A publication of

Autumn issue 2015 sponsored by

A publication of

Autumn issue 2015 sponsored by

CRE Finance World Autumn 2015

27

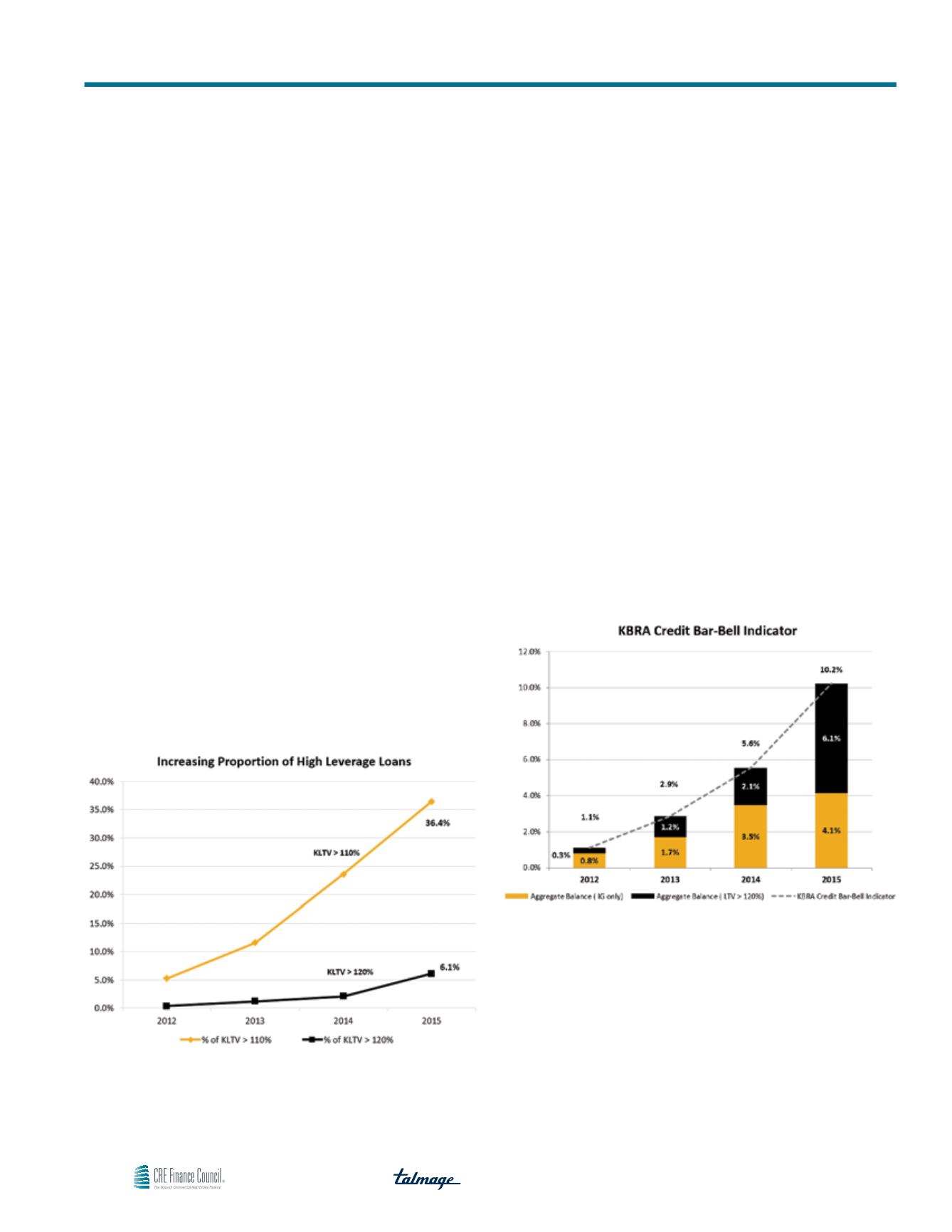

Many borrowers in the non-recourse space desire higher leverage

and absent any pricing dislocations we would expect the trend to

continue for the foreseeable future. We are hopeful, however, that

the rate of increase in HL loans will decelerate — as they already

constitute more than a third of recent conduit transactions.

It is important to note that KLTV is based on KNCF and KBRA

value, which reflect KBRA’s estimate of normalized sustainable

property performance, and are generally lower than third party

appraiser values by 35%, on average. Furthermore, some of the

higher leverage loans may be on higher quality assets in major

metropolitan areas, where conduit lenders are more likely to

compete with insurance companies and balance sheet lenders.

The location of these properties, coupled with their quality and,

at times, the presence of IG credit tenancy, somewhat mitigates

their higher leverage.

While this is the case, the growing number of HL loans is still viewed

unfavorably — particularly those with ultra-high leverage. As per

the graph, the proportion of these loans, which have KLTVs in

excess of 120%, has grown fourfold since 2013. In KBRA’s view,

they will likely experience higher defaults and losses over the loan

term than lower levered loans secured by properties of similar

quality, regardless of location.

Exhibit 2

HL Loans on the Rise

Source: Kroll Bond Rating Agency, Inc.

As the number of HL loans has been on the rise, so has the

proportion of IG loans. As noted in the gold column in Exhibit 3,

the proportion of IG loans more than doubled from 2013 to 2014,

and is up 17% YTD 2015. These loans had in-trust KLTVs that

were generally less than 70% and averaged 57% since 2012,

which is in stark contrast to triple digit KLTV HL loans. The

proportion of UHL loans has also increased, and at a faster rate

(black column). As a result, our credit bar-bell indicator, which

sums the UHL and IG loan exposures, has been expanding at or

near two times over the past few years, and pierced 10% YTD

2015. The increase in credit bar-belling has certainly masked

overall pool-leverage, and it is an important credit consideration —

particularly where larger concentrations of UHL loans are present.

To help better discern the trends on individual deals, we have

included a listing of our rated conduit universe (2013-2015) in the

addendum of this report.

Exhibit 3

KBRA Credit Bar-Bell Indicator

Source: Kroll Bond Rating Agency, Inc.

Our review of the conduit universe indicates that credit bar-belling

has impacted the overall KLTV for the 2015 universe by more than

3% (106.0% vs 102.8%) based on a three month rolling average.

There are, however, several individual deals where the difference is

meaningfully higher, and can be as much as 10%. In one transaction,

the pool had a KLTV of 96% but if the IG loans were excluded, the

pool’s KLTV would rise to 106%.

A Closer Look at Credit Bar-Belling

“The proportion of IG loans has doubled since 2013, but

during the same period there has been an threefold

increase in High Leverage Loans with KLTVs over 110%.

In fact, loans with KLTVs in excess of 120% have grown

five times since 2013.”