CRE Finance World Autumn 2015

24

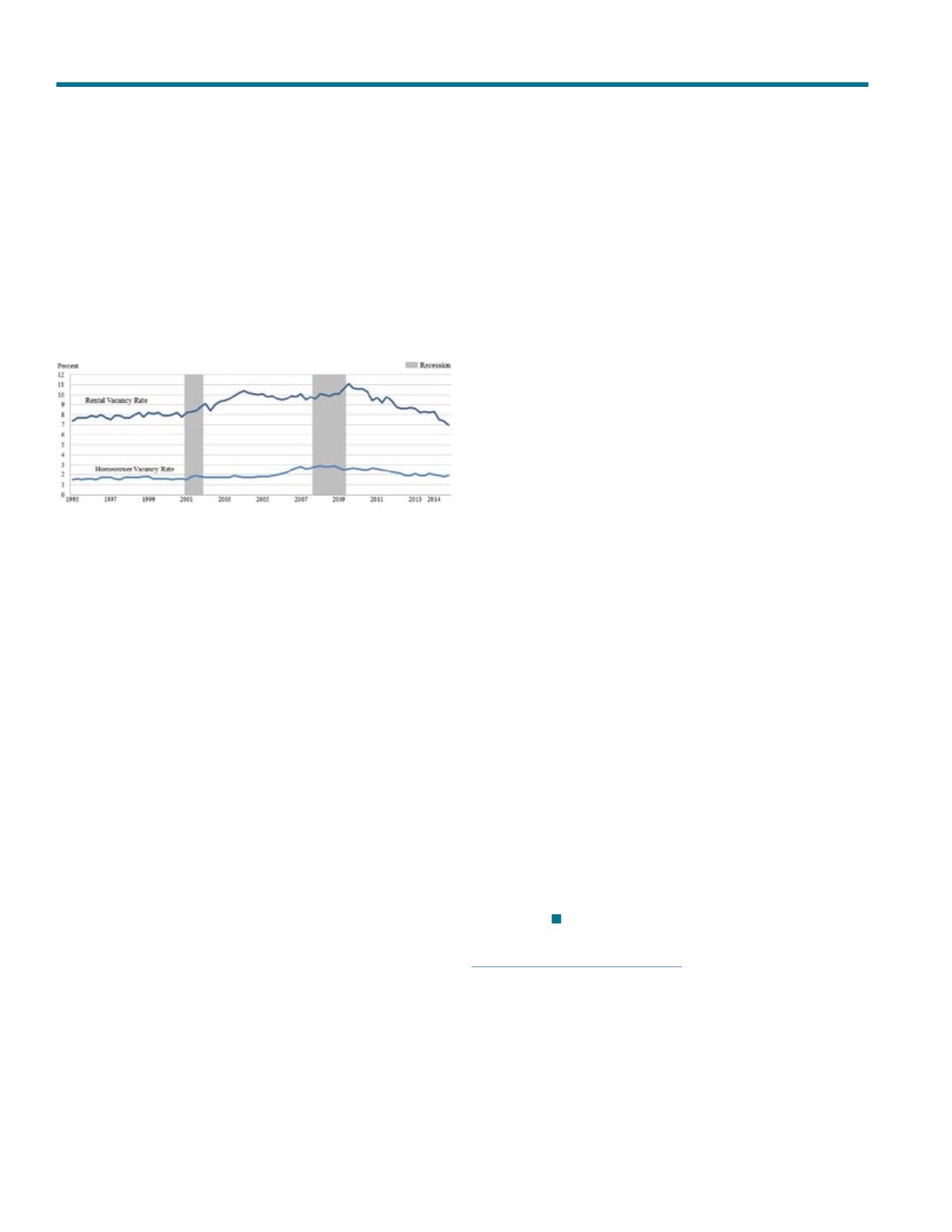

Exhibit 5

Quarterly Rental and Homeowner Vacancy Rates for the United States,

1995–2014

Source: U.S. Census Bureau

According to Morgan Stanley, large buyers have spent about $68

billion amassing about 528,000 SFR homes. Given that $12 billion

of securities tied to approximately 90,000 homes have so far been

issued, there are still plenty of SFR properties available in the

market to be securitized. Additionally, historical performances of

the prior SFR offerings have been quite assuring. Granted the very

first SFR securitization had initially sparked concerns as collected

rents declined by 7.6% within 3 months of the cut-off date, with

a stabilized vacancy rate (8%) higher than the issuer’s prediction

(6%). However, these vacancy numbers were still well within

the rating agencies’ stressed parameters and more importantly,

despite a reduction in rental cash flows received, payments were

nonetheless made in full to bondholders. As the market develops,

both delinquency rates and vacancy rates have been generally low

and stable. According to Morningstar, the month-end delinquency

rates of May 2015 ranged between 0.2-1.3% with American

Rental Properties 2014-SFR1 deal being an anomaly with 2.3%

and the vacancy rates among SFR securitizations remaining

relatively flat month-over-month at an average lower than 5%

despite a general trend of a rising number of lease expirations.

Where is SFR market heading?

Although institutional investors are likely to remain involved in the

SFR market for quite some time in the face of rising interest rates,

climbing home prices, high student debt, tight credit conditions

and depressed incomes that limit opportunities for would-be

homebuyers, the SFR market is expected to eventually shift from

larger-scale investors to smaller, individual investors.

With housing prices having recovered nearly their pre-crisis peaks,

these institutional investors will want to cash out and realize

their profits by liquidating their portfolios rather than holding

properties and associated market risks on their balance sheets.

Both Invitation Homes and Starwood Waypoint Residential Trust

plan to sell about 5% of their SFR portfolios every year. Moreover,

although millennials are expected to rent for the next few years,

they will eventually want to become homeowners as they form

families and become financially more stable, and may even be

forced to buy houses if rents outpace housing prices. Additionally,

access to credit is set to increase for retail investors looking to

purchase SFR properties. Private equity firms have already begun,

or are seriously considering, offering so-called landlord loans and

rent-to-own programs. The Blackstone Group, Colony Capital and

Cerberus Capital Management are providing landlord loans to

small and midsize investors buying single-family homes. Over the

last year, subsidiaries and affiliates of all three private equity firms

have reportedly lent about $1.5 billion collectively where most of

these loans range from $500,000 to $50 million in size, are two to

five years in length, have interest rates of 5-6% and are backed by

mortgages on the properties and sometimes the rental payments

on the homes. Blackstone is also considering whether to offer

rent-to-own programs or future financing options for tenants who

will eventually become homeowners.

These new lending platforms are generating another exciting

securitization opportunity as these firms are gearing up to bundle

those loans into bonds. Indeed, the first landlord loan securitization

is expected to hit the market in the next few weeks. Given little

competition these firms face with the only other significant SFR

lenders being Fannie Mae and Freddie Mac, which limits their

financings to true mom-and-pop investors, and hard-money lenders,

whose loans tend to be for short periods of time and carry higher

than normal interest rates, demand for landlord loans is expected

to grow fast.

Click Here to Share Comments on this ArticleSingle-Family Rental Securitization: Where Are We and Where Will We Be?