Forum Spotlight: Portfolio Lenders

October 24, 2023

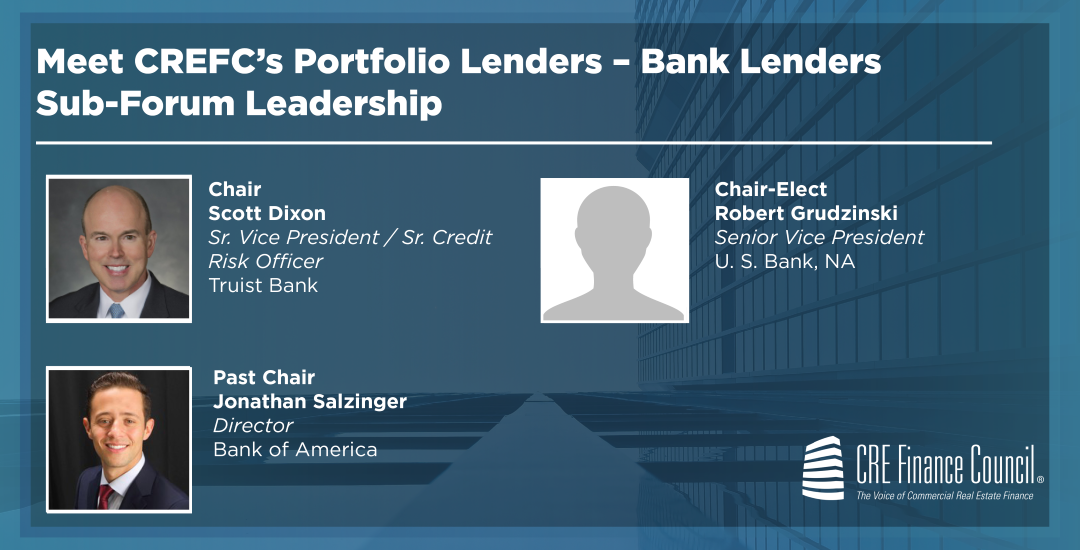

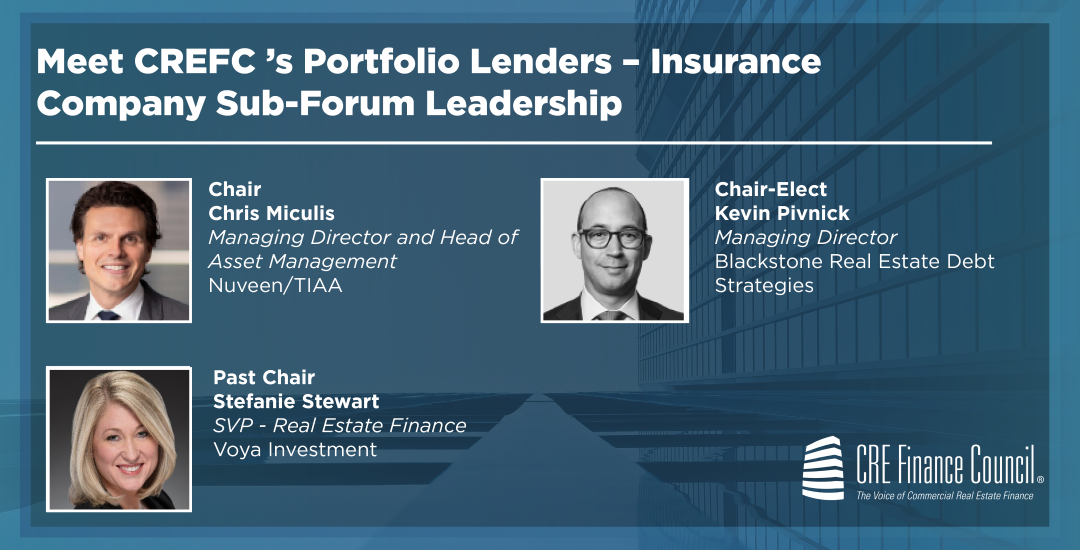

Together, Scott, Robert, Jonathan, Chris, Kevin, and Stefanie form the Leadership Working Group for CREFC’s Portfolio Lenders Forum. Importantly, this group sets the agendas and priorities for the Forum, as well as represents their constituencies on CREFC’s Policy Committee.

Key Portfolio Lender Focus Areas

Valuation and Rates. Declines in valuations and loan risk ratings continue, due to higher interest rates, disciplined underwriting, and challenging market fundamentals. Increasing operating expenses, particularly insurance and real estate taxes, continue to impact more asset classes and submarkets.

Lending Pipeline and Appetite. Despite the slower pace of rising rates, the market continues to adjust to expectations of ‘higher-for-longer’ rates.

The result:

Asset Management. Maturing loans are facing refinance risk from increased cap costs and tight debt yield and DSCR metrics.

-

Liquidity constraints in the debt capital markets, combined with borrowers’ reduced willingness and ability to invest capital, requires incumbent lenders to face difficult choices. Health of the CMBS market remains important to the industry, as it’s the only source of takeout debt in some cases.

Capital Markets: Members are monitoring stress in the banking sector closely, given dependence on banks for a fully functioning marketplace and sensitivity of the sector to interest rates.

What They’re Saying: Conversations at CREFC’s June conference focused on both macro-economic considerations and micro matters affecting the availability and appetite of banks and insurance companies to make loans, including the:

-

Regulatory environment,

-

Balance sheets, and

-

Capital treatment.

Mortgage-loan exposure often presents lower relative value versus liquid CRE investments, while long-term loans are difficult to source.

Key Policy Committee matters:

-

SEC’s C&DI Letter regarding timing of filings

-

Bank Capital Requirements

-

SEC Climate Reporting

-

Beneficial Ownership Reporting

-

NAIC Ratings

-

Fed Guidance

-

FDIC monitoring

What's Next? Forum leaders look forward to presenting CREFC members with an update on their forum at the Annual January Conference in Miami. Soon after, the chairs will seek nominations for the next Chair Elect to join their leadership slate.

To join the Portfolio Lenders Forum, please register here. For any forum related questions, please contact Kathleen Olin at kolin@crefc.org.

Contact

Lisa Pendergast

Executive Director

646.884.7570

lpendergast@crefc.org

Raj Aidasani

Managing Director, Research

646.884.7566

raidasani@crefc.orgThe information provided herein is general in nature and for educational purposes only. CRE Finance Council makes no representations as to the accuracy, completeness, timeliness, validity, usefulness, or suitability of the information provided. The information should not be relied upon or interpreted as legal, financial, tax, accounting, investment, commercial or other advice, and CRE Finance Council disclaims all liability for any such reliance. © 2023 CRE Finance Council. All rights reserved.