A publication of

A publication of

Winter issue 2016 sponsored by

CRE Finance World Winter 2016

11

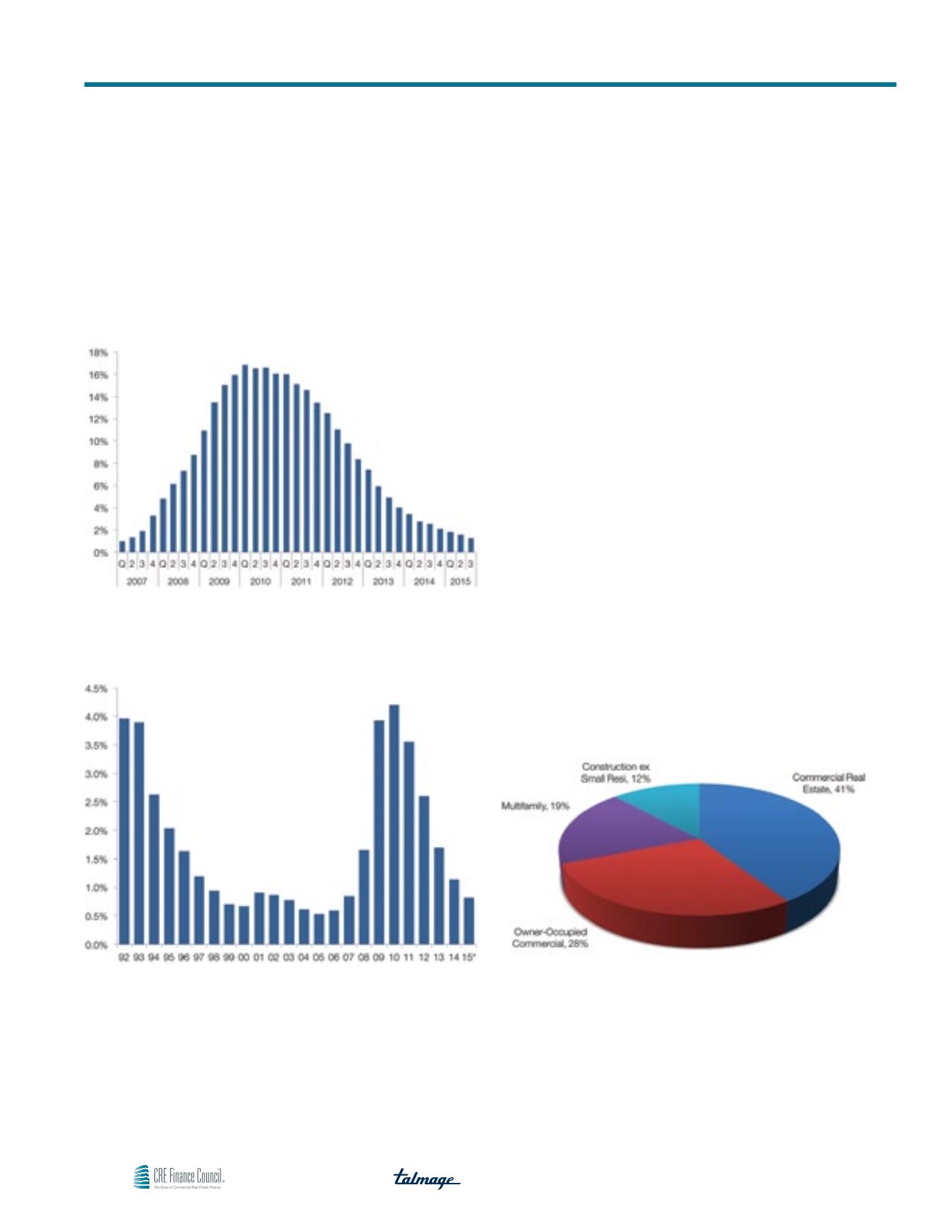

Chart 2

Default Rate for Bank Construction and Development Loans

Source: FDIC, Bank Call Reports, Chandan

Chart 3

Long-Term Default Rate Trends: End-of-Year Default Rate for

Commercial and Multifamily Mortgages Held by Banks

Source: FDIC, Bank Call Reports, Chandan

Note: 2015 through Q3

Bank New Lending Trends

Higher lending volumes have been an important contributor to lower

default rates, which reflect the near-complete dilution of legacy

pre-crisis bank loans as well as the cumulative impact of write-

downs and troubled debt restructurings. Exclusive of multifamily

lending, the balance of commercial mortgages held by banks

increased to $1.2 trillion in the third quarter of 2015, its highest

level on record. The $23.8 billion quarter-to-quarter increase was the

largest in seven years. Multifamily lending also posted its largest

quarterly net increase of the post-crisis era, rising $13.9 billion.

Across both commercial and multifamily mortgages, net lending

has increased by $106.4 billion from a year earlier, a 7.5% expansion

in banks’ exposure to the sector.

Bank Construction Financing

As of the third quarter, small residential properties accounted for

just under 22% of banks’ outstanding construction loans. Across

all projects, including multifamily and commercial real estate devel-

opment, net lending has increased for ten consecutive quarters, by

$64.6 billion over the two and half years since construction financ-

ing’s nadir. Loan-to-cost ratios have trended slightly higher but

understate the risk profile of banks’ exposure because of leverage

measured against rising construction costs.

Chart 4

Bank Exposure to Multifamily and Commercial Real Estate

As of Q3 2015

Source: FDIC, Call Reports, Chandan

Continued Slow Growth in Bank Construction Lending