CRE Finance World Autumn 2015

26

K

A Closer Look at Credit Bar-BellingPaul J. Fitzsimmons

Managing Director

Kroll Bond Ratings

Eric Thompson

Senior Managing Director

Kroll Bond Ratings

Larry Kay

Director

Kroll Bond Ratings

BRA has observed that an increasing number of

transactions have included more significant exposures

at both ends of the credit spectrum by adding more lower

leverage investment grade (IG), and highly leveraged

(HL) loans. This can result in credit bar-belling in a CMBS

deal when the low levered IG loans more than offset the impact of

higher leveraged loans in the calculations of the pool’s weighted

average KBRA Loan To Value (KLTV), KBRA Debt Service Coverage

(KDSC), and other credit metrics. Considering the increase that

we’ve seen in both IG and HL loans, we decided to take a closer

look at the issue of credit bar-belling, and its potential effect on a

transactions overall credit quality.

To explore the topic, KBRA examined each of its 101 rated conduits

to identify which of the underlying loans have credit characteristics

consistent with an investment grade rating obligation when analyzed

on a stand-alone basis. We subsequently analyzed each pool’s

credit metrics for both IG and non-IG loans, with a focus on KBRA

Loan to Value (KLTV). The results are highlighted in the

exhibitspresented herein – notably:

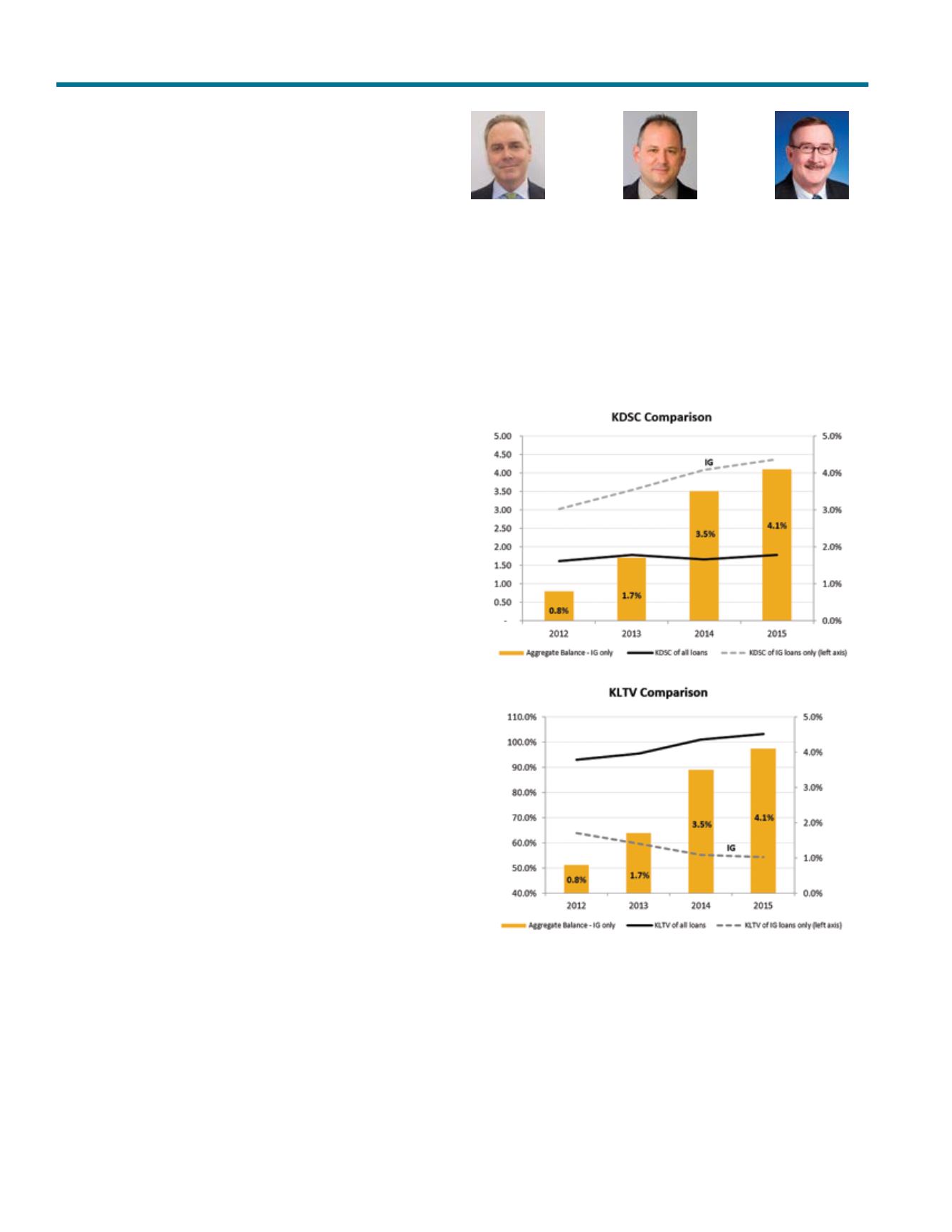

• Exhibit 1 — on a positive note, the percentage of IG loans with

favorable KDSC and KLTV credit metrics has increased over the

past three years. While the figure represents a relatively small

percentage of the conduit universe, at 4.1% YTD 2015, there

have been four transactions which had exposures to IG loans that

were in the mid to high teens since April 2015.

• Exhibit 2 — of concern is the rise in loans with high leverage “HL”,

which have KLTVs in excess of 110%. The proportion of these

loans has increased dramatically over the same time period,

and now represents more than a third of 2015 conduit issuance.

Furthermore, the presence of “ultra” HL (UHL) loans with KLTVs

in excess of 120% has tripled YTD, and currently stands at 6.1%.

• Exhibit 3 — KBRA combined the exposure to both IG and UHL

loans to create a “Credit Bar-Bell Indicator” — which has almost

doubled YTD 2015 over FY 2014, and currently stands at 10.2%.

As noted in Exhibit 1, the concentration of IG loans is increasing

and has more than doubled since 2013. Among deals with IG

loans, the exposure has ranged from 1.3% to 20.4%. In some

cases, the IG exposures are represented by whole loans, whereas

in others they are the trust component of a whole loan with

favorable credit characteristics. As illustrated in Exhibit 1, the IG

loans have KDSC and KLTV that are superior to non-IG loans.

The YTD weighted average KDSC for IG loans is 4.37x, which is

2.5 times higher than the overall average of 1.76x. The weighted

average KLTV (2012 to YTD) is 57.2% or 42% lower than the

overall KLTV of 98.9%. At these levels, IG loans should be far less

susceptible to defaults and losses than non-IG loans.

Exhibit 1

IG KDSC & KLTV

Notes:

1) IG loans are highlighted in the Key Credit Considerations section of our Presale Publications

2) KBRA’s CMBS Single Borrower & Large Loan Methodology Used in Determining IG

Classification.

Source: Kroll Bond Rating Agency, Inc.

Of rising concern is the sevenfold increase in HL loans since

2013. As the large field of originators competes for market share

in an environment with increasingly thin profit margins, they have

been more lenient on a number of fronts — particularly leverage.