Debt Ceiling Deal Closes

June 5, 2023

After Memorial Day weekend negotiations, the President and House Speaker Kevin McCarthy announced a debt ceiling deal that suspends the limit until January 2025 and implements a number of spending and policy reforms. The House and Senate passed the bill in short order, and Biden signed the legislation on June 3 before the June 5 “X date.”

Why it matters: The deal averts an economic crisis where the U.S. government would run out of cash and potentially default on its debt.

By the numbers: This bill increases the federal debt limit, establishes new discretionary spending limits, rescinds unobligated funds, and expands work requirements for federal programs. Highlights include:

- Debt ceiling is suspended until January 1, 2025 and increases the limit on January 2 to accommodate what has been spent. But that doesn’t mean Jan. 2 is the X date. Treasury will be able to use extraordinary measures to continue paying bills after hitting the limit.

- Spending caps for 2024 and 2025 budgets and suggested (not mandated) targets for the next 8 years. 2024 discretionary spending (non-defense) would be ~last years levels. FY 2025 would be capped at 1% growth, which amounts to a spending cut when considering inflation. The savings over 10 years is ~$1 trillion.

- Automatic spending cuts to the 2024 and 2025 budgets will occur if Congress doesn’t pass the 12 appropriation bills by end of year. This raises the stakes for Congress to get its work done, but it won’t automatically prevent a government shutdown if no agreement is reached. However, Congress could always change the rules in a continuing resolution.

- Student loan payments will restart by the end of August, but the Biden administration may still implement its $10,000 to $20,000 loan forgiveness program if the Supreme Court allows it to proceed.

- The remaining items include expanded work requirements for food and income assistance, clawing back $30 billion in unspent COVID funds, energy project permitting reform, and rescinding part of the funding increase to the IRS passed through the Inflation Reduction Act.

What they’re saying: After the deal was announced, the conservative wing of the House started to push back on the deal and complained it did not go far enough. Similarly, some Senate conservatives threatened to use procedural objections to bog down the process in that chamber. The House conservatives were unable to block the bill and the Senate negotiated votes on several amendments in order to speed up the time to vote.

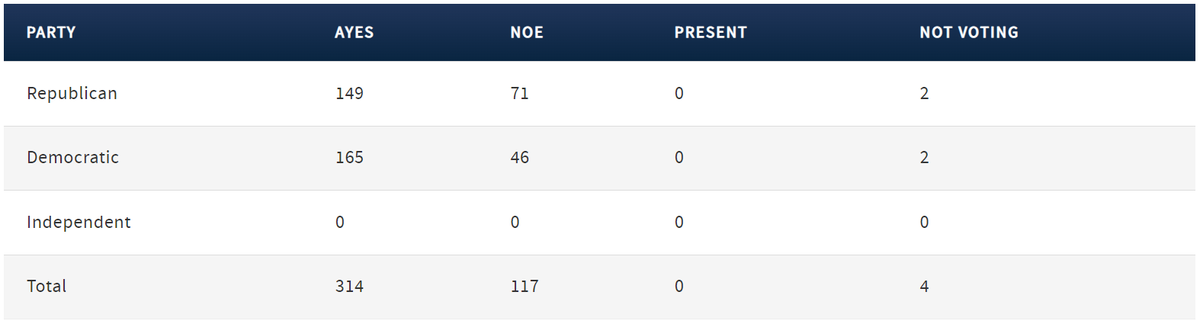

Yes, but: Democratic support has always been part of the vote math here. And Dem support was critical in both chambers. The Senate passed it 63-36, with 32 GOP and 4 Dems voting “no.” The House passed it 314-117 with the following breakdown.

The House voting breakdown on the debt ceiling. More Democrats supported passage.

What’s next: The debt ceiling debacle is resolved for the next two years, but the discussion on government spending will continue as Congress rolls up its sleeves to pass appropriations.

The bottom line: The press is sorting through the political winners and losers, but Speaker McCarthy seems to have emerged without a challenge to leadership. While Biden and Democrats ultimately had to move from their hard line of a clean debt ceiling increase, some are optimistic that this deal could pave the way for other bipartisan action in a divided government.

Contact David McCarthy (dmccarthy@crefc.org)with questions.