CRE Securitized Debt Update

July 22, 2025

Four transactions totaling $2.1 billion priced last week:

- BBCMS 2025-5C36, a $613.5 million conduit backed by 31 five-year loans secured by 163 properties from Barclays, LMF Commercial, Citi, UBS, Starwood, SocGen, DB, and Zions.

- MSBAM 2025-C35, a $597.8 million conduit backed by 40 10-year loans secured by 65 properties from BofA, Argentic, Morgan Stanley, Citi, and Starwood.

- P11 2025-P11, a $450 million SASB backed by a fixed-rate, five-year loan to Vornado Realty Trust to refinance the 1.2 million-sf PENN 11 office building, at 11 Pennsylvania Plaza in Midtown Manhattan.

- COMM 2025-SBX, a $435 million SASB backed by a fixed-rate loan for Daniels Real Estate and Nitze-Stagen to refinance Starbucks’ headquarters in Seattle. The loan is structured with a five-year ARD period following the initial three-year IO term.

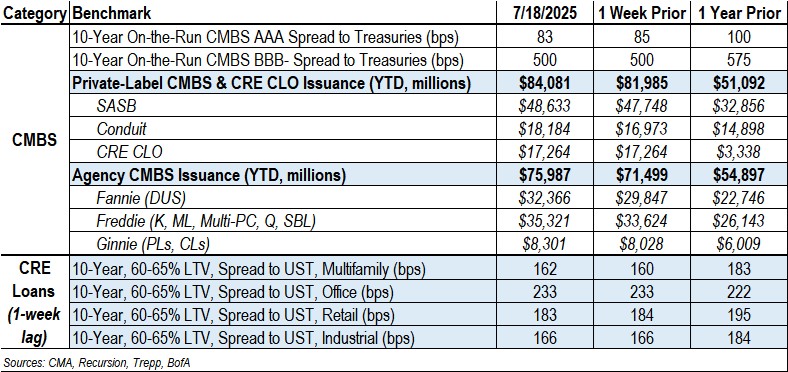

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $84.1 billion, representing a 65% increase from the $51.1 billion recorded for same-period 2024.

Spreads Narrow

- Conduit AAA and A-S spreads both tightened by 2 bps to +83 and +113, respectively. YTD, they both remain wider by 8 bps.

- Conduit AA and A spreads were unchanged at +160 and +200, respectively. YTD, they are wider by 25 bps and 35 bps, respectively.

- Conduit BBB- spreads were unchanged at +500. YTD, they are wider by 75 bps.

- SASB AAA spreads were tighter by 2 - 4 bps to a range of +103 to +130, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +135 and +375, respectively.

Agency CMBS

- Agency issuance totaled $4.5 billion last week, comprising $2.5 billion of Fannie DUS, $1.7 billion of Freddie K, SB, and Multi-PC transactions, and $273.2 million of Ginnie Mae transactions.

- Agency issuance for the year totaled $76 billion, 38% higher than the $54.9 billion for the same period last year

June 2025 Delinquency Update

CMBS

- The combined conduit and SASB delinquency rate was 7.13% in June, up 5 bps from the prior month. This was the fourth consecutive monthly increase, following increases of 5 bps and 38 bps in May and April, respectively.

- The office delinquency rate rose 49 bps in June to 11.08% and remains the highest delinquency rate among all property types.

- Loans in special servicing increased 27 bps to 10.57% in June. The special servicing rate has increased in 16 of the last 18 months and is up 234 bps year-over-year.

CRE CLOs

- The share of CRE CLO loans at least 30 days delinquent declined 70 bps in June to 5.35%, while transfers to special servicing dropped 94 bps to 6.11%, according to KBRA Credit Profile, a division of KBRA Analytics.

- The improvements in delinquency and special servicing rates can be attributed to increased issuance in the CRE CLO market, which drives the denominator used to calculate the rates higher.

Contact

Raj Aidasani (

raidasani@crefc.org) with any questions.