CRE Finance World Autumn 2015

32

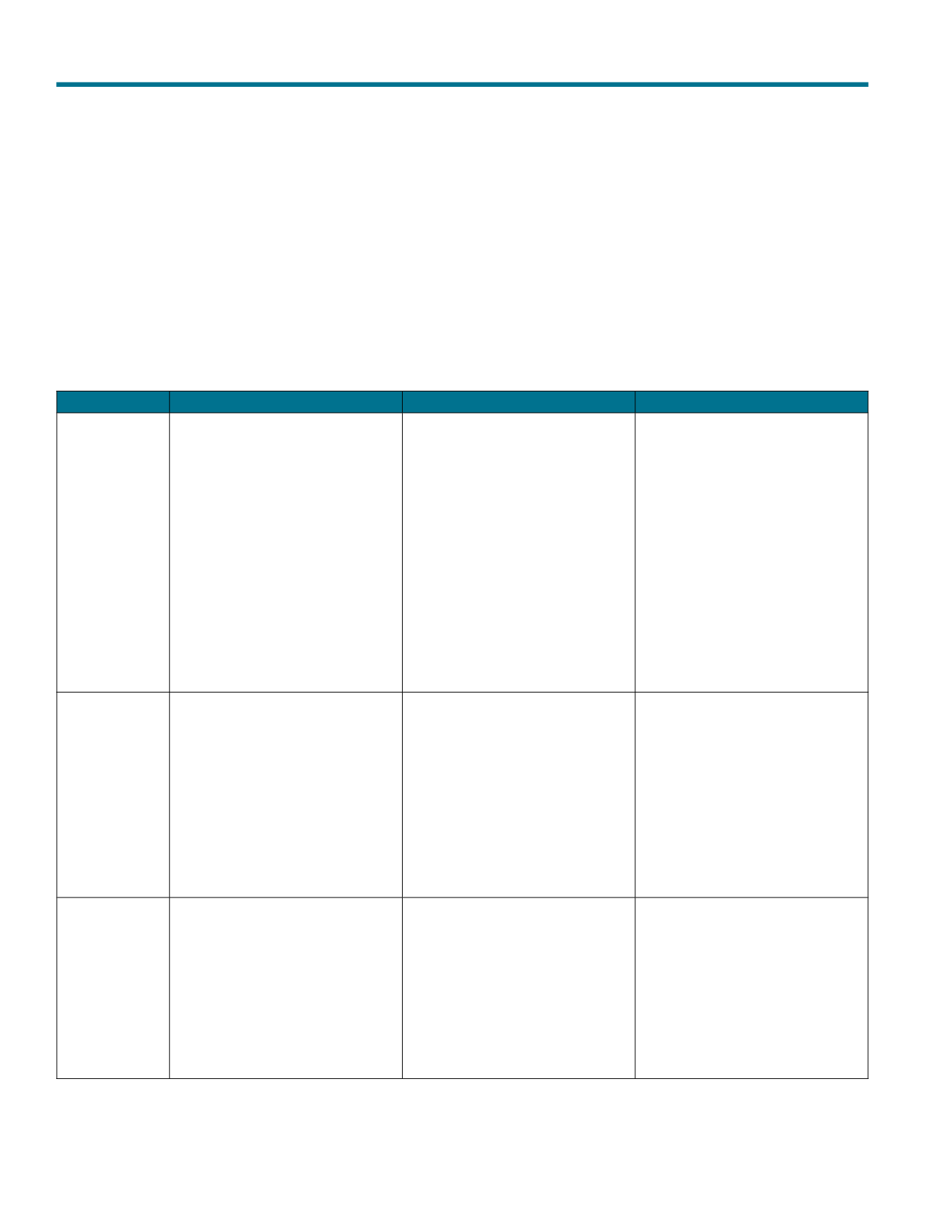

Table 1

Levels For Potential HQLA

Designation

Europe

U.S.

Canada*

Level 1 assets

(0% haircut,

covered bonds at

least 7% haircut)

(a) Coins and banknotes.

(b) Certain central bank reserves.

(c) Certain central or regional govern-

ment assets or claims.

(d) Certain third-country government/

central bank assets or claims

(typically must be rated ECAI 1)

†

.

(e) Certain assets issued by credit

institutions.

(f) Extremely high-quality covered bonds

(ECB member states).

(a) Federal Reserve bank balances.

(b) Foreign withdrawable reserves.

(c) Securities issued by or unconditionally

guaranteed as to timely P&I by the

U.S. Treasury.

(d) Liquid and readily marketable

securities guaranteed by any other

U.S. government agency.

(e) Certain liquid and readily marketable

securities that are claims on, or claims

guaranteed by, a sovereign entity, a

central bank, the Bank for Interna-

tional Settlements, the International

Monetary Fund, the European Central

Bank, and European Community, or a

multilateral development bank.

(f) Certain debt securities issued by

sovereign entities.

Securities issued under the National

Housing Act Mortgage Backed Se-

curities (NHA MBS) program may be

included as level 1 assets.

For non-foreign non-DSIB institutions,

holdings of NHA MBS and CMBS where

the minimum pool size is less than $25

million may be included as level 1 assets.

Sovereign and central bank debt se-

curities, even with a rating below ‘AA-’,

should be considered eligible as level

1 assets only when these assets are

issued by the sovereign or central bank

in the institution’s home country or in

host countries where the institution has a

subsidiary or branch.

Level 2A assets

(15% haircut)

(a) Certain regional government, local

authority, or public sector entities as-

signed a 20% risk weighting.

(b) Certain third-country government/

central bank/regional government/

local authority/public sector entities

assigned a 20% risk weighting.

(c) Certain high-quality covered bonds

(ECB member states rated ECAI 2).

(d) Certain third-country covered bonds

rated ECAI 1.

(d) Certain ECAI 1-rated corporate

bonds.

(a) Certain obligations issued or guar-

anteed by a U.S. GSE (Freddie Mac,

Fannie Mae, Farm Credit System,

Federal Home Loan Bank).

(b) Certain obligations issued or

guaranteed by a sovereign entity or a

multilateral development bank.

Covered bonds that were issued

by Canadian institutions before the

Canadian covered bond legislation

coming into force on July 6, 2012, may

be included as level 2A assets if the

other requirements are met.

Level 2B assets

(25%-50%

haircut)

(a) Certain asset-backed securities.

(b) Certain ECAI 2- or 3-rated corporate

bonds.

(c) Shares.

(d) Certain restricted-use liquidity

facilities.

(e) Certain high-quality covered bonds.

(f) Certain third-country government/

central bank/regional government/

local authority/public sector entities

rated ECAI 5 or higher.

(a) Certain IG-rated corporate debt

securities.

(b) Certain publicly traded shares of

common stock.

Sovereign and central bank debt securi-

ties rated ‘BBB+’ to ‘BBB–’ that are not

included in the definition of level 1 assets

may be included in the definition of level

2B assets with a 50% haircut within the

15% cap for all level 2B assets.

Institutions are permitted to include

long cash non-financial equity positions

held against synthetic short positions as

eligible level 2B assets provided certain

operational requirements are met.

*Based on our read, the Canadian regulations are built on the EU regulations. We’ve included what we believe to be the relevant OSFI notes.

†

Our understanding is that an ECAI 1 rating is equivalent to

a ‘AA’ or ‘AAA’ category, while ECAI 2 is ‘A’, ECAI 3 is ‘BBB’, ECAI 4 is ‘BB’, and ECAI 5 is ‘B’. P&I—Principal and interest. CMB—Canada mortgage bond. ECAI—External Credit Assessment Institutions.

ECB—European Central Bank. IG—Investment grade. GSE—Government-sponsored enterprise.

Basel III’s Recent Liquidity Guidelines

regulations, most level 1 assets may be included with no haircut,

level 2 assets receive a 15% market value haircut, and level 3 are

haircut by 25%-50%, although different instruments in each level

may have varying haircuts.