CRE Finance World Winter 2016

28

T

Trends Impacting

Habitation Alternatives

he multifamily market is experiencing extraordinary

demand. In terms of value appreciation, apartments are

31.7% above the previous peak. Apartments in major

markets have outperformed all other property types

at 54.0% above the previous peak, while apartments

in non-major markets are up 17.4% from the previous peak

1

.

Market fundamentals have also rallied. As of Q2 2015, the national

apartment vacancy rate was 4.2% representing a 14 year low.

Construction as a percentage of existing inventory is at its highest

point since 2001. Despite the new construction, supply has not

kept up with demand. The effective annual rent growth rate aver-

aged 3.6% from 2011 to 2014. In contrast the Consumer Price

Index experienced an annual average growth of 1.7% during the

same time period.

The demand surge has its roots in underlying demographic, economic

and social trends. These include: the large cohort of millennials,

those born between 1980 and 2000 reaching prime renting age;

the growing prevalence of singlehood; the increase of adult years

without children at home; the aging of baby boomers and as a

corollary the growth of 65+ population combined with extended

US life expectancy; and the economic stress being experienced by

large sectors of American society. These trends portend demand

stability for a variety of habitation alternatives including luxury and

moderately priced multifamily product in urban, suburban, and non-

downtown city neighborhoods as well as for manufactured home

communities and seniors’ housing.

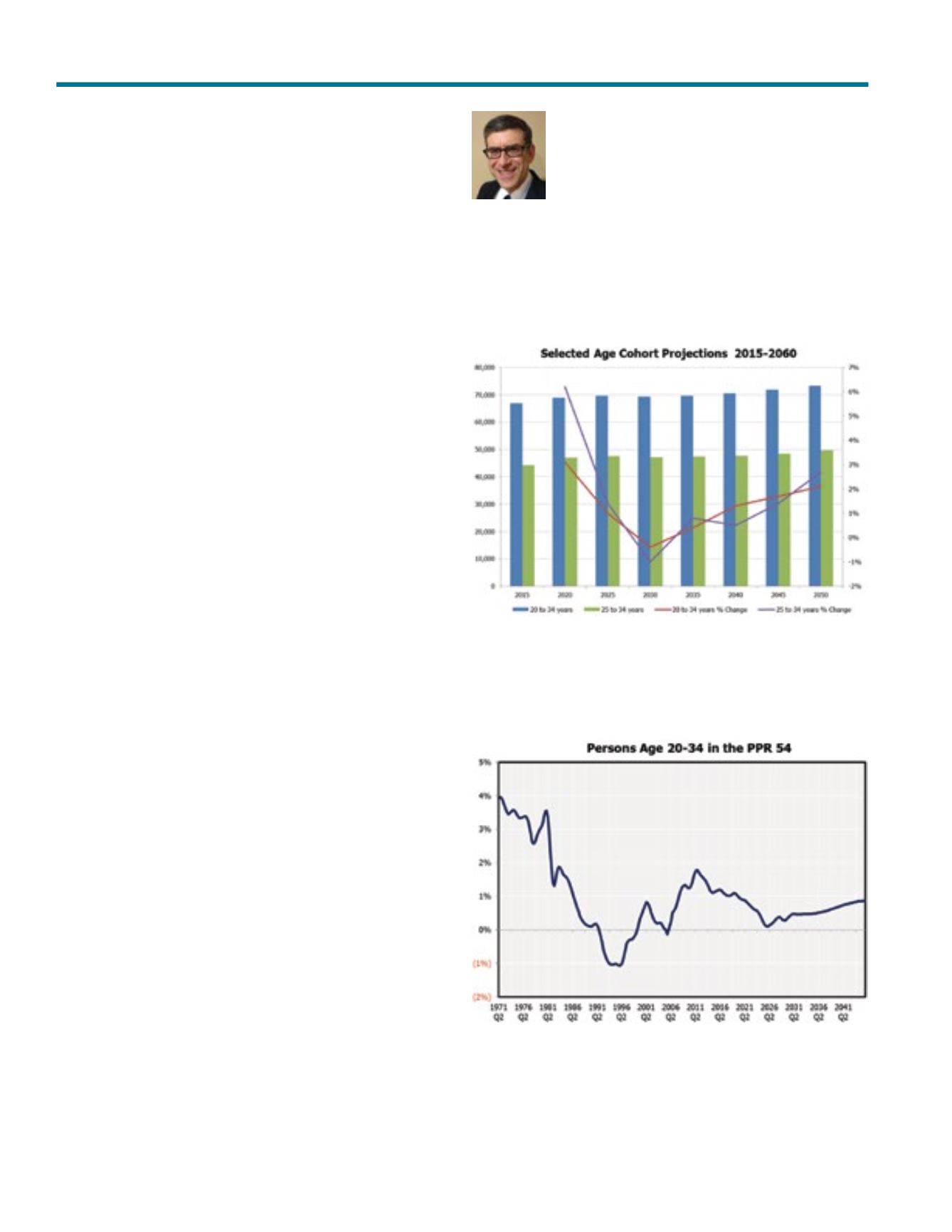

Prime Renting Age Population Growth

The primary demand generator for apartments is households headed

by someone between the age of 20 and 34. Young households

headed by someone 34 or younger are much more likely to rent

than all other age segments. In addition, younger households were

more likely to rent in 2013 than they were in 2005. For example,

according to the US Census, households headed by someone

25-34 years old had a 2013 renter share of 63% compared to

the 53% recorded in 2005. The large 87 million strong age cohort

of the American population born between 1980 and 2000 is now

15-35 years old and has driven a surge in rental housing demand.

This age bracket is expected to grow through 2025 and then

decline by 2030. It will then resume its ascent by 2035.

Table 1

Projected Size of Age Cohort

Source: US Census Bureau.

However, when isolating the top 54 markets tracked by CoStar

(PPR 54) collectively, the population is not projected to decline.

Table 2

Ppr 54 — Age 20-34 Age Cohort Historical and Projected Growth Rate

Source: CoStar and US Census Bureau.

Although some of the individual PPR54 markets’ population of

20-34 year olds is expected to decline between 2015 and 2030,

most of the individual PPR 54 markets are projected to exhibit an

increase in this age category.

Stewart Rubin

Senior Director

New York Life Real Estate Investors