CRE Securitized Debt Update

July 15, 2025

Private-Label CMBS and CRE CLOs

Four transactions totaling $3.2 billion priced last week:

- BX 2025-VLT7, a $1.5 billion SASB backed by a floating-rate loan for Blackstone’s QTS to refinance two new, single-tenant data centers in Atlanta and Sandston, VA. The loan will have a term of two years, with three one-year extension options prior to the Anticipated Repayment Date, followed by two additional one-year options.

- BBCMS 2025-C35, a $795.3 million conduit backed by 33 10-year loans secured by 80 properties from Barclays, UBS, DB, JPM, Starwood, SocGen, Goldman, BofA, and LMF Commercial.

- WFCM 2025-5C5, a $596 million conduit backed by 32 five-year loans secured by 46 properties from Wells, Argentic, Citi, UBS, BMO, Greystone, Zions, Benefit Street, and Natixis.

- WFCM 2025-AGLN, a $300 million SASB backed by a floating-rate, five-year loan (at full extension) for Agellan, a subsidiary of Almadev, on 28 industrial properties and one office property totaling 4.2 million sf in seven states.

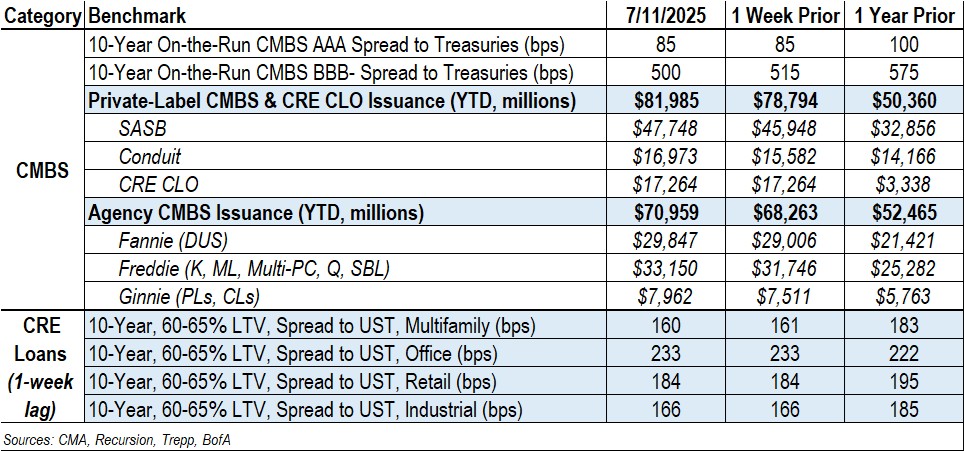

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $82 billion, representing a 63% increase from the $50.4 billion recorded for the same period in 2024.

Spreads Hold Steady

- Conduit AAA and A-S spreads were unchanged at +85 and +115. YTD, they are both wider by 10 bps.

- Conduit AA spreads were unchanged at +160 while A spreads were tighter by 5 bps to +200. YTD, they are wider by 25 bps and 35 bps, respectively.

- Conduit BBB- spreads were tighter by 15 bps to +500. YTD, they are wider by 75 bps.

- SASB AAA spreads were tighter by 1 - 2 bps to a range of +105 to +134, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +135-140 and +375, respectively.

Agency CMBS

- Agency issuance totaled $2.7 billion last week, comprising $1.4 billion of Freddie K, ML, and Multi-PC transactions, $841 million of Fannie DUS, and $450.7 million of Ginnie transactions.

- Agency issuance for the year totaled $71 billion, 35% higher than the $52.5 billion for the same period last year.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.