CRE Securitized Debt Update

July 1, 2025

Private-Label CMBS and CRE CLOs

Three transactions totaling $1.6 billion priced last week:

- VDCM 2025-AZ, a $735 million SASB backed by a fixed-rate, five-year loan for Vantage Data Centers to refinance three recently constructed data centers in Goodyear, AZ.

- BANK5 2025-5YR15, a $556.3 million conduit backed by 31 five-year loans secured by 68 properties from Morgan Stanley, BofA, JPMorgan, and Wells.

- GSAT 2025-BMF, a $330 million SASB backed by a floating-rate, five-year loan (at full extension) for Buckingham Cos. to refinance seven multifamily properties totaling 2,381 units in five states.

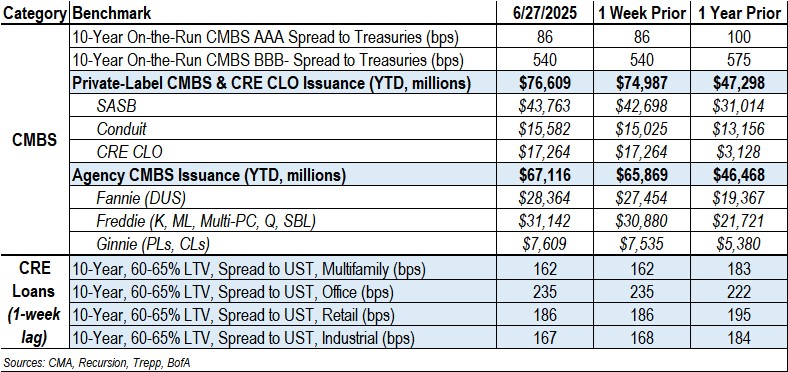

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totals $76.6 billion, representing a 62% increase from the $47.3 billion recorded for same-period 2024.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +86 and +115. YTD, they are wider by 11 bps and 10 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +205. YTD, they are wider by 25 bps and 40 bps, respectively.

- Conduit BBB- spreads were unchanged at +540. YTD, they are wider by 115 bps.

- SASB AAA spreads were tighter by 1 - 3 bps to a range of +110 to +138, depending on property type. YTD, they are wider by 3-21 bps.

- CRE CLO AAA and BBB- spreads were unchanged at +145 and +390, respectively.

Agency CMBS

- Agency issuance totaled $1.2 billion last week, comprising $910.3 million of Fannie DUS, $262.2 million of Freddie Multi-PC transactions, and $74.4 million of Ginnie transactions.

- Agency issuance for the year totaled $67.1 billion, 44% higher than the $46.5 billion for the same-period 2024.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.