A publication of

Autumn issue 2015 sponsored by

A publication of

Autumn issue 2015 sponsored by

CRE Finance World Autumn 2015

23

additional investor protections such as back-up property manager

that would step in and gain control in the event of materially

adverse conditions.

Is SFR securitization market competitive?

While the growth of SFR market is expected to slow as foreclosures

slow and housing prices recover, bottom line can be strengthened

as institutional investors become more focused in particular MSAs

and experienced at managing properties, rental market remains

strong with overall rents increasing, and delinquency and vacancy

rates remain low.

Institutional investors are becoming much more selective in new

portfolio acquisitions and are shifting their focus to managing

their properties, collecting rents and improving operations. For

example, Invitation Homes has recently agreed to sell about

1,300 Atlanta-area residences in order to focus on creating

highly-efficient SFR infrastructure in certain MSAs. Focusing on

particular MSAs will make property management more efficient

and homogenous which is an important factor for many of the

SFR bond investors, as the continuity of net cash flows from

the underlying properties depends heavily on the ability of their

owners to manage large numbers of SFR homes, which are often

geographically dispersed and uniquely constructed, hence cannot

be implemented with a one-size-fits-all approach.

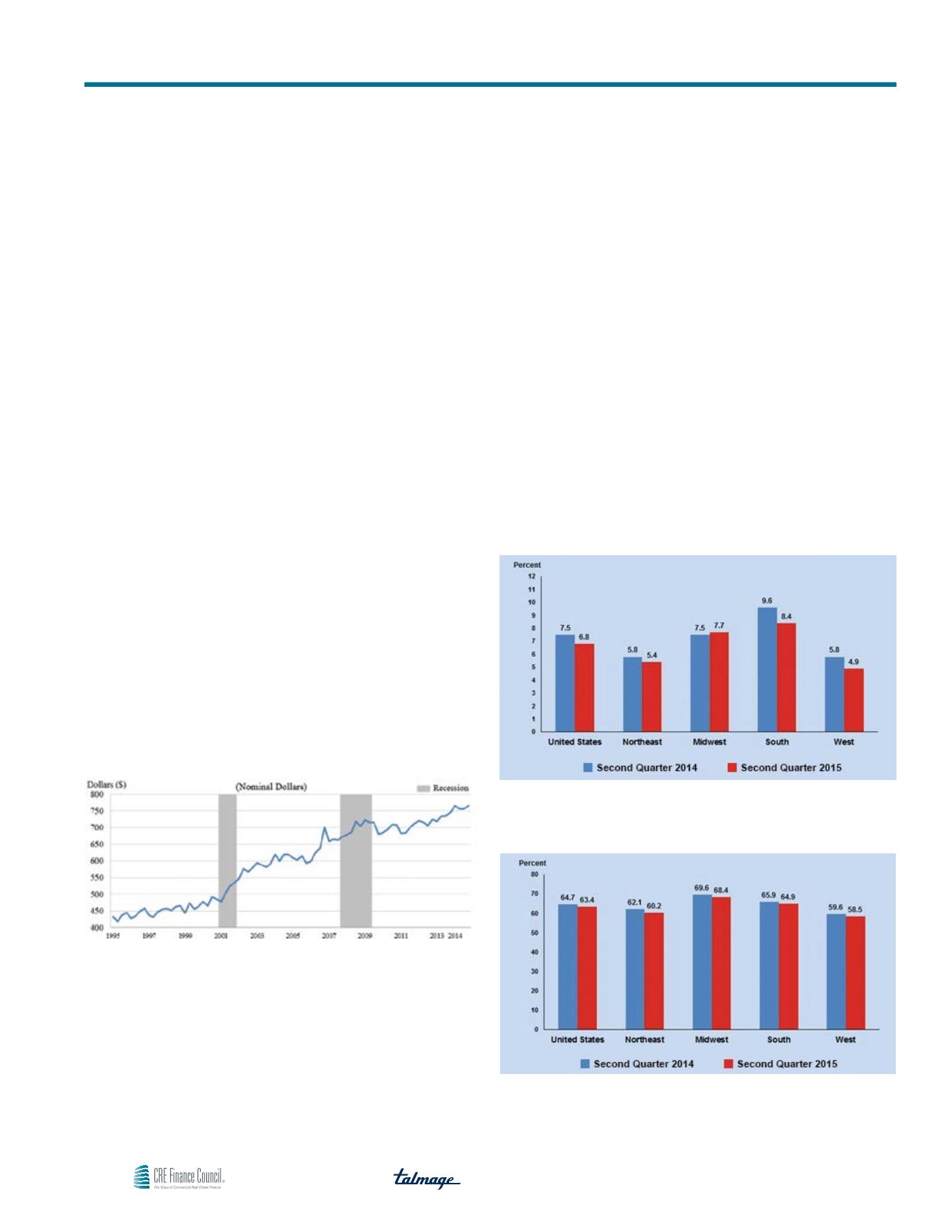

Exhibit 2

Median Asking Rent for Vacant Rent Units, 1995–2014

Source: U.S. Census Bureau

SFR market is not likely to contract any time soon and overall

rents have been and will continue to rise. According to Moody’s

SFR homes make up about 13% of the U.S. housing stock, up

from 9% before the financial crisis. The number of SFR homes

has increased 35% since 2006 to 15.1 million from 11.2 million

and, as of July 2015, single-family rentals comprise 40% of the

rental market which nearly equals multi-family rental share of

42%. As millennials start to form families but are typically unable

or unwilling to buy homes, the rental numbers are expected to go

up. Strong demand for rental homes have translated into rents

increase and the median asking rent has been continuously rising,

as seen in Exhibit 2. Rent growth is expected to accelerate this year

as landlords plan to raise their rents as much as 4% on renewals

and 5.7% for new tenants and will average nearly 3% per annum

through the end of the decade. Combined with lower rental vacancy

rates (Exhibit 3) and lower homeownership rates (Exhibit 4) in

the second quarter of 2015 in comparison to that of 2014, bottom

line is expected to further improve. Exhibit 5 shows that the rental

vacancy rate is at a historic low.

Exhibit 3

Rental Vacancy Rates by Region

Source: U.S. Census Bureau

Exhibit 4

Homeownership Rates by Region

Source: U.S. Census Bureau

Single-Family Rental Securitization: Where Are We and Where Will We Be?