A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

41

Exhibit 3

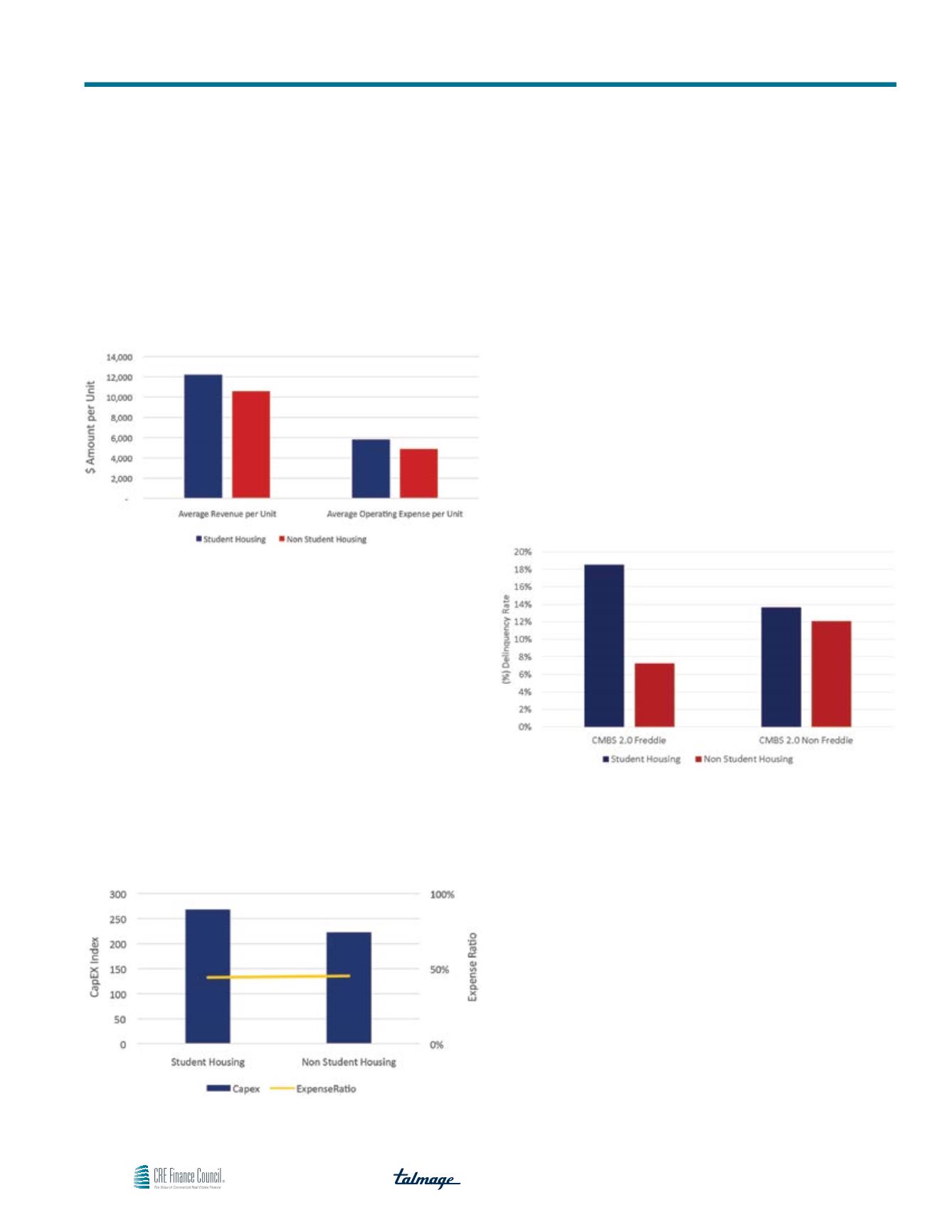

US CMBS: Annual Revenues and Expenses per Unit for SH/NonSH

DBRS sampled all multifamily properties securitized in CMBS deals of

all vintages and based on borrower reported financials (rather than

servicer normalized), found that the expense ratio between student

housing (44.2%) and non-student housing properties (45.2%) are

essentially the same. The overall operating expense on a per unit

basis was found to be $5,808 and $4,881 for student housing and

non-student housing properties, respectively. Looking at income,

annual revenue per unit was also found to be higher for student

housing properties ($10,045) versus non-student housing properties

($9,443). The data does suggest, however, that reported replacement

costs were are on average 20.6% higher for student housing

properties ($268.25 per unit) than non-student housing properties

($222.47 per unit). While there are some in the market, including

DBRS, which underwrite above-average capital expenditures on

properties with student concentrations in order to reflect this trend,

it is not a method employed universally among lenders.

Exhibit 4

US CMBS: CapEX & Expense Ratio for SH/NonSH

In legacy CMBS (transactions issued prior to 2010) student housing

properties have roughly the same probability of loss (10.3%) when

compared to non-student housing multifamily properties (11.1%);

they have a similar albeit slightly higher loss severity (53% vs.

49%) . However, there is reason to suspect that CMBS 2,0 student

housing is different than the legacy student housing and that its

performance will be different than non-student housing multifamily

going forward. As noted in the graph below, the watchlist rate for

student housing properties securitized in transactions issued in

2010 through present day is significantly higher than the watchlist

rate for non-student housing multifamily properties.

Exhibit 5

US CMBS: Student Housing Watchlist Rate Since 2010

Breaking out those transactions issued by Freddie Mac, the trend

continues, which is interesting given the agency’s well-defined

lending guidelines. In the CMBS industry, it is widely believed that

Freddie Mac, and its GSE sister, Fannie Mae, is offered the first

look to lend on multifamily properties because of its attractive cost

of capital and therefore can be selective in its lending practices.

The elevated watchlist rate of even Freddie Mac loans secured by

student housing properties versus non-student housing multifamily

Freddie Mac loans further perpetuates the perception of increased

volatility associated with these assets.

Student Housing Performance in CMBS