CRE Finance World Winter 2016

50

5.8 million over 15 years. That works out to somewhere between

350,000 to 400,000 units per year, which is roughly in line with

the long-term average annual construction of apartments in the U.S.

Under our most optimistic scenario, we project that current home-

ownership trends will continue modestly and the homeownership

rate will decline by 50-100 basis points in each age cohort. This

might be the most likely scenario, given that the homeownership

rate shows little sign of stopping its decline. Under this optimistic

scenario, some 2.9 million renter households will be created over

the next five years, 6 million over the next decade and 9 million over

the next 15 years. The result would be roughly 600,000 new renter

household units per year, which is well above the 350,000-unit

long-term annual average for U.S. multifamily supply. If this scenario

comes to pass, then not only is the current level of development

not going to create oversupply, but unless new construction

increases, there will be a chronic undersupply. That could produce

continued outsized rent growth and exacerbate the problem of

affordability that is reaching crisis proportions in some markets.

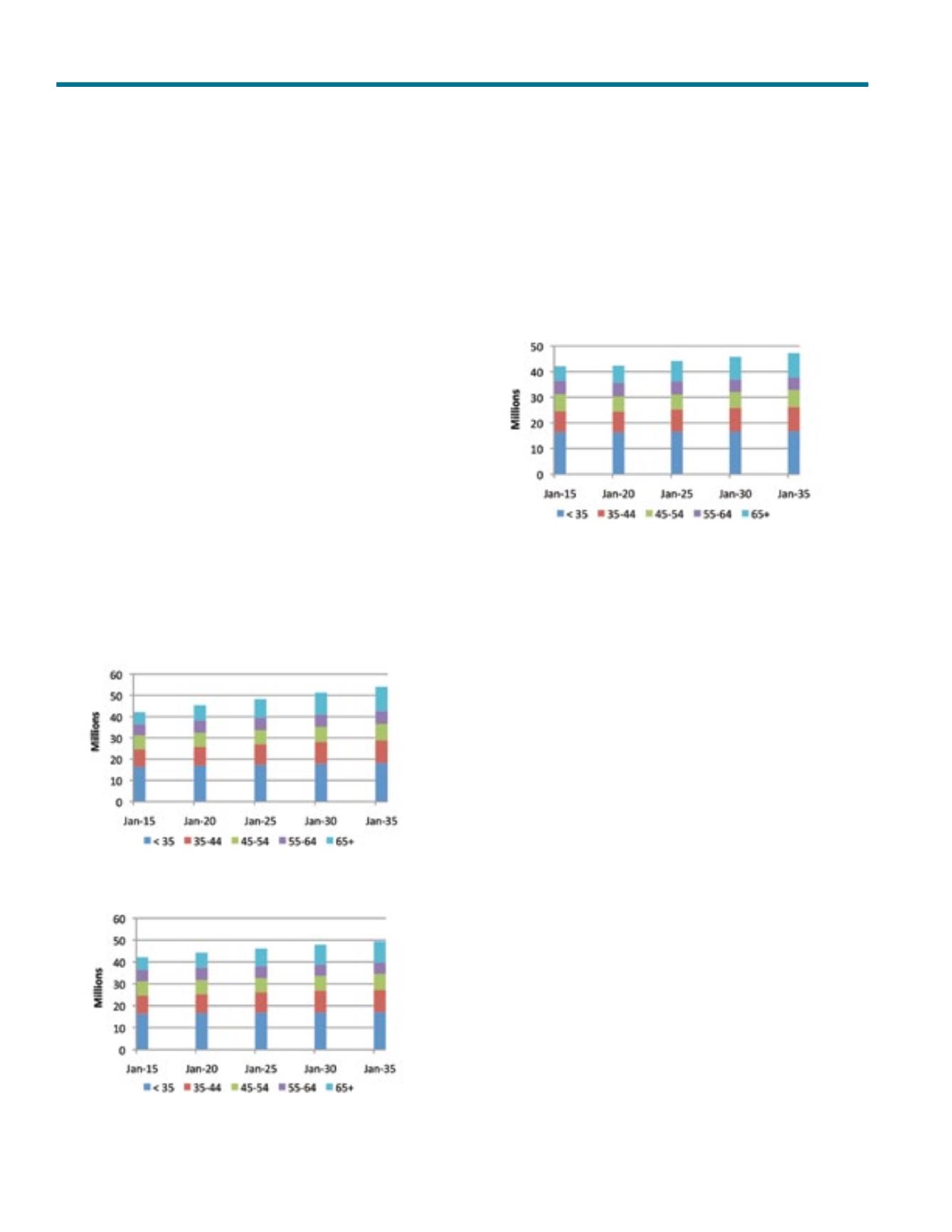

Table 4

Renter Demand: High Projection

(Source: Census Bureau, Yardi Systems)

Table 5

Renter Demand: Baseline Projection

(Source: Census Bureau, Yardi Systems)

Table 6

Renter Demand: Low Projection

(Source: Census Bureau, Yardi Systems)

It should be noted that not all renters wind up in traditional multi-

family units. In fact, the fastest-growing share of the U.S. housing

market in each age cohort is single-family rentals (SFR). SFRs

have always comprised a much smaller portion of the rental market

than multifamily, but the share of SFRs has grown from about 5%

of the total housing stock in 1994 to about 7% in 2014, according

to the Mortgage Bankers Association. SFRs have grown steadily

since credit crisis. One reason is that there are a number of former

homeowners who lack the credit scores needed to buy a house but

still prefer the amenities and location of a single family home. Also,

the sector segment is growing due to the entrance of institutional

investors that have created a new business model that involves

buying and/or financing large numbers of single-family homes.

Traditionally SFRs have been owned and operated by small investors.

Demand by Age Cohort

Based on our calculations, demand for rental housing seems likely

to increase strongly for another decade or more. In order to assess

demand more specifically, however, it helps to understand the

demand by age cohort because people want and need different

types of housing at different points in their life.

By age cohort, by far the largest increase in multifamily demand

over the next decade will come from the 65+ group, the Boomers.

For example, if we use our baseline scenario, the 65+ group will

account for more than half of new demand: 1.2 million of the

additional 2.2 million rental units to be created over the next five

years and 2.3 million of the 4 million units to be generated over

the next 10 years. If we use our more optimistic scenario, the

65+ cohort will comprise 1.5 million of the 3.2 rental units to be

generated over five years and 3.1 million of the 6.2 million units

to be generated over 10 years.

Led by Boomers, Multifamily Demand to Remain Robust