CRE Finance World Summer 2015

42

One can argue that there are non-performance related reasons a

loan may be flagged by the servicer for watchlist status, including

borrower issues and upcoming maturity. Upon further analysis,

DBRS has concluded that most of the loans included in the count

above are currently on the watchlist for performance-related issues.

CREFC guidelines dictate that properties experiencing a substantial

decline in occupancy may be flagged for the watchlist, though the

investor reporting package does not account for seasonality. Given

the nature of student housing, it is common that these asset types

experience higher vacancy during the summer months. Freddie

Mac generally requires that its borrowers submit financial reports

on a quarterly basis, which would theoretically lead to a rise of

loans secured by student housing properties flagged for occupancy

issues in those quarterly reporting periods that fall during the

summer months. Based on its review of the data, DBRS does not

believe seasonality to be a driving factor behind the propensity

of student housing properties to fall on the servicer’s watchlist.

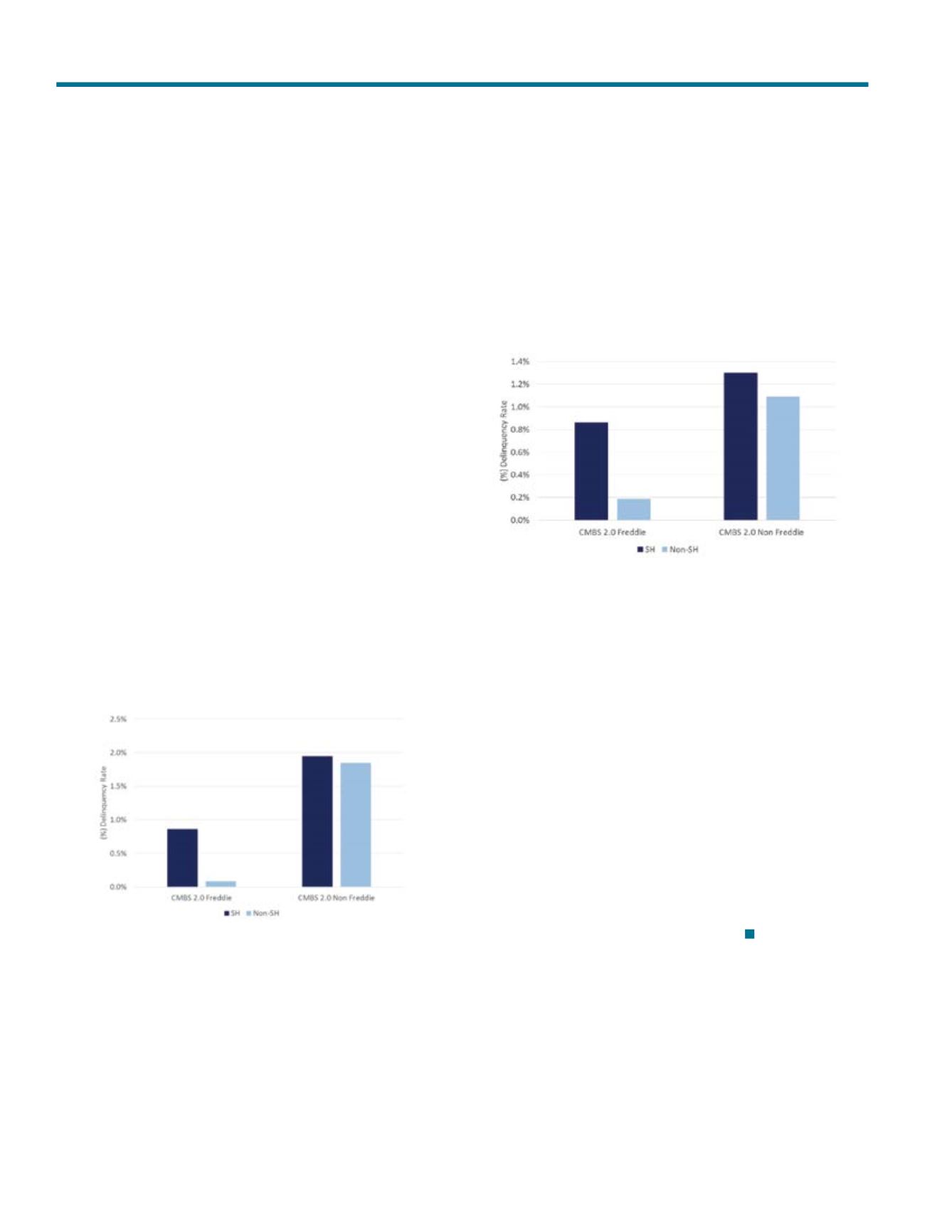

Beyond the watchlist, loans secured by student housing properties

also experience delinquency and special servicing transfers more

often than loans secured by traditional multifamily properties, as

illustrated in the charts below.

Exhibit 6

US CMBS: Student Housing Delinquency Rate

Exhibit 7

US CMBS: Student Housing SS Rate

As long as university enrollment continues to increase and on-campus

development remains stagnant, developers of off-campus student

housing will continue to see business opportunities. It would stand

to reason that the largest and most popular universities will support

a more sustainable student housing market. This opinion is echoed

by senior industry professionals, who regularly prefer large schools in

states such as Texas, Florida and Virginia, where student enrollments

and demand for housing continues to rise. The expectation for new

construction and increased competition means that owners will

need to constantly invest in their properties to remain viable in the

student housing sector with the added challenge of convincing

tenants and their cosigners that the upgrades are worth the rising

rental rates. DBRS does not expect to see a slow-down in the

securitization of student housing collateral in the near term, but will

continue to view this particular property type as being susceptible

to higher credit risk than traditional multifamily. Since demand

is directly correlated with college enrollment, greater volatility in

occupancy rates and net cash flow and historic performance issues

is to be expected.

1 As measured by the standard deviation of annual cash flow changes for

all post 2010 CMBS student housing properties.

Student Housing Performance in CMBS