CRE Finance World Winter 2016

6

A

The Case Against a Commercial

Real Estate Bubble

Shan Ahmed

Analyst

Reis, Inc.

Michael Steinberg

Associate

Reis, Inc.

Ryan Severino

Senior Economist and

Director of Research

Reis, Inc.

financial bubble is generally defined as trading in an asset

market at a price or price range that significantly deviates

from the corresponding asset market’s intrinsic value.

It could also be described as a situation in which asset

prices appear to be based on improbable, aspirational, or

inconsistent views about the future. Bubbles are insidious things.

They are incredibly difficult to spot in advance because it is often

difficult to determine intrinsic value on a real-time basis. Therefore,

it is almost always only after the fact of a bubble bursting that it

becomes apparent that one even existed. Even as the commercial

real estate (CRE) market stared into the face of one in 2008, there

were many who ardently denied the bubble’s existence.

The only good thing about bubbles (if there is any such good thing)

is that they provide useful guides to determine if a market has

entered another bubble. Therefore, by using the most recent CRE

bubble as a benchmark, the current market environment can be

analyzed to determine if another bubble has formed, or is potentially

forming. When this analysis is performed, it is apparent that the

current situation is not representative of a bubble.

What Qualifies as a Bubble?

In CRE what qualifies as a bubble? What should be used to determine

if intrinsic value is misaligned with current values? Comparing a

pure valuation metric such as price per square foot or price per

unit can be misleading since values tend to rise over time, if for no

other reason than inflation. Therefore, ceteris paribus, one should

expect real estate values to trend upward over time. Empirically,

that is generally observed. However, we can compare cap rates,

which are defined as the ratio of net operating income (NOI) to

value, because both NOI and values tend to rise over time due

to the systematic impact of inflation on both, providing a better

assessment of value. Moreover, cap rates are frequently the key

pricing metric that investors use to determine the intrinsic value

of a property. As a general rule, the lower the cap rate, the greater

the perception that market values have risen above intrinsic values

because of the inverse relationship between value and yield.

Therefore, this examination will compare the current cap rate

environment to that of the bubble years from before the recession to

determine if the market is currently experiencing another valuation

bubble. Specifically, it will look at the constituent components

of cap rates to help determine if intrinsic values are aligned with

current valuations.

Current Cap Rates Versus Bubble Cap Rates

The first step in this process is to compare the current cap rate

environment with the previous bubble’s cap rates across property

types. For this purpose, we employ cap rates from the three major

property types — apartment, office, and retail. We will compare cap

rates from 2006, 2007, and 2008 (when the CRE bubble finally

burst after the implosion of Lehman Brothers) with cap rates from

the last few years — 2013, 2014, and 2015. Therefore 2006 will be

compared to 2013, 2007 to 2014, and 2008 to 2015. These years

were chosen not only because we want to compare the current

environment to that during which the bubble burst, but also because

the recovery/expansion periods in the economy are of similar length

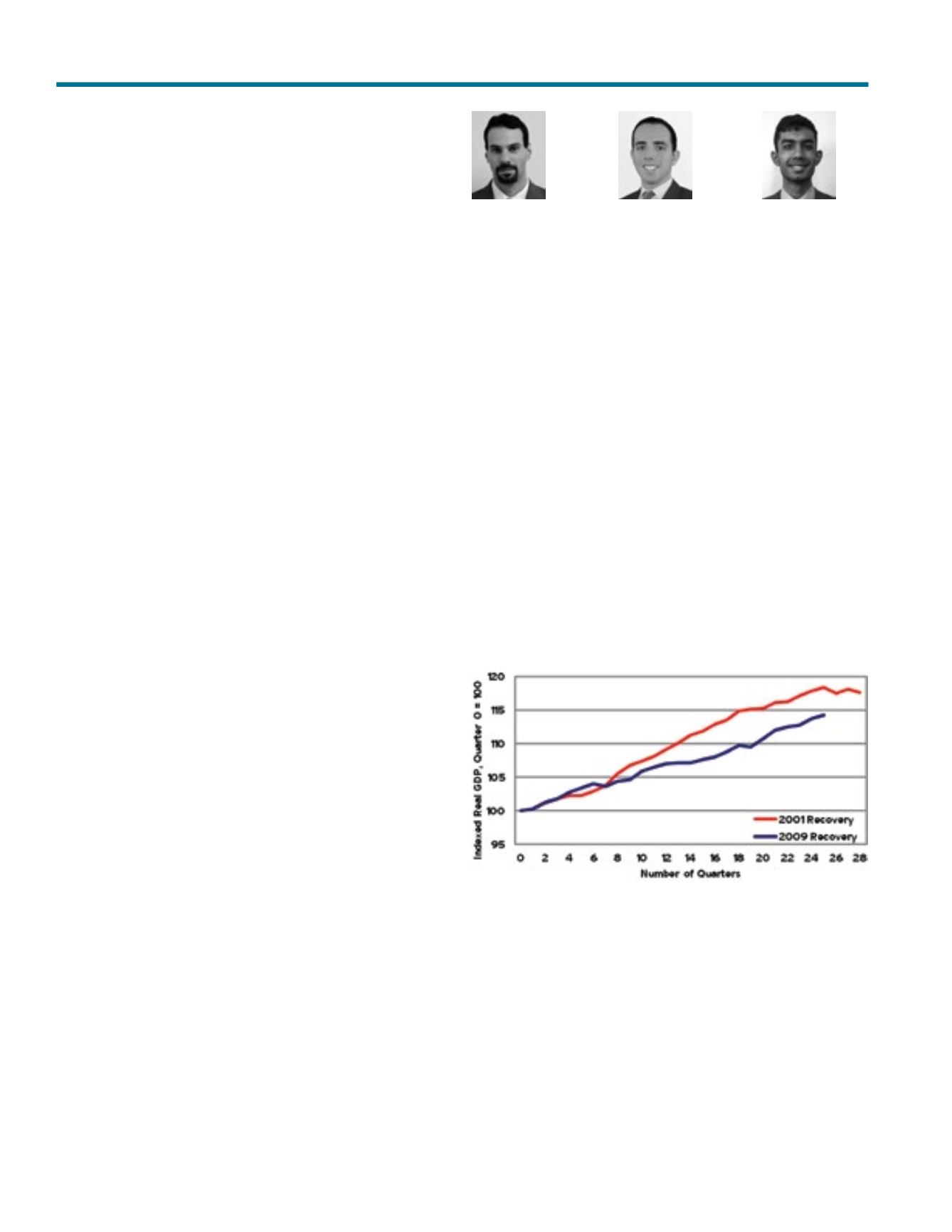

and make for an apt comparison. After the

dot.comrecession of

2001 ended, there were 28 quarters until the CRE bubble burst.

In contrast, there are 26 quarters between the end of the Great

Recession and the current quarter, the fourth quarter of 2015. This

comparison is shown in Exhibit 1. Because the fourth quarter has

not yet ended, there is no growth rate for real GDP yet.

Exhibit 1

Comparison of Two Recoveries

The aim is not to imply that a bubble is imminently about to burst,

but to contrast the environment leading up to the bursting of the

bubble from the last decade with the environment leading up to

today. We utilize 12-month rolling cap rates because 2015 has not

yet ended so the full calendar-year cap rate is not available. For

the other time periods the 12-month rolling cap rate is the average

cap rate for each calendar year. The simple differences between

calendar year cap rates show how remarkably similar today’s cap

rates are to cap rates from before the Great Recession. These are

shown in Exhibit 2.