Economy, the Fed, and Rates…

May 6, 2025

The Economy, the Fed, and Rates…

Economic Data

- GDP contracted 0.3% in Q1 2025, driven by a 41.3% surge in imports as businesses front-loaded shipments ahead of President Donald Trump's tariffs – imports subtracted five percentage points from GDP growth, marking the largest drag from net exports on record dating to 1947.

- April jobs report exceeded expectations with 177,000 jobs added vs. 133,000 expected, while unemployment held steady at 4.2%. "This jobs print came too early to capture the blow from 'Liberation Day' tariffs – we expect to see much weaker readings in coming months," said Bloomberg Economics.

- ISM Manufacturing PMI surprised to the upside in April, falling less than expected. However, production slowed along with supplier deliveries, while prices accelerated.

- Supply chain disruptions are mounting, with the Port of Los Angeles expecting shipments to drop 35% this week year-over-year. "It's almost like we're speeding towards a brick wall, but the driver of the car doesn't see it yet," noted a toy company CEO.

- McDonald's reported a 3.6% drop in U.S. same-store sales, the biggest quarterly decline since COVID, as uncertainty weighs on consumer spending. "Even $5 value meals have struggled to tempt customers," FT reported.

Federal Reserve Policy

- Fed poised to keep funds rate steady at 4.25 – 4.50 % on May 7, arguing that tariff induced inflation is a supply shock it can "look through" if jobs hold up.

- Markets are pricing in four quarter-point rate cuts this year, though the strong jobs report has prompted economists to push back timing expectations. Barclays and Goldman Sachs now forecast the first cut in July rather than June.

- Treasury Secretary Scott Bessent suggested the Fed should consider cutting rates, noting "two-year rates are now below fed-funds rates. So that's a market signal that they think the Fed should be cutting" – a rare comment on monetary policy from Treasury.

- Fed has "three tools to fight tariff-related inflation, none are ideal," according to analysts: raising rates (won't reverse tariffs), holding steady (allows inflation expectations to drift), or cutting rates (may reinforce price increases).

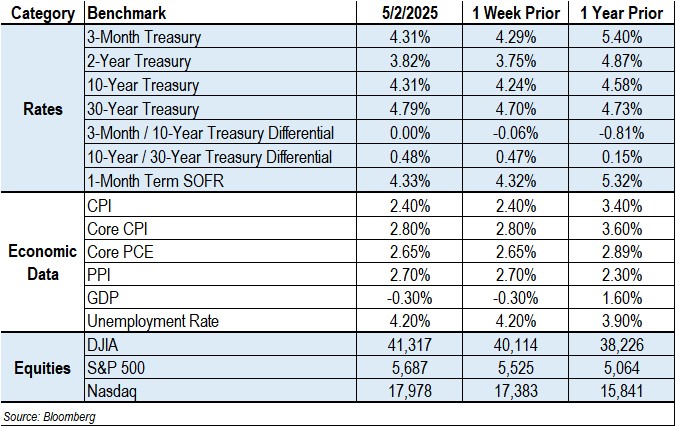

Treasury Yields and Markets

- 10-year Treasury yields rose to 4.31%, up 7 bps on the week, as strong economic data offset flight-to-quality flows from tariff concerns. Two-year yields jumped 8 bps to 3.82% after traders scaled back rate cut expectations.

- China quietly diversifies from U.S. Treasuries, with holdings down 27% since January 2022 to $759 billion. Officials are exploring agency CMBS and other alternatives amid concerns that "the safety of U.S. Treasuries is no longer a given."

- S&P 500 extended its winning streak to 10 consecutive days, the longest since 2004, erasing all losses from April's tariff shock. The index is still down 8% from its high reached on February 19.

Implications for CRE Finance

- Capital flows may prove a tailwind for agency multifamily. China's pivot toward Fannie/Freddie paper and "private equity to commercial real estate and infrastructure such as data centers," suggests incremental demand for agency CMBS and core plus assets.

- Retail property fundamentals are at risk, with major chains reporting sales declines and empty shelves looming. This could pressure retail performance, particularly for properties anchored by discretionary retailers.

- Office sector vulnerability could be extended as companies freeze hiring and expansion plans amid uncertainty. "Nobody knows anything. We are in no man's land," summarized one CIO, suggesting office CMBS refinancing risk may increase as leases expire into this uncertain environment.

You can download CREFC's one-page MarketMetrics, which includes statistics covering the economy and the CRE debt capital markets, here.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.