CRE Finance World Winter 2016

48

T

Led by Boomers, Multifamily

Demand to Remain Robust

he apartment sector has flourished in recent years as the

U.S. economy has rebounded from the global financial

crisis, leading occupancies, rents and property values to

soar. New supply, which bottomed during the credit crisis,

has bounced back to historical averages, prompting

concerns that oversupply is rearing its ugly head. However, based

on an analysis of economic, demographic and social trends, we

believe that those fears are unjustified. By and large, the results

of the analysis point to outsized growth in renter demand over the

next decade and possibly beyond.

Much of the increased demand has been attributed to the now-

familiar story of the Millennials, the 80-million-strong cohort that

is growing into prime renter age and increasingly moving into

urban apartments. Millennials will continue to be a key component

of multifamily demand in coming years, even as they start to age

out of the 20- to 34-year-old prime renter cohort. Less noticed,

however, is the increase in demand coming from the other end of

the age spectrum, the Baby Boomers, who are now in their 50s

and 60s. Based on demographic and social trends that are likely

to continue, today’s Boomers will be a key driver of demand for

apartments — whether traditional multifamily, single-family rentals

or age-specific senior housing — going forward.

Current Cycle

The U.S. multifamily market is in a sweet spot. Occupancies are at

or near all-time highs in most markets. Rents are rising at almost

unprecedented levels. According to Yardi Matrix, rents in the U.S.

rose a cumulative 20.2% between January 2011 and September

2015 and are not showing signs of slowing down. In fact, rents

climbed 6.8% year-over-year as of September 2015, the fastest

rate on record during the current market cycle. Elevated renter-

household formation of the heels of several years of weak supply

has been the primary force behind rent growth. Vacancy rates

are at or near all-time lows in most markets, and it will take more

than a year or two of heavy supply to change the supply-demand

dynamics.

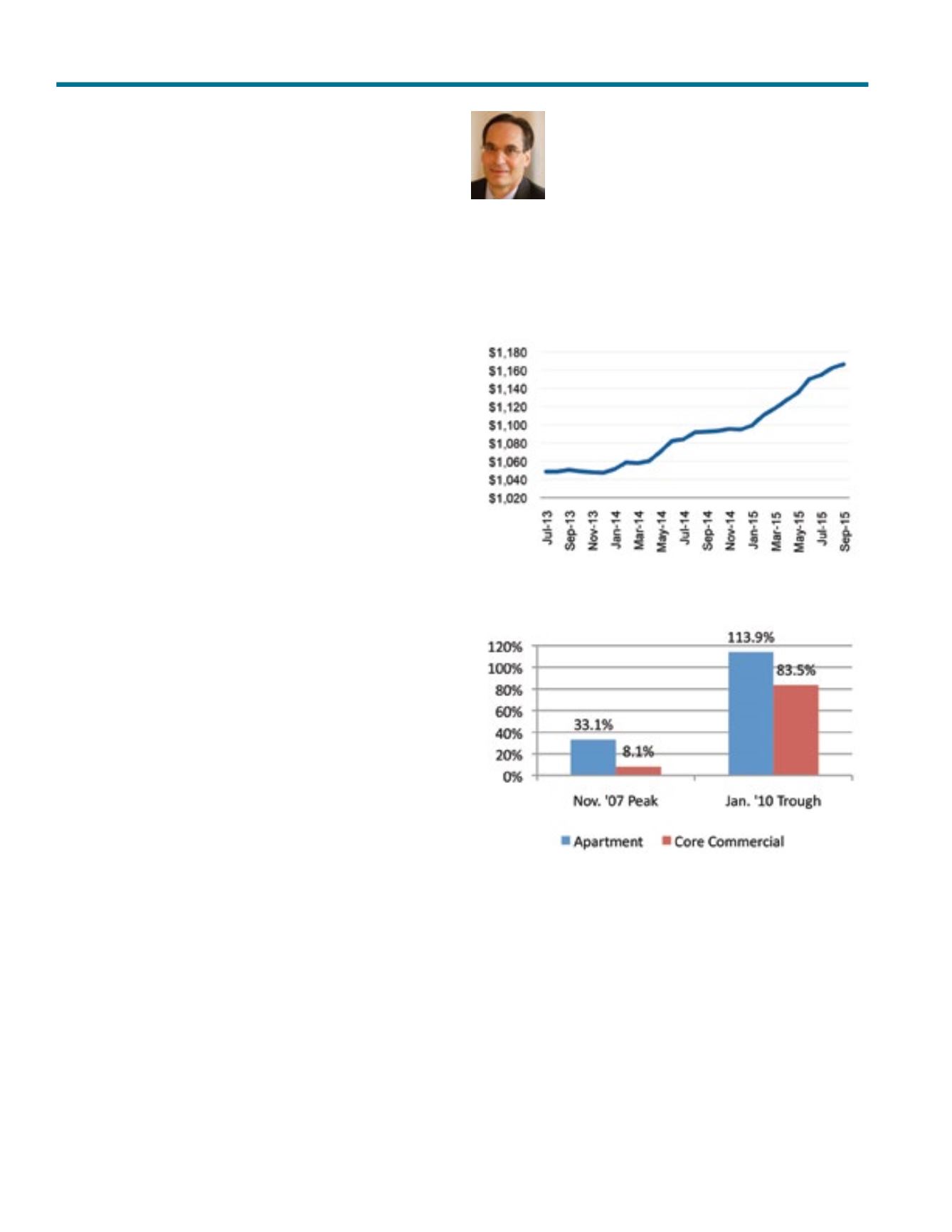

Table 1

Average U.S. Multifamily Rent

(Source: Yardi Matrix)

Table 2

Change in Value: Apartment vs. Core Commercial

(Source: Moody’s/RCA CPPI)

Property values are also soaring, as apartments have outper-

formed all other commercial real estate segments. As of August

2015, U.S. multifamily property values were up 114% from the

January 2010 trough and had eclipsed the last peak in Decem-

ber 2007 by 33%, according to the Moody’s/RCA Commercial

Property Price Index (CPPI). For perspective, prices in other core

commercial property sectors increased 84% since the trough and

are only 8% above the most recent peak.

Paul Fiorilla

Associate Director of Research

Yardi Matrix

“Based on demographic and social trends that are

likely to continue, today’s Boomers will be a key

driver of demand for apartments — whether traditional

multifamily, single-family rentals or age-specific

senior housing — going forward.”