CRE Securitized Debt Update

May 20, 2025

Seven transactions totaling $7.5 billion priced last week:

- ALA 2025-OANA, a $2.4 billion SASB backed by a floating-rate, five-year loan (at full extension) for a joint venture led by Brookfield to refinance the 2.7 million-sf Ala Moana Center in Honolulu.

- MF1 2025-FL19, a $1.3 billion CRE CLO sponsored by MF1. The managed transaction is comprised of four whole loans and 21 loan participations secured by 82 multifamily properties in 18 states.

- BSPDF 2025-FL2, an $894.4 million CRE CLO sponsored by Benefit Street Partners Real Estate Opportunistic Debt Fund. The managed transaction is comprised of three whole loans and 35 loan participations secured by 62 properties in 15 states. The top three property types are multifamily (61.3%), hotel (19.3%), and industrial (15%).

- BX 2025-LIFE, an $869.3 million SASB backed by a fixed-rate, 10-year loan for Blackstone’s BioMed Realty unit on eight life-sciences buildings in the Boston area.

- ARCLO 2025-BTR1, an $801.9 million CRE CLO sponsored by Arbor Realty SR, Inc. The managed transaction is comprised of 21 loans secured by 21 multifamily properties.

- BSTN 2025-1C, a $650 million SASB backed by a fixed-rate, seven-year loan for Carr Properties and National Real Estate Advisors to refinance the recently constructed One Congress office tower in downtown Boston.

- WFCM 2025-5C4, a $581.6 million conduit backed by 32 five-year loans secured by 82 properties across 16 states from Wells, Citi, LMF, Argentic, and JPMorgan.

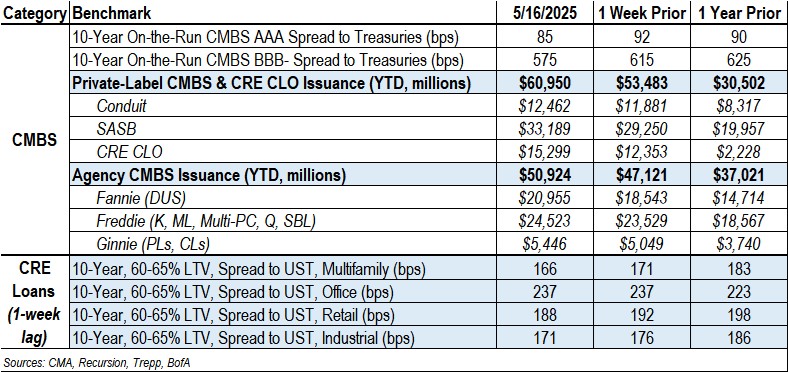

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totals $61 billion, representing a 100% increase from the $30.5 billion recorded for same-period 2024.

Spreads Rally

- Conduit AAA and A-S spreads tightened by 7 bps and 5 bps to +85 and +130, respectively. YTD, spreads are wider by 10 bps (AAA) and 25 bps (A-S).

- Conduit AA and A spreads were tighter by 35 bps and 40 bps to +170 and +225. YTD, they are wider by 35 bps and 60 bps, respectively.

- Conduit BBB- spreads were tighter by 40 bps at +575. YTD, they are wider by 150 bps.

- SASB AAA spreads were tighter by 10 - 17 bps to a range of +115 to +140, depending on property type. YTD, they are wider by 8 - 23 bps.

- CRE CLO AAA were tighter by 15 bps to +150, while BBB- spreads were unchanged at +425.

Agency CMBS

- Agency issuance totaled $3.8 billion last week, comprising $2.4 billion of Fannie DUS, $993.8 million of Freddie Multi-PC and SBL transactions, and $396.2 million of Ginnie Mae transactions.

- Agency issuance for the year totaled $50.9 billion, 38% higher than the $37 billion for the same period last year.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.