A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

35

or this article, we examine the CMBS 2.0 “State of the

Market” and have brought together industry leaders who

not only shape and define the CMBS market but who

also represent different segments including investment

(from AAA to Mezzanine), origination, distribution, trading

and special servicing. With 2015 CMBS origination already 33%

ahead of 2014 levels, delinquencies reaching new lows and loans

in special servicing at approximately half of peak levels, we wanted

to explore where the current opportunities (and risks) are, where

we are in the cycle, current challenges, and what “keeps us up at

night.” Our participants included:

Matt Borstein — Head of Commercial Real Estate Lending,

Deutsche Bank

George Carleton — Executive Managing Director, C-III

Capital Partners

Michael Nash — Senior Managing Director, Blackstone Real

Estate Debt Strategies

Rich Sigg — Head of CMBS trading, Bank of America Merrill Lynch

The consensus observations were that real estate fundamentals

are strong and continue to improve, low interest rates will be here

for some time, valuations will continue to climb and that transactions

are generally more conservative and better structured than 2006/7,

but that credit standards continue to gradually loosen. Global factors,

including interest rates, the price of oil, currency fluctuations, and

the emergence of the sovereign buyer are creating new challenges

and paradigms, and all agreed that CMBS (and related commercial

real estate debt) continues to provide compelling values “across the

stack” if you know where to look and are able to maintain discipline.

Where are we in the Cycle?

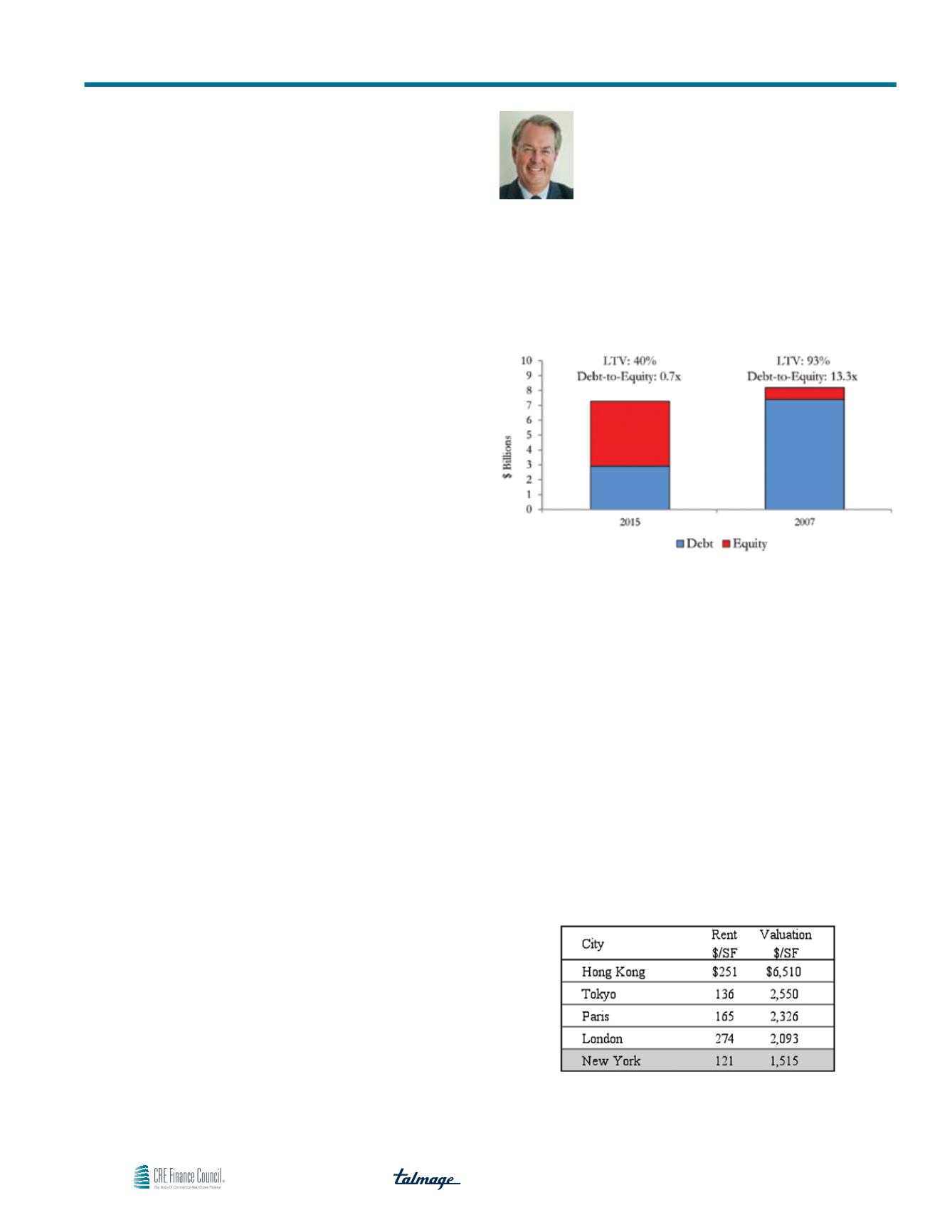

All of our participants agreed that we are still early (fifth or

sixth inning) in the cycle for real estate fundamentals and that

as the U.S. economy continues to improve/expand, so too will

property occupancies, rent rolls and cash flows. While valuations

are currently on the high end due to a combination of low interest

rates and an influx of foreign capital, leverage levels are comparatively

modest, particularly as compared to the 2006/7 vintages as

illustrated by the valuations and leverage points for the ESA

Portfolio depicted below.

Exhibit 1

ESA Comparative Capital Structures 2015 vs 2007

Sources: Various Offering Circulars, Public Information & Talmage Research

The Extended Stay America Hotel Portfolio is used for this illustrative example.

Additionally, new, larger “permanent capital” buyers with longer

holding horizons have replaced the heavily leveraged buyer of the

pre-financial crisis days. “You can’t compare today’s long-term,

highly capitalized, and generally conservatively leveraged investors

with the individual pre-financial crisis buyer of 2007 who was

beholden to the capital markets at a 6x leverage ratio. While prices

are higher, the structures are fundamentally more stable,” noted

Michael Nash from Blackstone.

It was also observed that we are now living in a global property

market where prices in New York are not only being compared to

other U.S. gateway cities but also to their international counterparts

such as London, Hong Kong and Tokyo. On this new metric, which

may take a certain amount of acclimation, the consensus was

that the U.S. remains fundamentally cheap — though “rich” to

historical levels.

Exhibit 2

Global Class A CBD Office Rental Rates and Valuations

Source: World Property Journal, CBRE

F

CMBS 2.0 — State of the Market 2015Ed Shugrue III

CEO

Talmage LLC