CRE Finance World Winter 2016

10

T

Continued Slow Growth in

Bank Construction Lending

he readiness of US banks to participate in the commercial

real estate lending market improved in 2015. Healthier

balance sheet positions, rising asset prices, and a

brightening outlook for fundamentals all contributed to

swifter matchmaking between lenders and their borrowers.

This progress did not occur in isolation, however. Lenders of all

stripes, including conduit participants and non-bank financial

institutions, were also more vigorous in their engagement with

borrowers. The result was observably higher risk-taking for banks

that, competing with other classes of lenders as well as with each

other, faced a practical choice of pushing the underwriting envelope

or ceding opportunities and market share.

In contrast with stabilized property lending, small- and medium-balance construction financing remained a weakly contested

segment of the market in 2015, largely free of competitive

pressures from geographically remote balance sheet lenders and

from the conduit. That continues to suit regional and community

banks perfectly well. Following the post-crisis drought in building

activity, opportunity knocks once again. As of Q3 2015, banks

have increased net construction lending for ten consecutive

quarters. The magnitude of the increases is measured however.

As compared to historic norms, subdued expansion in construction

lending reflects plodding improvements in the number of viable

small- and mid-cap development projects. The impact of higher

risk weights on the banking system’s construction lending capacity

is almost certainly a factor as well. The extent of its drag should

become clearer in 2016.

Cyclical Attention to Risk Fades

Data from the most recent slate of bank call reports and from

Chandan Economics’ independent mortgage data collection show

sustained trends in bank lending heading into the new year: both

small and large banks are growing their positions in commercial

real estate and construction; the lending market is increasingly

crowded and many banks are losing market share; to stave off that

competition, the risk profile of recently originated loans is often

markedly higher than for loans made just a few years ago; and, in

contrast with CMBS, drags from banks’ legacy debt are now a de

minimis consideration.

As in past cycles, the medium-term implications of banks’ increasing

risk tolerance are not perfectly observable—or heeded—at the time

of loan-making. Quite the opposite, the current profile of bank

activity suggests they are discounting their own stress testing

regimes in an unsurprising effort to remain competitive. Uneven

regulation across classes of lenders is a complicating factor in that

competitive landscape. Even as our risk models show deterioration

in marginal loan quality, improving property fundamentals and the

shrinking pool of legacy loans are supporting favorable inferences

about the future performance of today’s new exposures.

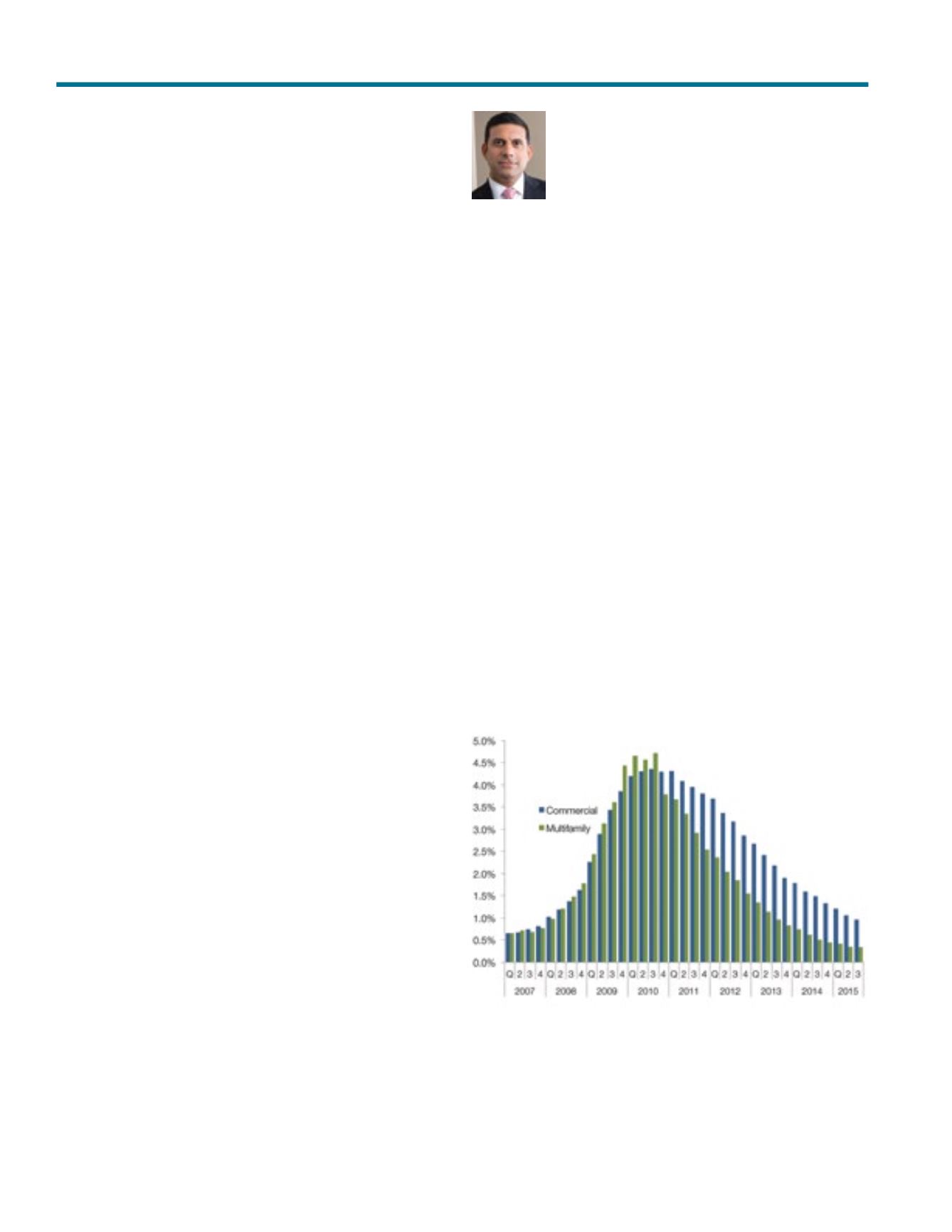

Bank Delinquency and Default Trends

The blended default rate on commercial and multifamily mortgages

held by banks—including loans 90 days or more delinquent and

loans in non-accrual—declined to just 0.8% in the third quarter of

2015, the lowest level since before the financial crisis. Excluding

apartments, the commercial property default rate fell to 1.0%, its

lowest level in more than seven years. The apartment default rate

is now just 0.3%. That is well below Chandan Economics’ estimate

of the long-term structural non-performance rate, centered around

0.5%. Five years earlier, banks’ multifamily default rate had peaked

at 4.7%, higher than for their commercial mortgages. At that time,

banks’ multifamily default rate was also significantly higher than

roughly comparable agency measures of distress, a difference

we attribute principally to selection bias in the apartment sector’s

lender-borrower relationships.

Chart 1

Default Rate for Bank Commercial and Multifamily Mortgages

Source: FDIC, Bank Call Reports, Chandan

Sam Chandan, PhD

The Wharton School and

Chandan Economists