A publication of

A publication of

Winter issue 2016 sponsored b

yCRE Finance World Winter 2016

49

The apartment sector’s strong performance reflects a variety of

trends, including the desire of global investors to increase allocations

to U.S. real estate in general and multifamily in particular. It also

reflects investors’ confidence that multifamily property fundamentals

will continue to improve as a result of the continuation of demographic

and social trends, including:

• The growing number of Millennials entering the 20- to 34-year-

old prime renter cohort.

• Job growth that is enabling Millennials to move out of

parents’ homes.

• The general population shift to urban areas with concentrations

of rental housing.

• Millennials waiting longer to get married and having fewer children.

• The declining homeownership rate as Americans of all ages

lack the financial wherewithal or stringent credit requirements

of banks. Young adults are putting off buying homes for many

reasons, including crushing student debt and reasons of lifestyle

preferences, such as waiting longer to get married and have

children. Older Americans are giving up large suburban homes,

for reasons both financial and lifestyle.

By now, these trends are familiar — whether and how long they

continue are key factors in gauging future multifamily demand.

Rental Demand to Grow

Multifamily absorption has been strong for years, but has the wave

passed? Demand for multifamily is based on a number of factors,

including population changes, household formation and the proportion

of renters versus those who own a home. To calculate future rental

demand, we used U.S. Census Bureau forecasts of population

growth and household formation by age cohort and factored in

projected homeownership rates by age cohort.

Our study contains three scenarios depending on potential trends

in homeownership. Our baseline scenario assumes that home-

ownership rates will remain at current levels. While it isn’t likely

that homeownership rates will not change, we believe that the rate

is nearing a bottom. If homeownership rates continue to fall, we

would expect a policy response stimulate, as the housing market’s

contribution to the broader U.S. economy already is falling short of

its historic watermark.

An optimistic scenario for rental demand assumes that homeownership

rates will continue to decline slightly, which means more households

will rent. The most pessimistic scenario assumes that homeownership

rates will rise to the mid-point between where they are today and

the 10-year average. We believe that this pessimistic scenario is

unlikely because it would hinge upon a quick reversal of social and

economic trends that have been building. Lower homeownership

rates are associated with marrying and having children at later ages

and preferences for living in urban neighborhoods, where a greater

percentage of housing stock is for-rent as opposed to suburbs.

Preferences and trends are fluid, which makes them hard to

predict. Millennials’ preference to live in urban cores has had

profound impact on commercial real estate, not only on multifamily

but all property types. A holistic live-work-play lifestyle has given

rise to “24-hour” core markets and “18-hour” secondary markets

that combine housing, offices, shopping and entertainment. It is

possible that as Millennials age into child-rearing years, this trend

will reverse and many will seek out suburbs for better schools and

quieter streets. Banks might loosen credit as the financial crisis

moves further into the rear view mirror, which could help push

homeownership rates back up. Even if trends that favor renting

start to reverse at some point, the shift will be slow and gradual

and will take years for the homeownership rate to rise significantly.

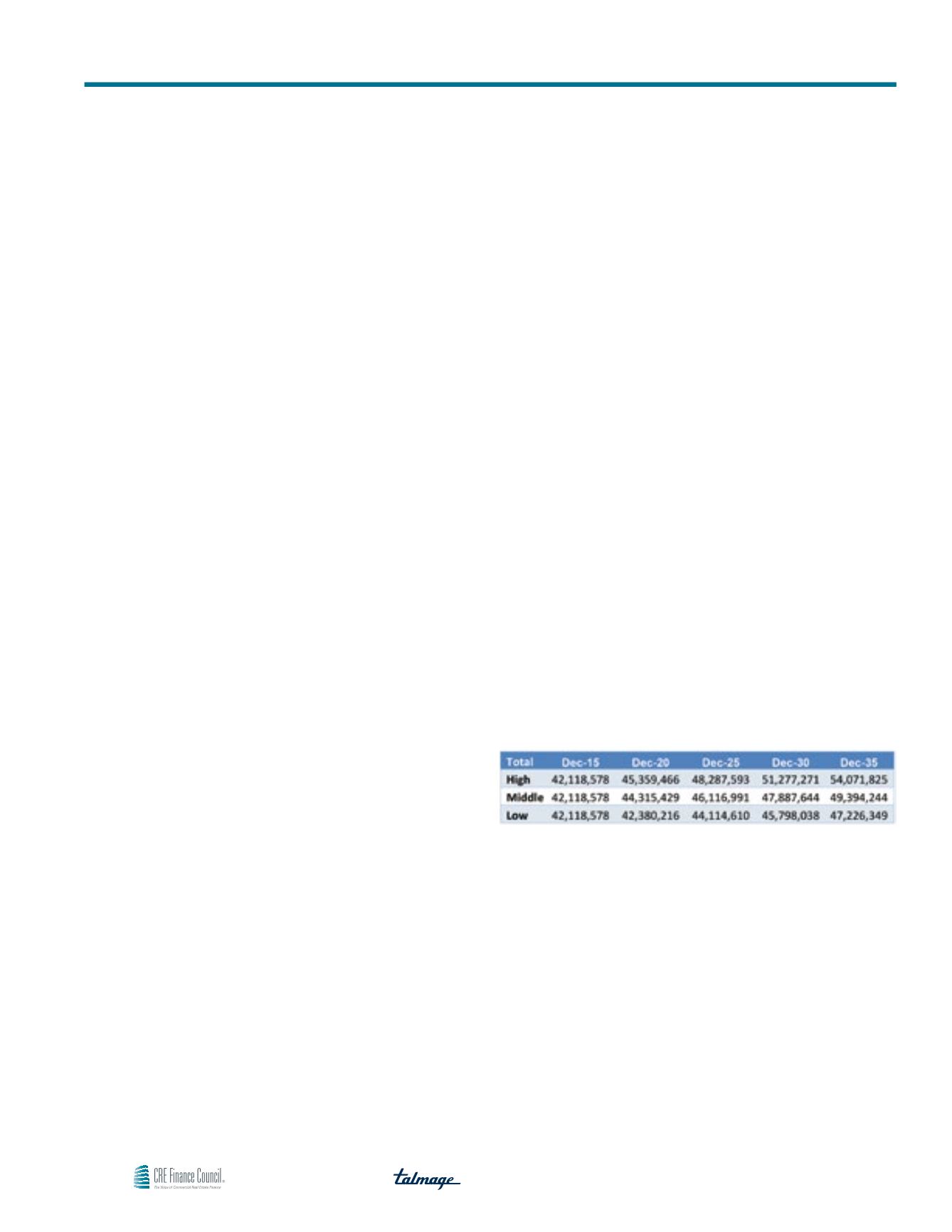

Table 3

Total U.S. Renter Households, Current and Forecast

(Source: Census Bureau, Yardi Matrix)

With that caveat, even under the most pessimistic scenario in

which homeownership makes a comeback, demand for multifamily

units will rise by 2.3 million over the next decade and 4.6 million

over the next 15 years. The demand growth comes mainly from the

rising population and growth in households.

Under our baseline scenario in which homeownership remains at

current levels for each of the individual age cohorts, rental demand

will rise steeply. In this case, the demand for multifamily units will

total 2.2 million over the next five years, 4 million over 10 years and

Led by Boomers, Multifamily Demand to Remain Robust