CRE Finance World Autumn 2015

22

T

Single-Family Rental Securitization: Where Are We and Where Will We Be?WonJu Sul

Associate, Capital Markets

Cadwalader, Wickersham &Taft, LLP

he fledgling single-family rental (SFR) market—formed in

the wake of the financial crisis as institutional investors

amassed large portfolios from foreclosure auctions and

short sales—is on the verge of some major developments.

Deals securitized since the first-ever SFR securitization

by Invitation Homes in November 2013 have been substantially

alike, with investors primarily being large institutions. But that is

about to change as new lending programs alter the profile of the

collateral and the investor base expands.

The SFR market has expanded substantially in the past few years

and will continue to do so as demands for SFR homes and rents are

expected to continue to increase, property management becomes

more efficient and historical performances have demonstrated

generally low rental vacancy and delinquency rates. With housing

prices rising, institutional investors will seek to cash out their SFR

portfolios and, together with heightened demand for SFR houses

from millennials and availability of new lending programs for retail

SFR investors, SFR market is likely to shift from large institutional

players to smaller individual investors. What is more, a new asset

class—landlord loans—is expected to grow substantially.

Where We Are

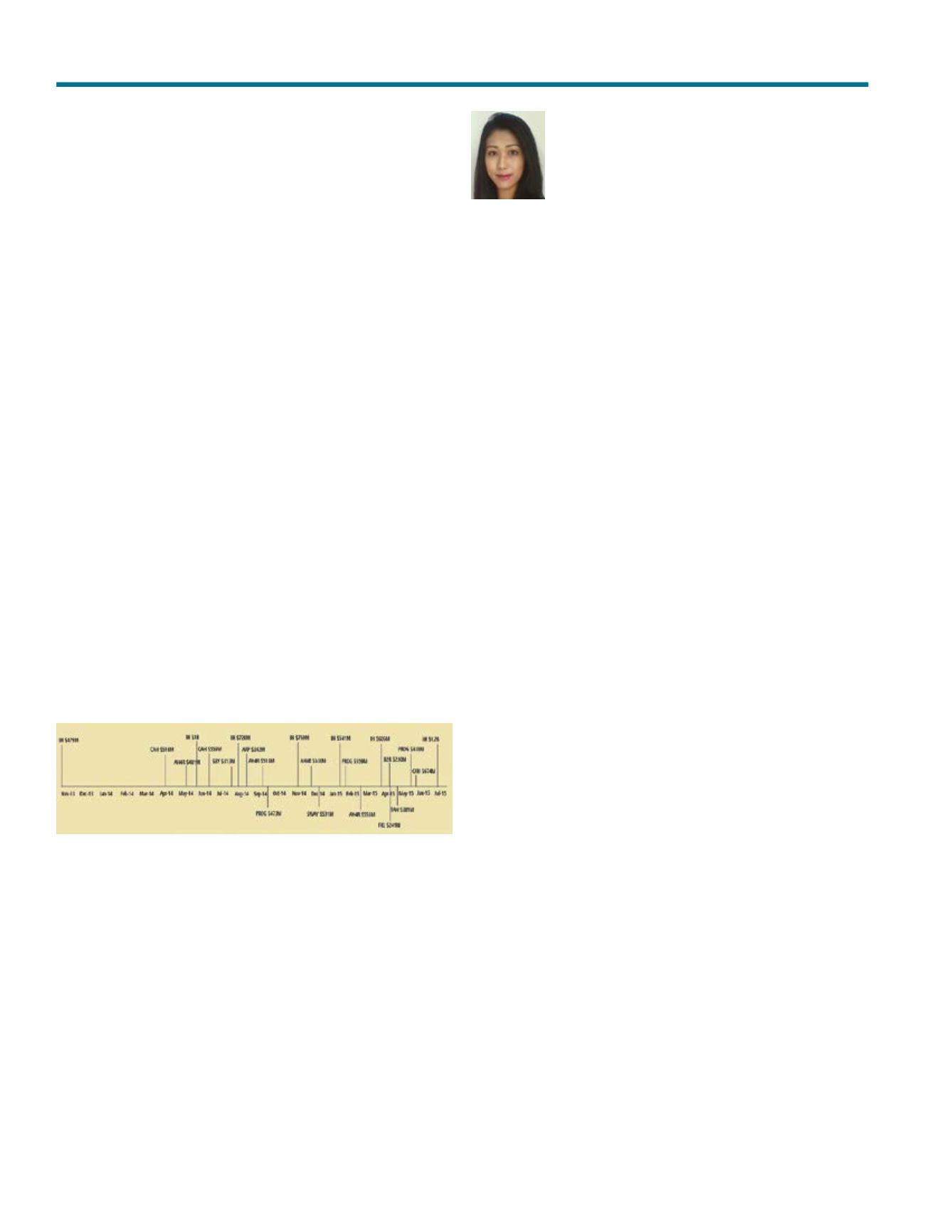

Exhibit 1

REO-to-Rental Securitizations Timeline (as of August 19, 2015)

Source: Bloomberg Terminal, Asset-Backed Alert

To date, there have been 23 SFR securitizations. Exhibit 1 shows

the timeline of these securitizations. SFR industry has expanded

tremendously in the past two years. According to Commercial

Mortgage Alert, the US CMBS issuance was about $94 billion and

the US SFR issuance was about $6.8 billion in 2014. As of July

2015, year-to-date US SFR issuance is $5.42 billion up 53% from

$2.85 billion for the same period in 2014 whereas year-to-date US

CMBS issuance is $55.74 billion up 22% compared to the same

period in 2014. The SFR bond market is currently estimated to be

a $12.65 billion market with Blackstone’s Invitation Homes unit

having a leading market share of 42.1% through its seven offerings

totaling $5.32 billion. American Homes 4 Rent stands second at

$2.08 billion followed by Colony American Homes at $1.75 billion.

Typical structure is as follows: an investor first forms a REIT or

LLC and raises debt and/or equity financing to acquire a portfolio

of SFR homes and then transfers such portfolio to a borrower

(typically an LP or LLC) where it serves as the general partner

owning 100% of the borrower. The borrower then obtains a loan

secured by the first priority mortgage on such portfolio. The loans

typically have two to three year terms with the borrower’s option

of multiple one-year extensions for a total of five years. The lender

then transfers the secured loan to depositor (typically an LP or

LLC) who will deposit such loan in a special purpose entity that

is bankruptcy-remote and will issue debt securities. These debt

securities are callable and/or non-callable bonds with first lien

security interest over rental incomes from the collateralized SFR

homes and sometimes are also backed by pledge of equity interest

in the borrower and guarantees from sponsors. Similar to CMBS

issuances, these SFR offerings typically elect REMIC structure.

Every SFR offering to date has received triple-A rating on its most

senior tranche. Credit rating agencies have adopted methodology

that leverages elements of CMBS and RMBS criteria because the

collateral underlying an SFR transaction has both commercial and

residential characteristics. Loan-to-value (LTV) ratio ranges from

63.1% to 78.9% with an average of approximately 73%. Later

deals tend to have higher LTV ratio as the industry becomes more

comfortable with the asset class and issuers consider structuring

deals with an added risk retention tranche (5%) that allows the

securities to be sold in Europe, as was the case with the Invitation

Homes 2014-SFR2 offering. All but four offerings have been

priced using LIBOR with coupon size for its top tranche ranging

from 113.7 to 163.6 basis points. Two of the four fixed rate bonds

have been issued by American Homes 4 Rent in September 2014

and March 2015 respectively; and the other two fixed rate deals

were by FirstKey Lending in April 2015 and Progress Residential

in May 2015. The underlying portfolios for the SFR securitizations

issued during the past year ranged in size from 2,876 to 4,661

properties with an average of 3,728. The largest offering to date

is the $1.2 billion floating rate, interest-only offering by Invitation

Homes secured by mortgages on 7,265 income-producing SFR

homes issued in June 2015.

As SFR securitization market develops, there have been several

structural variations. The first three deals offered were structured

to amortize whereas the following seven deals have been structured

as interest-only loans. The offerings by FirstKey Lending and

B2R Finance in April 2015 were the first multi-borrower SFR

securitizations (backed by multiple loans to one or more entities).

Prior to these offerings, transactions have been backed by

one loan from a single borrower. Some later offerings involved