A publication of

Autumn issue 2015 sponsored by

A publication of

Autumn issue 2015 sponsored by

CRE Finance World Autumn 2015

17

There is no particular reason why CMBS trading on the unregulated

market of a stock exchange could not be issued with short and

simple offering circulars with investors undertaking their own

due diligence. However, this has not yet been seen in the market

and there seems to be no consensus as to whether this would be

acceptable to investors.

Conclusion

European CMBS is set for its best year since 2007.

€

3.3 billion

of new CMBS has been issued in Europe in the first half of 2015

compared with

€

887 million in the first half of 2014. It is also clear

that new pressures from regulators and market sources are driving

the development of new forms of CMBS.

The development of products such as unrated CMBS and A/A2

CMBS shows that CMBS can continue to innovate and find

solutions to the challenges it faces. As such, the future of CMBS

in Europe seems more secure today than has been the case for

a number of years.

Click Here to Share Comments on this ArticleAppendix

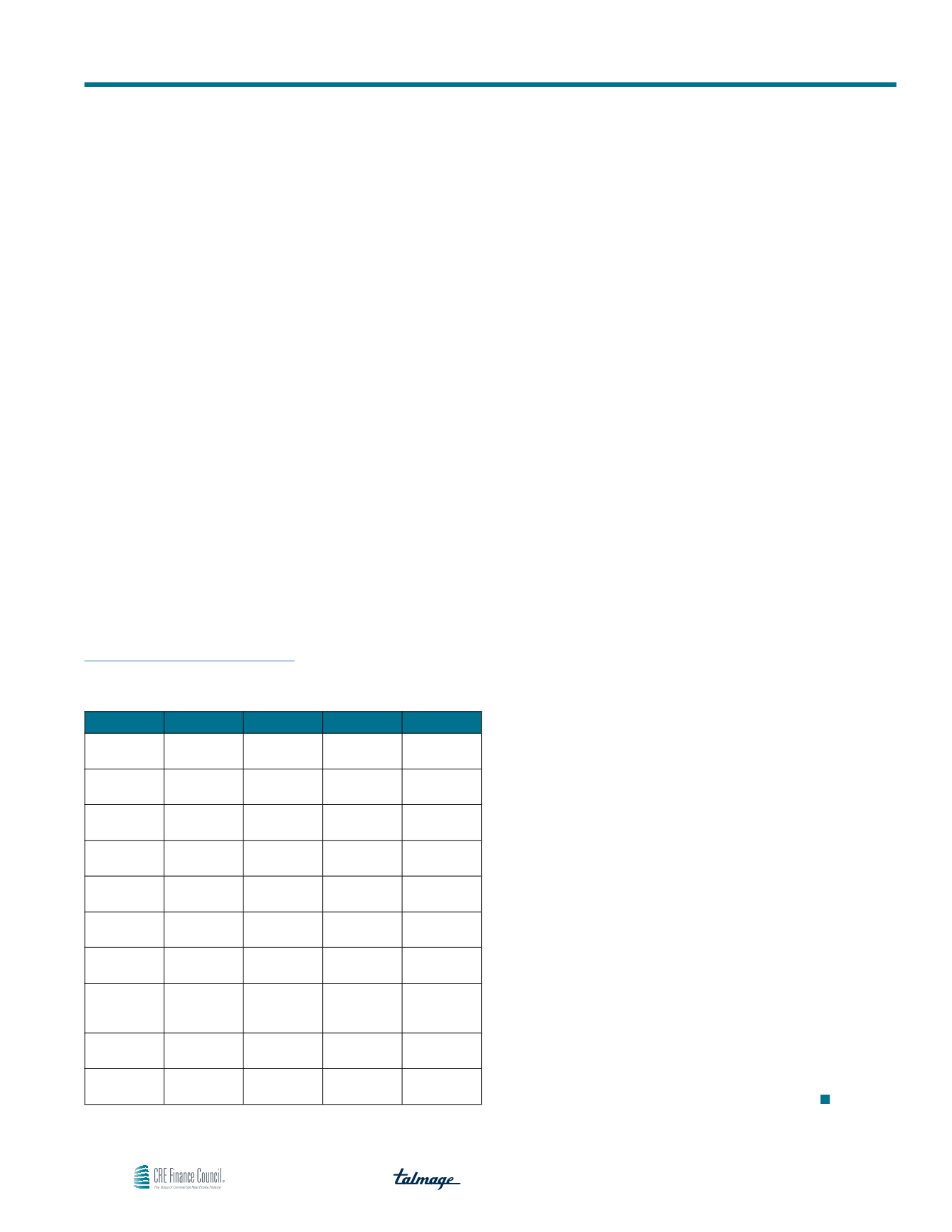

Publicly Announced European Unrated CMBS

Date

Name

Amount (M) Assets

Arranger

August

2012

Utrecht

Funding 1

£215

Dutch

offices

Eurohypo

June 2013 DECO 2013

– CSPK

£380

UK offices Deutsche

Bank

September

2013

Monnet

Finance

€

406

German

multi-family

Deutsche

Bank

January

2014

Reni SPV

€

135

Italian retail

BNP

Paribas

August

2014

Taurus 2014

FR-1

€

410

French

offices

Merrill

Lynch

August

2014

Pangaea

Funding 1

€

237

Greek

offices

Cairn

Capital

December

2014

Zephyrus

(ELOC 30)

£196

UK retail

Morgan

Stanley

February

2015

Mint

Mezzanine

2014

£75.9 &

€

30.9

UK hotels J.P. Morgan

April 2015 Midas

Funding UK

£100

UK offices Morgan

Stanley

July 2015 Lusso S.r.l.

€

75

Italian retail

BNP

Paribas

1 Bank of America Merrill Lynch – European SF & CB Weekly, 1 June

2015.

2 Bank of America Merrill Lynch – European SF & CB Weekly, 18 May 2015.

3 Bank of America Merrill Lynch – European SF & CB Weekly, 8 June 2015.

4 European Regulation (EU) 648/2012, 4 July 2012

5 European Regulation (EU) No 575/2013, 26 June 2013.

6 Many pre-credit crunch CMBS did not provide this information.

7 In a small number of transactions fees and margins were higher or lower

than shown here.

8 European Regulation (EU) 575/2013.

9 Article 4 Clause (61) of Article 4(1) of European Regulation (EU)

575/2013. Under CRR, a tranche can be a class of bonds or a loan.

10 European Regulation (EU) No 462/2013, amending Regulation (EC)

No 1060/2009.

11 Real Estate Capital, Quasi-CMBS issues sound a new property debt

note, June 2015.

12 Zephyrus (ELOC 30) issued one class of bonds and a subordinated

loan which is treated as a tranche under the CRR.

13 Real Estate Capital, Quasi-CMBS issues sound a new property debt

note, June 2015.

14 Subject to limited exemptions for the most senior tranches of bonds issued.

15 In transactions where the composition of the pool of securitised assets

is known at all times, as an alternative, investors may look through to

the risk weighting of the pool and apply a weighted average risk weight

by multiplying the risk weight of the underlying assets by a concentra-

tion ratio equal to the nominal amount of all tranches in the structure

divided by the nominal amount of all tranches junior to or pari passu

with the tranche in which the firm has a holding. However, as CRE loans

are themselves 100% risk weighted, this is unlikely to produce a better

result.

16 These schemes are dynamic and flexible and have on occasion relaxed

their criteria (including ratings requirements) for particular types of

investments and particular jurisdictions to meet market needs.

17 A two tranche £171.1 million UK office CMBS rated A/BBB- arranged

by RBS.

18 Bank of America Merrill Lynch – European SF & CB Weekly, 1 May 2015.

19 For the purposes of the Markets in Financial Instruments Directive

2004/39/EC (MiFID).

20 European Directive 2003/71/EC.

21 The Mint Mezzanine offering circular runs to 366 pages.

Unrated CMBS: A New European Asset Class