A publication of

A publication of

Winter issue 2016 sponsored b

yCRE Finance World Winter 2016

53

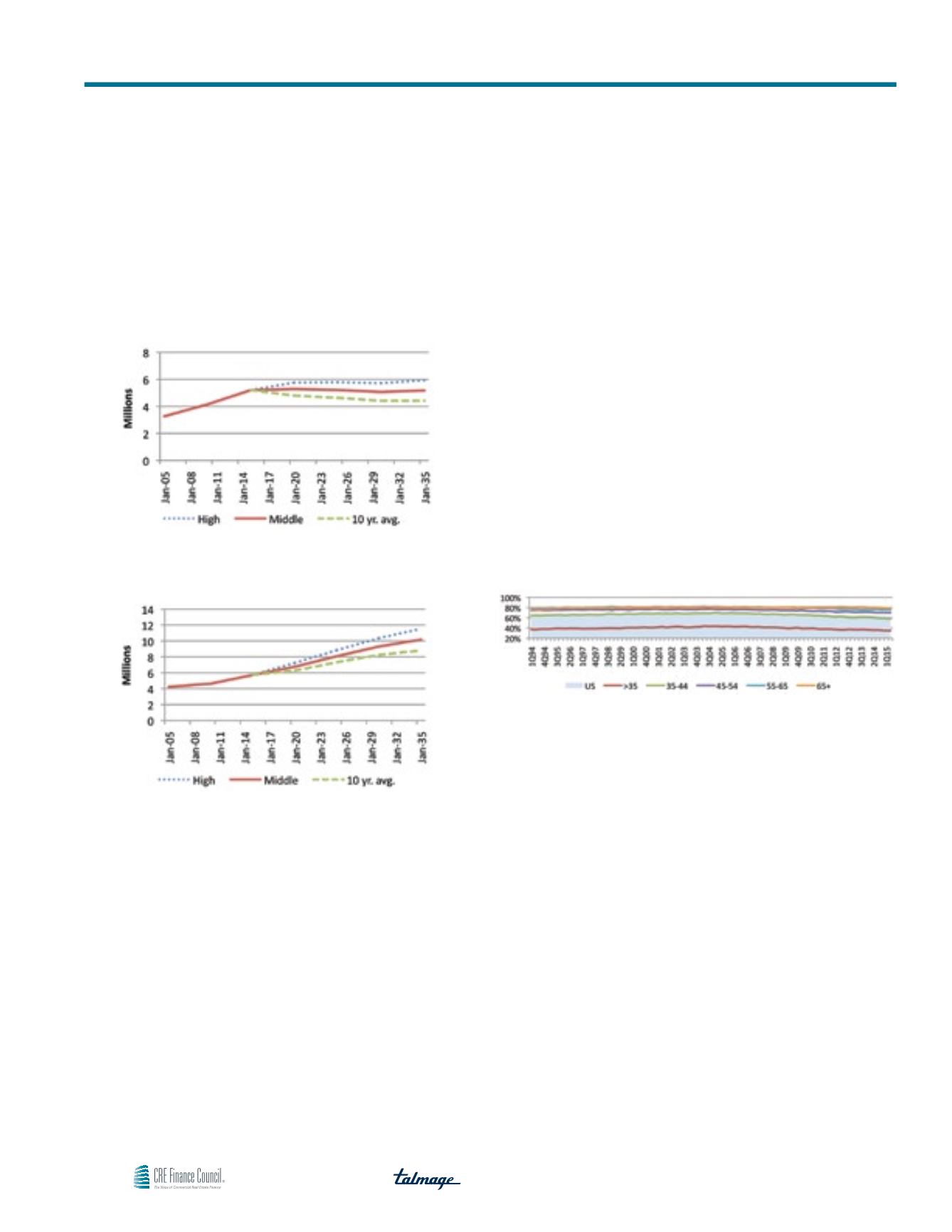

Table 11

U.S. Rental Households 55–64

(Source: Census Bureau, Yardi Systems)

Table 12

U.S. Rental Households 65+

(Source: Census Bureau, Yardi Systems)

Impact of Social Trends, Demographics

The Baby Boomer generation doesn’t generate as much discussion

as Millennials when it comes to multifamily demand. But the data

indicates that not only will they be a significant generator of demand

going forward, but they have been an underrated part of the rising

demand in the current cycle. According to an analysis by the Federal

Reserve Bank of Kansas City, between 2007 and 2013, Boomers

(individuals between ages 50 and 69) increased occupancy in

multifamily units by 1.3 million, compared to a 459,000 increase

in multifamily occupancy among 20- to 34-year-olds (Millennials).

Put another way, 70% of the increase in multifamily occupancy

in the current cycle came from Boomers, compared to 24% from

Millennials. Another 14% increase in multifamily occupancy came

from individuals ages 70 and up, while there was an 8% decrease

in occupancy among individuals ages 35 to 49, which is an age

when many move out of apartments into single-family homes.

What prompted the increase in rentals among Boomers? The biggest

factor is the size of the age cohort. At 78 million, the Boomer

generation is just behind Millennials as the largest generation

in the history of the U.S. Improvements in medical technology

means that individuals over age 50 are living longer than previous

generations. The youngest Boomers are in their early 50s, so by

virtue of sheer numbers, there will be rapid growth in age groups of

50+ in coming decades. Over the next 15 years, the 50-and-older

population is projected by the Census Bureau to grow by 20%, to

134 million in 2030 from 112 million today. Meanwhile, the 20- to

50-year-old cohort is projected to grow by only 9%, to 140 million

in 2030 from 128 million today. In other words, the 50+ population

will grow by 22 million, almost double the 12 million increase in the

24- to 49-year-old population.

Table 13

U.S. Homeownership Rate by Age Cohort, 1994–2015

(Source: Census Bureau, Yardi Systems)

Another factor is the decline in the homeownership rate. While

discussion around this topic has largely focused on Millennials,

every age category has seen a decline in homeownership. Although

the rate among households headed by individuals ages 55 and

up has not declined as rapidly as younger age groups, there has

been a steady decline in recent years. The homeownership rate

of the 55-64 age group fell to 75.4% in 2Q15 after peaking at

82% in 2Q04. For the 65 and up cohort, homeownership stands

at 78.5% after peaking at 81.8% in 3Q04. It’s not clear whether

the homeownership rate has bottomed or will keep declining, but

it is unlikely to trend upwards. Boomers face the same financial

pressures as younger generations – many are underemployed

and/or have had homes foreclosed – and bank credit remains tight

since the credit crisis.

While homeownership will remain the dominant form of housing for

senior citizens, some Boomers will no doubt become less interested

in maintaining large suburban houses with high property taxes,

expensive maintenance costs and the burden of physical tasks

such as lawn care and snow removal. Boomers also may have

different goals for retirement than preceding generations. Today’s

50+ cohort – especially those that are well-off – are staying active

Led by Boomers, Multifamily Demand to Remain Robust

“…even under the most pessimistic scenario, in which

homeownership makes a comeback, demand for

multifamily units will rise by 2.3 million over the

next decade and 4.6 million over the next 15 years

… under (an) optimistic scenario, some 2.9 million

renter households will be created over the next five

years, 6 million over the next decade and 9 million

over the next 15 years.”