CRE Finance World Autumn 2015

28

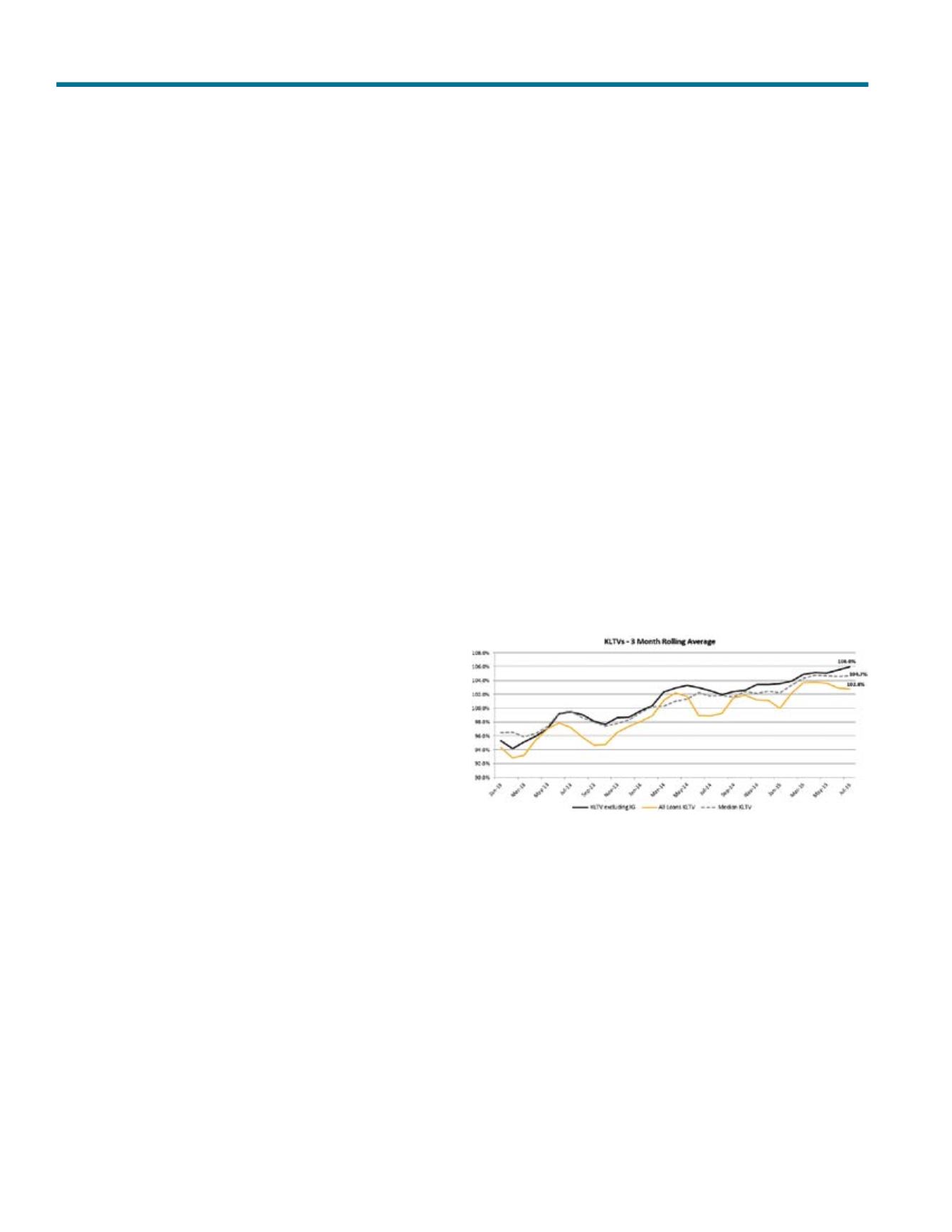

In addition to focusing on weighted average credit metrics with and

without the presence of IG loans, it is also important to focus on

medians. As noted in our Beyond the Credit Metrics commentary,

this statistic can provide a top side view of just how much IG loans

are bleeding down weighted average statistics.

This is illustrated in Exhibit 4 in regard to KLTV trends over the

past few months. The gold line in the graph depicts the three

month rolling average KLTV we present in each edition of our

Monthly Trend Watch publication. As can be observed in the

graph, the median KTLV provides a better top side view of overall

leverage in recent deals where credit bar-belling has been more

prevalent. Conversely, the median can actually fall through the

weighted average if there is little or no exposure to higher leverage

loans, which occurred for several periods in 2014.

Top side measures only go so far in CMBS, and it is more critical to

examine higher leverage loans on an individual basis and not solely

look at the pool’s KLTV. The presence of UHL loans can create

credit distortions in transactions, and contribute to meaningfully

higher risk. KBRA has observed that these loans have meaningful

higher credit enhancement levels than other loans in the pool,

which is appropriate given their increased propensity of default

and loss. To better assist investors in earmarking these loans for

further scrutiny, all KBRA conduit presales have downloadable

spreadsheets which provide each loan’s credit metrics and identify

all IG loans. Look for the KBRA Comparative Analytic Tool (KCAT)

link in the table of contents, which also allows investors to compare

individual KBRA rated conduits amongst one another across our

rated universe.

The bottom line is risk distribution can matter more than an

individual transaction’s overall credit metrics. Two transactions

with identical leverage, property type concentration, and collateral

quality can behave very differently if one of the transactions

exhibits credit bar-belling and has a large exposure to HL loans

that exposes the securitization to higher losses throughout its

term. In KBRA’s view, bar-belling, in and of itself, isn’t necessarily

a credit positive or a credit negative – and the answer may vary

depending on one’s position in the capital structure. Transactions

that exhibit bar-belling with sizeable portions of IG loans may be

more desirable to investors in the most senior portion of the capital

stack. They will ultimately benefit from less credit risk and more

certainty that IG loans will pay-off in a timely manner. However,

the same deal may be much less desirable to those investing in

more subordinate securities which have BBB or speculative grade

ratings. Those certificates will more likely bear the burden of

increased credit volatility and loss through the transaction term.

Exhibit 4

KLTVs

Source: Kroll Bond Rating Agency, Inc.

A Closer Look at Credit Bar-Belling