CRE Finance World Winter 2016

12

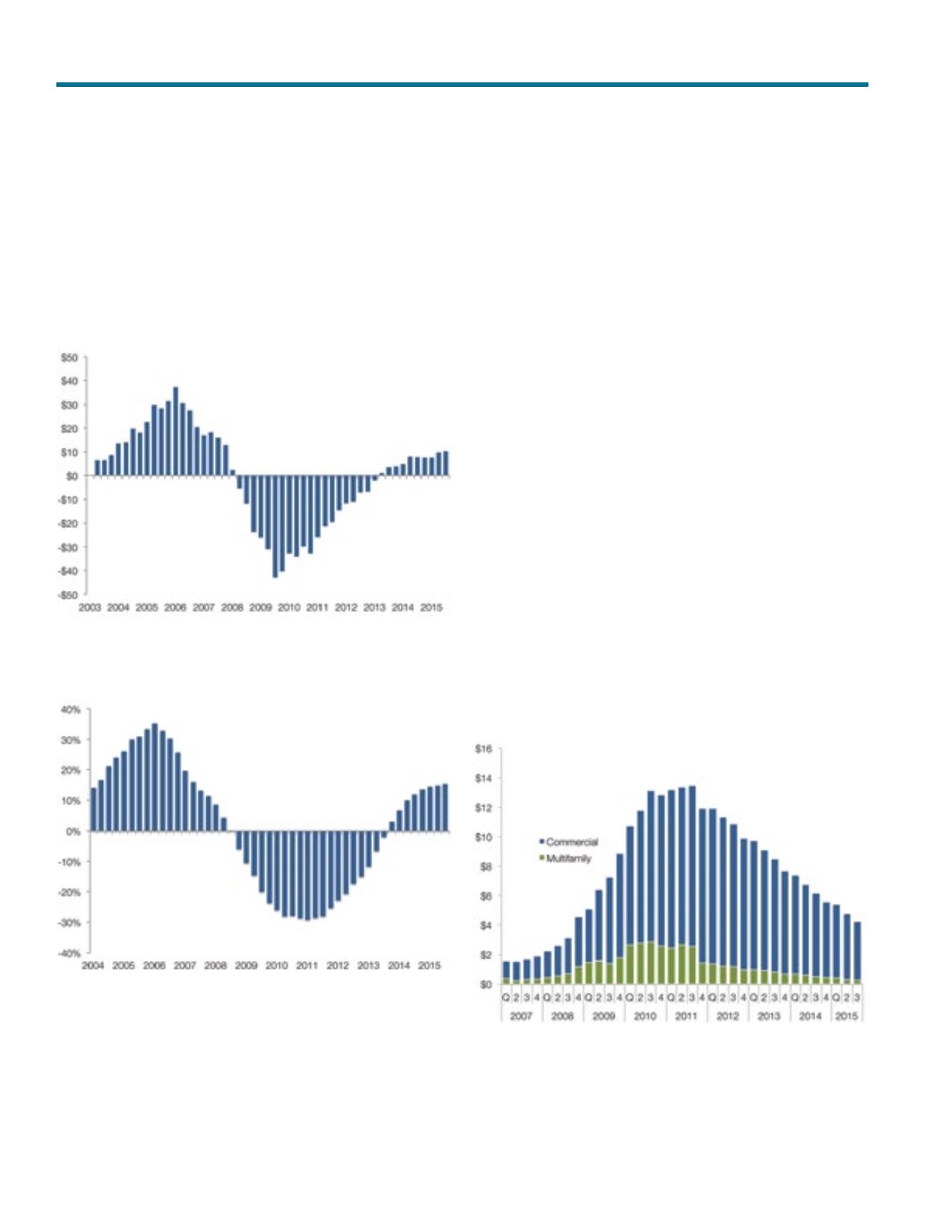

Chart 5

Quarterly Change in Construction Loans Held on Bank Balance Sheets

Source: FDIC, Call Reports, Chandan

In Billions

Chart 6

YoY Percent Change in Construction Loans Held on Bank Balance Sheets

Source: FDIC, Call Reports, Chandan

In Billions

While the pace of construction lending is increasing, it continues

to lag historical recoveries. Banks’ total construction exposure was

$266.1 billion in the third quarter, still a far cry from the 2008 peak

of $626.5 billion. In the years after the dot-com recession, growth

in year-over-year construction lending peaked at well above 30%.

Reflecting an ambiguous balance of regulatory pressures and lim-

ited need for additional inventory, construction lending is growing

at half its former record-setting pace. There are exceptions, most

notably New York City’s office building boom, but smaller banks

play a limited role in this segment of the market.

Bank Real Estate Owned and Restructuring

Distress investors with capital to deploy will do better with pending

CMBS maturities, where persistent concerns about pending legacy

maturities are a direct rather than indirect driver of the analysis. As

of the third quarter, commercial and multifamily other real estate-

owned (REO) had fallen to $4.2 billion, roughly one quarter of its

peak level in 2010. Whether through write-downs or modifications

or improvements in market conditions, the bulk of moderate quality

and high quality properties have found their way out of distress.

Exceptionally high recovery rates on early REO sales reflect that

better quality investments were jettisoned early by banks. Little of

what now remains holds institutional appeal.

Chart 7

Bank Commercial and Multifamily Real Estate Owned (REO)

Source: FDIC, Bank Call Reports, Chandan

In Billions

Continued Slow Growth in Bank Construction Lending