CRE Finance World Summer 2015

36

How is Today Different from 2006/2007?

The consensus was that we are in a totally different, more rational

and more stable market today than in 2006/7. Our panelists

cited several reasons, all of which serve to protect the stability

of today’s market:

1. More Dealer Discipline. CMBS conduit transactions are smaller

(see below) and are issued more rapidly since dealers are less

willing to retain/warehouse inventory.

2. More Control from CMBS Buyers. Today’s ‘AAA’ and ‘AA’ buyers

are able to exert more influence on CMBS credit quality —

rewarding stronger transactions and punishing weaker ones —

resulting in higher and more consistent asset quality.

3. Less Leveraged Buyers. Particularly in larger loans, gone are

the days of unlimited leverage.

4. Better Ratings. New rating agencies have emerged post financial

crisis and have created a healthier and more competitive ratings

market benefitting investors.

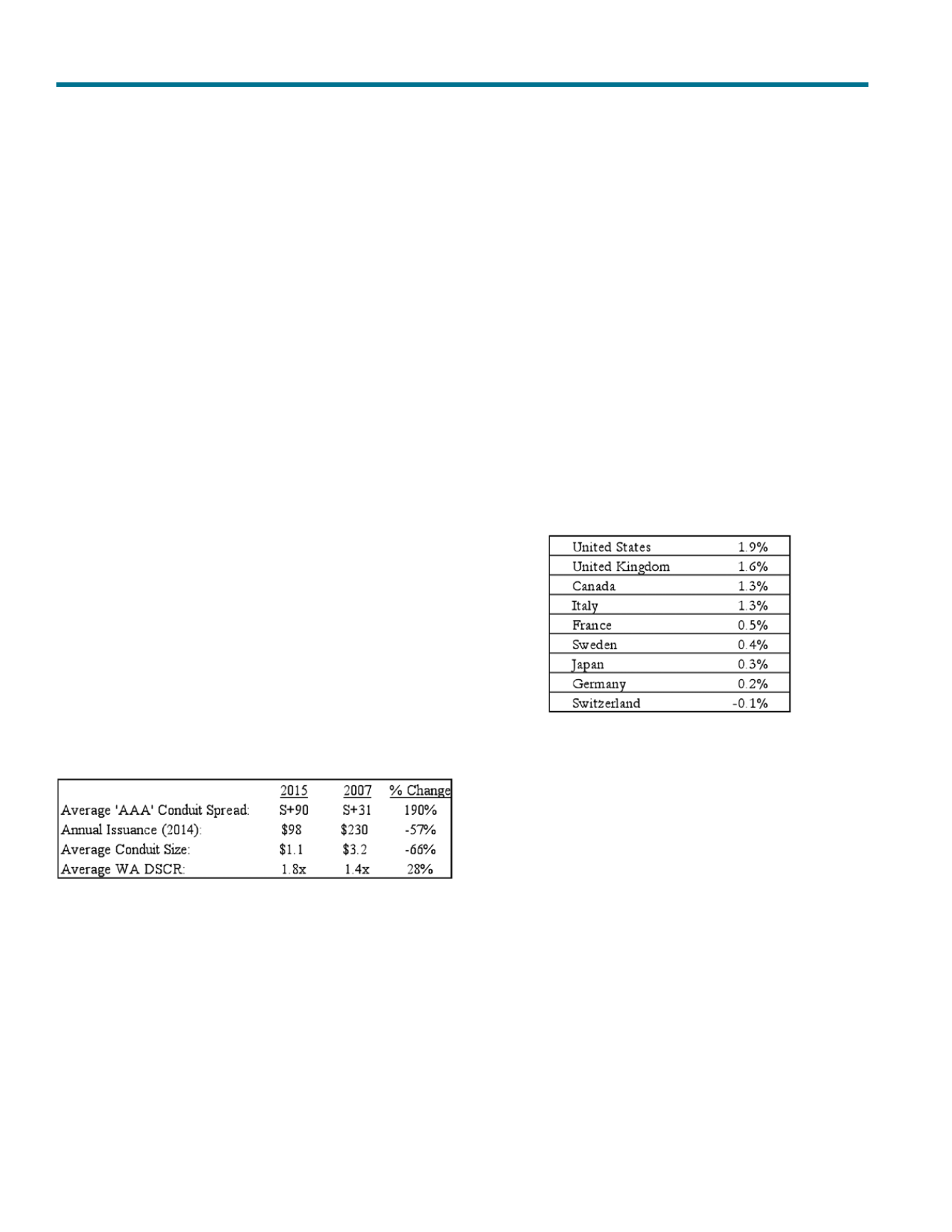

The CMBS spreads, issuance levels, average transaction sizes and

debt service coverage levels of today are presented as compared

to 2007 levels.

Exhibit 3

CMBS Metrics — 2015 vs 2007 ($ Billions)

Source: CMA, Talmage Research

“From the issuer’s perspective, all of us have several constraints

(regulatory, balance sheet, risk management, etc.) that are forcing

us to be very careful on asset selection and to be disciplined about

securitizing, or otherwise disposing of inventory, in a timely fashion —

this is healthy for the markets,” commented Rich Sigg from Bank

of America Merrill Lynch. Indeed, others agreed that dealers

have been very mindful of inventory levels and have been better

at partnering with buy-side investors as opposed to being an

outright competitor.

Rates – How low can you go?

As noted below, global interest rates are at historically low levels,

and in the case of Switzerland, negative levels. Given the large

scale and liquidity of the U.S. investment market, the U.S. has

attracted unprecedented amounts of foreign capital which has

fundamentally altered traditional equity valuation metrics. While

our participants agreed that the “V” in loan-to-value was reaching

record territory for Class “A” properties in gateway cities, all agreed

that those investments were supported by substantial equity

contributions and comparatively modest leverage ratios.

Exhibit 4

Ten-Year Sovereign Treasury Yields (April 2015)

Source: Bloomberg

Low interest rates, it was felt, have also acted as a governor to

the recovery of CMBS spreads which appear to be “range bound”

at swaps+80, as compared to swaps+30 pre-crisis, as CMBS

investors struggle with minimum “total return” thresholds. Despite

outsized CMBS spreads (as compared to pre-crisis spreads),

everyone agreed that given the combination of low interest rates,

easy monetary policy and investor demand for yield product, the

current environment represents an outstanding time to finance

real property.

Further, despite a healthy and recovering U.S. economy, coupled

with clear pronouncements from the Federal Reserve that easy

monetary policy would be ending, our panel felt strongly that

foreign capital would keep U.S. rates range bound at current

levels for the foreseeable future, other things being equal.

A “Three Tier” Market?

Despite the rising tide that lifted all boats equally pre-financial

crisis, our participants felt that the commercial real estate market

in 2015 has evolved and been refined into a three-tier market of

clear winners, losers, and the overlooked assets stuck in the middle.

CMBS 2.0 — State of the Market 2015