A publication of

A publication of

Winter issue 2016 sponsored by

CRE Finance World Winter 2016

33

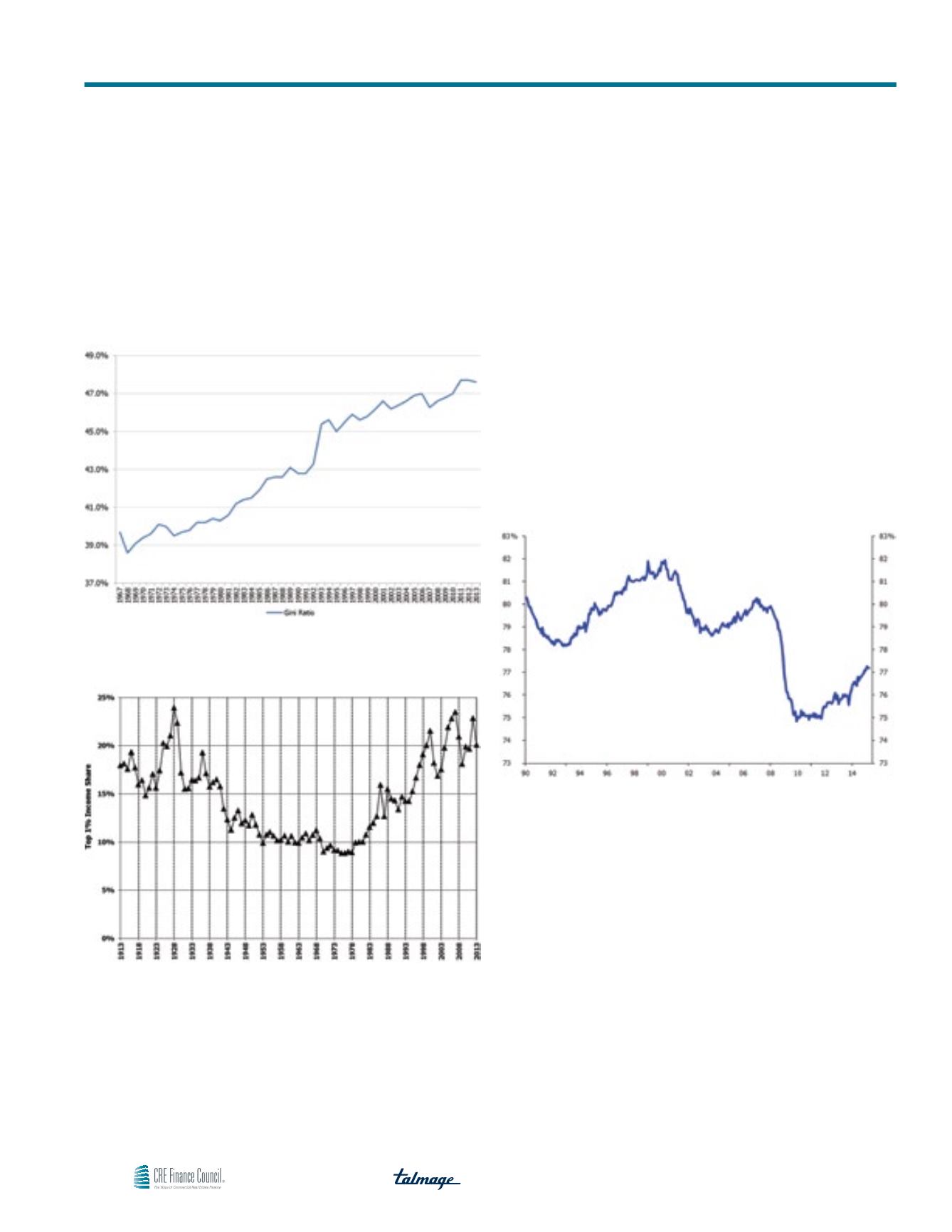

Table 11

Gini Ratio

Source: US Census Bureau.

Table 12

Top 1% US Pre-Tax Income Share, 1913–2013

Source: Piketty and Saez, 2003 updated to 2013. Series based on pre-tax cash market income

including realized capital gains and excluding government transfers.

The effect of the economic bifurcation is not limited to the 20-34

year old prime renter group; less people in all age categories can

afford homes or can qualify for mortgages

5

. Table 14 illustrates

that the employment to population ratio for those in prime working

years of 25-54 has not recovered to its pre-crisis level. According

to JCHS “the real median income for households aged 50–64 in

2012 fell to $60,300, back to mid-1990s levels. Incomes of renters

in this age group have declined especially sharply, dropping 12

percent from 2002 to 2012 and now back to 1980s levels. Real

median annual incomes have fallen by $9,100 among 50–54

year olds and by $5,700 among 55–59 year olds since 2002”.

Consequently, renting levels are up for those 55 to 64 and they

accounted for almost a quarter of the growth in renter households

between 2005 and 2013.

Table 13

Employment to Population Ratio of 25–54 Year Olds

Source: Deutsche Bank, Bureau of Labor Statistics.

Nevertheless, the prime renter age bracket of 25-34 is of more

concern. According to the JCHS study, median incomes of younger

and middle-aged adults are at their lowest levels since 1970. The

steepest declines have been among younger adults. The median

income for households’ aged 25–34 fell 11% from 2002 to 2012,

leaving their real incomes below those of same-aged households

in 1972. Some of this economic stress is manifested in the growing

share of the 25-34 year olds as well as 23-24 year olds living

in their parents’ home. In addition it has also resulted in a lower

homeownership rate.

The home ownership rate has declined precipitously from the 2005

high water mark of 69.2% reached in December 2005. The Q2

2015 homeownership rate of 63.4% is the lowest it’s been since the

63.4% achieved in March 1967 according to the U.S. Census Bureau.

Trends Impacting Habitation Alternatives