CRE Finance World Autumn 2015

34

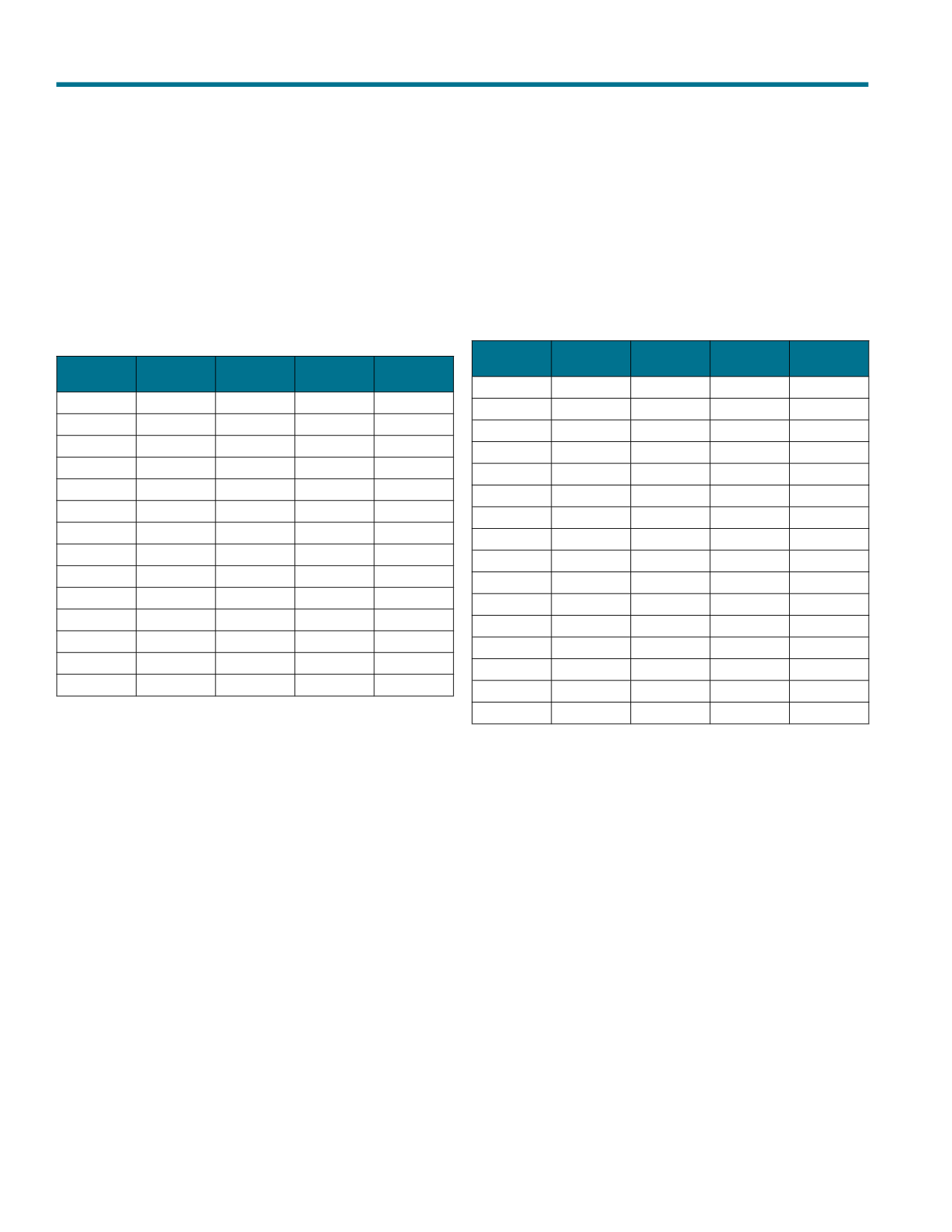

Chart 1

U.S. Average Daily Trading Volume Of Munis, Corporates, And Agency MBS

2002-2015 YTD

Year

Treasuries

Agency

MBS

Corporate

(IG Only)

Municipal

2002

366.4

154.5

12.7

10.7

2003

433.5

206.0

11.9

12.6

2004

499.0

207.4

11.2

14.8

2005

554.5

251.8

10.2

16.9

2006

524.7

254.6

10.4

23.1

2007

570.2

320.1

10.2

25.1

2008

553.1

344.9

9.2

19.4

2009

407.9

299.9

13.3

12.5

2010

528.2

320.6

12.9

13.3

2011

567.8

243.3

13.2

11.3

2012

518.9

280.4

13.9

11.3

2013

545.4

222.8

14.9

11.2

2014

505.4

177.9

15.4

9.9

2015 YTD

500.6

203.2

16.7

9.8

Source: FINRA Trace/IDC via SIFMA, 2015 data Through July 31.

Data in $billons

Chart 1 shows that agency MBS is the most liquid bond product

traded in the U.S. by a wide margin, except for Treasuries. This

explains investors’ concerns that it is classified as level 2A and

haircut at 15%. While bid-asked spreads for corporate and

municipal bonds are also consistently quoted by many market

makers, the volumes are nowhere near the magnitude that can

be traded in the agency market.

Chart 2

U.S. Average Structured Finance Daily Trading Volumes Q3 2011-Q1 2015

CMBS

(P&I Only)

Auto

Credit Card

Student

Loan

2011 Q3

1425.0

136.3

273.1

217.7

2011 Q4

967.9

165.7

176.8

168.2

2012 Q1

1511.9

236.4

249.6

280.8

2012 Q2

1312.4

295.2

250.6

344.7

2012 Q3

1367.1

290.7

190.8

302.7

2012 Q4

1319.5

558.8

340.2

367.7

2013 Q1

1522.5

711.4

305.2

422.5

2013 Q2

1548.5

664.1

280.5

392.3

2013 Q3

1535.4

622.2

403.5

195.1

2013 Q4

1167.4

530.8

398.6

191.1

2014 Q1

1280.7

788.8

461.2

347.6

2014 Q2

1271.6

792.4

402.0

293.0

2014 Q3

1070.5

785.4

589.7

355.4

2014 Q4

1020.5

746.0

522.3

223.4

2015 Q1

1070.9

851.9

447.1

263.2

2015 Q2

1199.4

Source: FINRA Trace/IDC via SIFMA

Data in $millions

Because of the limited overall liquidity during the 2008-2009

crisis, many investors turned to other securitized bonds products

such as CMBS, as many market makers were still able to transact

among accounts in large amounts in these products, albeit at wider

spreads. For CMBS, this created a record of widening historical

price transaction levels, but given the volumes involved, that record

actually indicates that liquidity was available in a functioning

marketplace. Looking at the available data since 2011 (see chart

2), CMBS clearly remains one of the more actively traded and

liquid structured finance bond sectors, with average trade volumes

usually exceeding $1 billion on a daily basis. The shorter duration

ABS products, such as credit cards or autos, have very low trading

volumes because those investors usually buy to hold for the two-

or three-year term, and so market makers may be less prepared

to make markets in those bond classes. As a result, and because

of their shorter terms, these bonds are less likely to see price

distortion. The question still exists as to whether these assets are

as liquid as a super-senior CMBS class that did see bids during

crisis conditions. The overall high trade volumes for CMBS are

likely to come mostly from the highest-rated classes, as many

investors use those classes as a swap spread or yield substitute,

Basel III’s Recent Liquidity Guidelines