A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

31

(“WODRA”) to the PSA in late 2003. WODRA provided a mechanism

for master servicers to recover advances from principal collections

first as the result of workouts in which the applicable borrowers

were specifically obligated to pay such advances. In CMBS 2.0

PSAs (mostly PSAs issued 2010 or later), the industry adjusted

the waterfall for liquidation proceeds to properly account for the

intentions of the ASER. In the new PSAs, recoveries of ASERs are

after principal repayments, allowing for higher rated bonds to recover

their principal before subordinate classes recapture interest.

Whereas CMBS 1.0 PSAs generally directed that recoveries on

any loan be allocated to unpaid interest prior to being allocated

to unpaid principal, CMBS 2.0 PSAs generally (and particularly

with respect to liquidation proceeds) direct that recoveries on any

loan be allocated to unpaid interest less the portion of any interest

that was not advanced due to an Appraisal Reduction Amount

(Appraisal Reduced Interest) prior to being allocated to unpaid

principal and then only allow for allocations to recover Appraisal

Reduced Interest once unpaid principal has been recovered in full.

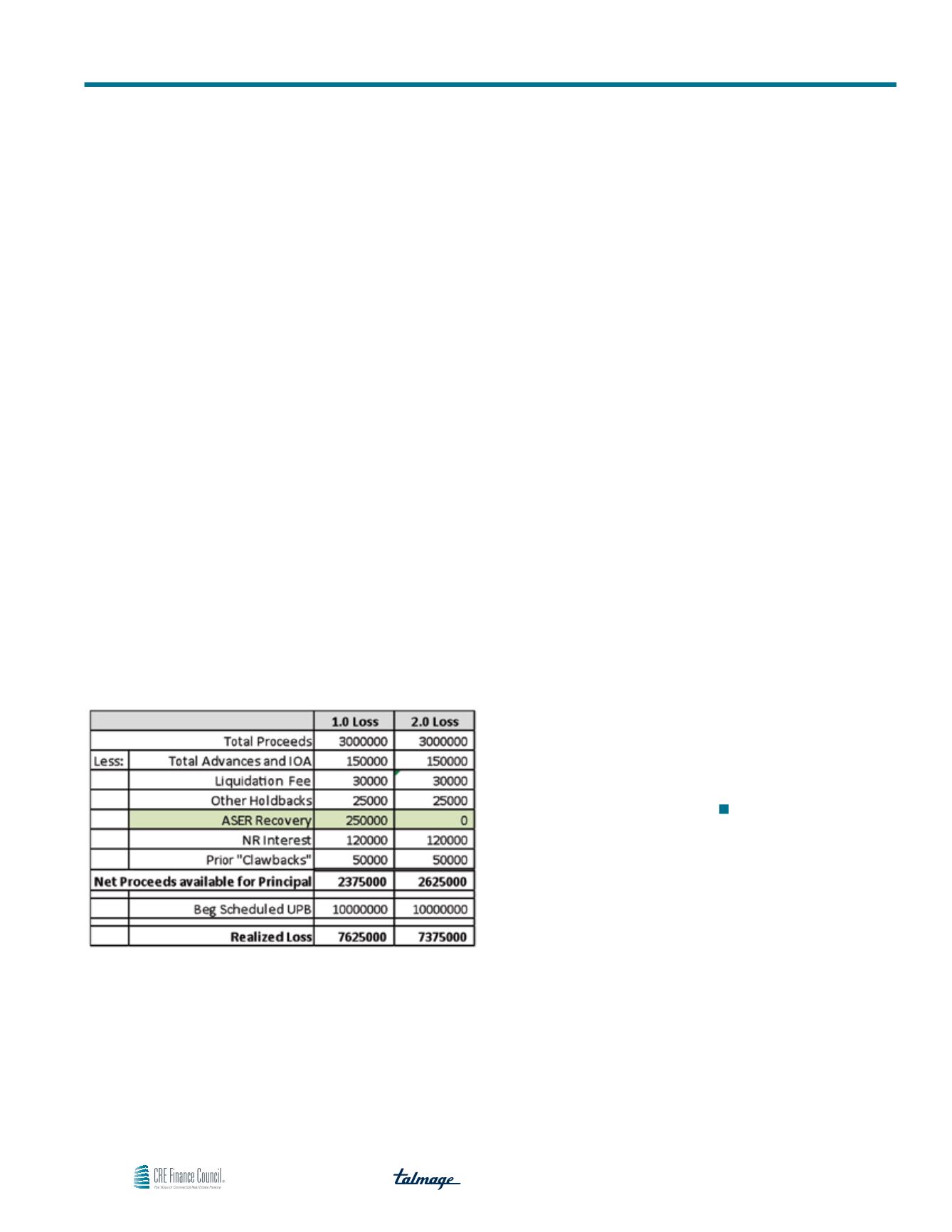

The impact of this change is illustrated below in the comparison

of the hypothetical liquidation waterfall with outstanding ASERs in

CMBS 1.0 and CMBS 2.0 deals.

Exhibit 1

As illustrated above, in CMBS 2.0, the principal loss to the trust is

less than in CMBS 1.0 due to the ASER recovery mechanics. In

CMBS 1.0, the ASER recovery would have been passed through

to the subordinate bond holders instead of the more senior bond

holders. Allocating the first loss to the most subordinate bondholders

is the true intention of the ASER concept.

This change to waterfall calculations will have a substantial impact

on many different CMBS constituents. We have not yet seen any

post-CMBS 2.0 losses that would follow this new waterfall convention;

however as an industry it is time for us to be prepared for the first

one. Master servicers, special servicers, trustees, and certificate

administrators should be training their staff on what to look for in

the PSA to make sure they are following the proper conventions.

The CREFC IRP committee needs to revisit the current Realized

Loss Templates to determine if adjustments are required to handle

the reporting for this allocation. Rating agencies must make sure

their models are aligned with the PSA waterfall definitions to

properly account for the potential impacts. Lastly, investors need to

be aware of which of their holdings could potentially be impacted

by these changes. Proactively addressing this change will prevent

us from marketplace surprises, something no one in the CMBS

industry wants to see.

1 See

Trepp Outstanding Advances

. Excel Spreadsheet (Trepp, LLC, New

York, N.Y.), March 24, 2015.

2 According to Trepp, LLC data the total amount of ARAs (in 000s) for (1)

loans originated in 2006 is $2,232,505, (2) loans originated in 2008 is

$2,484 and (3) loans originated in 2010 is $570. See

Origination Year

by Appraisal Reduction Stratification Matrix

. Excel Spreadsheet (Trepp,

LLC, New York, N.Y.), March 24, 2015.

ASERs 2.0: Who Gets the Short End of the Stick?