CRE Finance World Winter 2016

52

The 65+ cohort’s domination of the increase in multifamily demand

largely stems from its size. Baby Boomers are not only aging into

retirement, but they are living longer (hence they need places to

live) and a growing number are renting rather than owning. The

big question related to demand for living space for the aging Baby

Boomer generation is their choice of housing. Will they congregate

in senior housing complexes, move to urban apartments with desired

amenities or stay in their own homes? Will they flock to traditional

retirement climates such as Florida and Arizona or will they opt to

remain near families closer to where they spent the bulk of their

lives? The answers to those questions will determine the long-term

demand for residential construction.

After the 65+ cohort, the group with the most demand will be the

35-44 group. Our baseline scenario projects additional demand for

500,000 apartment units over five years and 1.2 million units over

10 years. Our optimistic scenario projects demand for an additional

600,000 units over five years and 1.4 million over 10 years. Again,

this is based on demographics as the Millennials age from the

under 35 category to the 35-44 group. A big question in projecting

demand is whether today’s Millennials act more like their parents

and buy homes as they enter child-rearing years or if they will

continue to gravitate to cities, whether they are parents or not.

Demand for apartments from the Millennial generation will be more

muted. Under our more optimistic scenario, there will be demand

for an additional 1 million units over the next decade from those

35-and-under. Our baseline scenario produces just over 400,000

units of demand over the next decade. Why the cooling of Millennial

demand? In large part, it is the result of the older Millennials aging

into the 35-44 age cohort, which historically has a higher level of

homeownership. Gen X, the cohort that follows the Millennials, is

simply not as large.

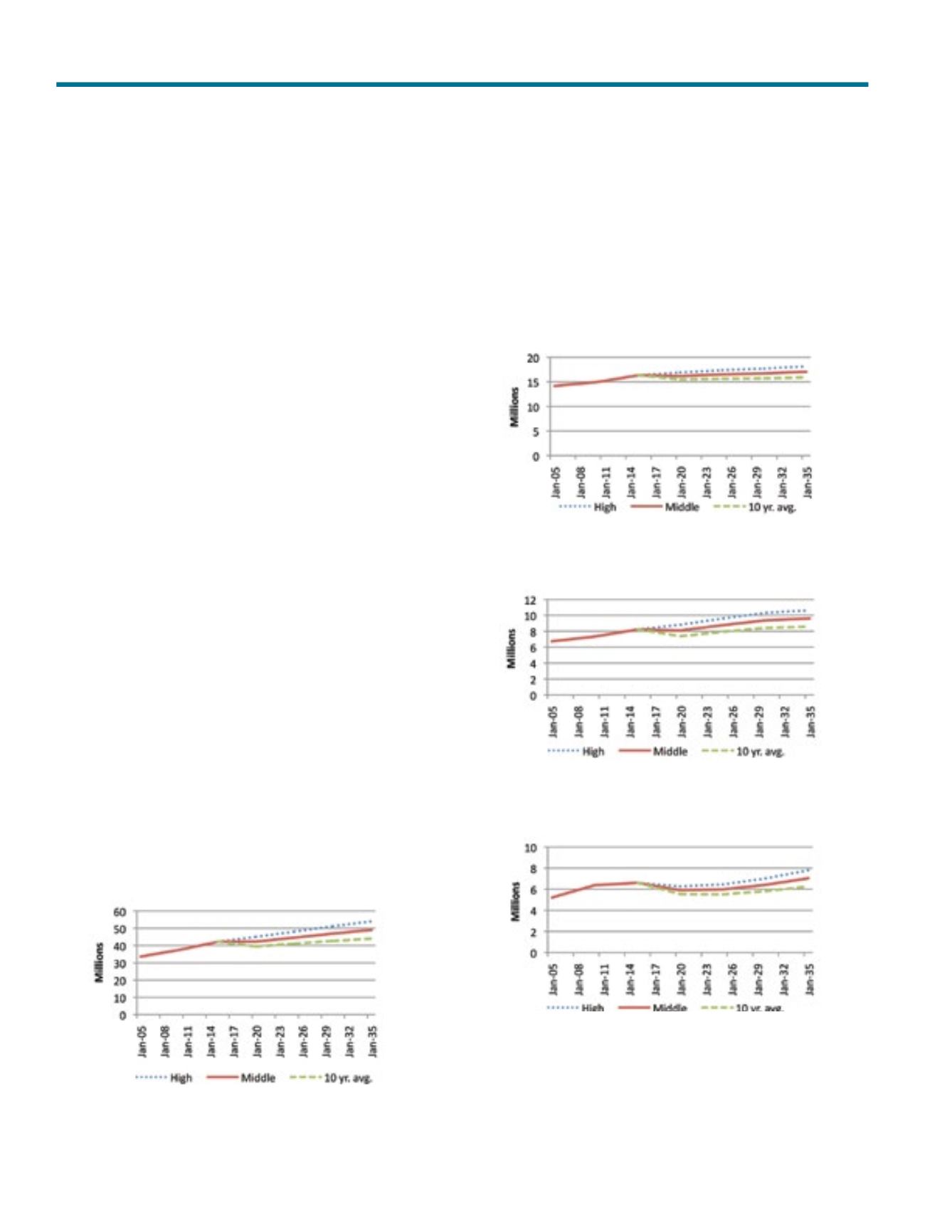

Table 7

Total U.S. Rental Households

(Source: Census Bureau, Yardi Systems)

Table 8

U.S. Rental Households < 35

(Source: Census Bureau, Yardi Systems)

Table 9

U.S. Rental Households 35–44

(Source: Census Bureau, Yardi Systems)

Table 10

U.S. Rental Households 45–54

(Source: Census Bureau, Yardi Systems)

Led by Boomers, Multifamily Demand to Remain Robust