while the business provisions would mainly be the 20% pass-through tax deduction.

- Individual: The expiring provisions include the elimination of personal exemptions for taxpayers and dependents and increases in both the standard deduction and the size of the child tax credit. Changes to various itemized deductions and the alternative minimum tax will also expire.

- Business: The expiring provisions affect the expensing of business investment and the 20% deduction for certain business income. Several other provisions related to cross-border business activity are also scheduled to change over the next several years. An employer credit for paid medical and family leave will also expire.

- Estate Tax: The federal estate tax exemption is $13,610,000 for 2024 but will revert to an inflation-adjusted $5.6 million.

What’s next: Over the summer we’ll cover in more detail the expiring provisions; Biden’s and Democratic tax proposals; Trump’s and Republican tax proposals; and key tax policies for CRE.

Contact David McCarthy (dmccarthy@crefc.org) with questions).