CRE Finance World Winter 2016

32

As Americans are living longer and healthier lives, the 65+ age

cohort will continue to grow. This age cohort is large both because

of the size of the baby boom generation and increased longevity.

As baby boomers age, the largest population increase will be in the

65+ age category. The number of Americans age 65+ is expected

to increase by 61% from 46 million in 2014 to 74 million by 2030.

The increase for the top 44 markets tracked by CoStar is expected

to be 63%.

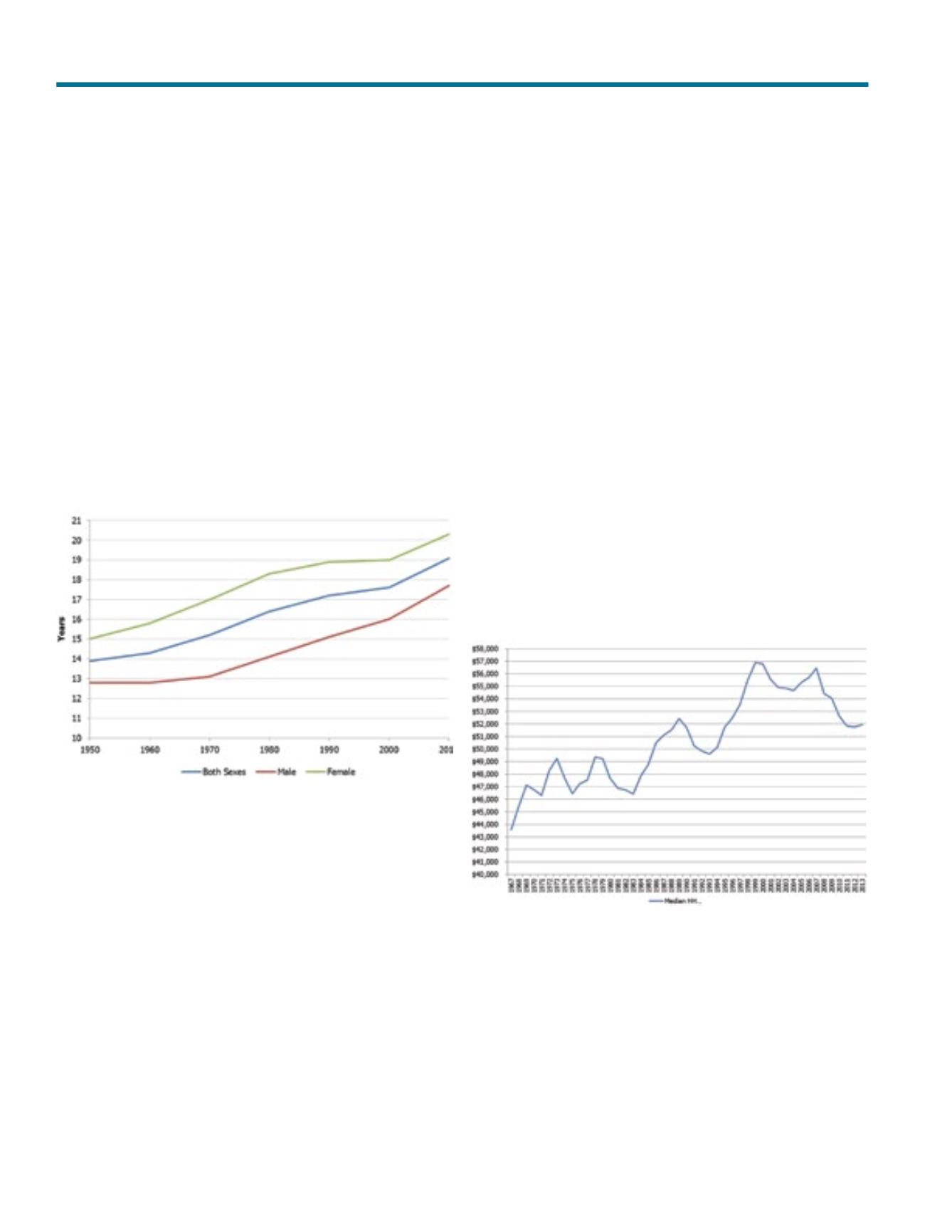

Table 9

Life Expectancy at Age 65

Source: Centers for Disease Control and Prevention.

Older Americans are more likely to own a home than younger

Americans. In 2014 79.9% of adults 65+ owned a home compared

to 76.3% of those 55 to 64 years, 70.7% of those 45 to 54 years,

and 59.7% of those 35 to 44 years. Home ownership rates taper

off after age 75. Even though individuals in the 65+ age bracket

are less likely to rent apartments, the significant growth of this age

segment will add substantial numbers to the potential rental pool.

Even if the current share of seniors that downsize from owning

to renting remains steady – the large size of the age cohort will

increase demand for multifamily units. Future seniors are less likely

to own homes as evidenced by the current home ownership rate of

the 55-64 and 45-54 age categories. Indeed renting levels have

increased over the past 10 years for those 45 to 64 according to

the recent JCHS study.

Economic Stress Being Experienced by Large Sectors of

American Society

Although the economy has improved significantly, since the great

recession, a considerable sector of American society has been

left behind. Despite significant improvements in the unemployment

rate (U-3) to pre-crisis levels, and a lower rate of the more expansive

U-6 measure of unemployment, the employment to population

ratio remains significantly below prerecession levels. The

employment to population ratio for those aged 25-64 is 73.5%

vs. 76.5% prerecession.

The recovery economy is tarnished by weak wage growth and

a record number of civilians not in the labor force. Real median

household income in the United States has declined since its

most recent peak in 2007. Although median household income

experienced a slight increase in 2013, it has not recovered back

to the level achieved in 1996.

Table 10

Real Median Household Income 1967–2013

Source: US Census Bureau.

Since the financial crisis 86% of Americans have seen their wages

fall in real terms, while 14% have experienced a real wage rise

4

.

Measures of income inequality include the Gini Ratio and the

distribution of income and wealth between the top 1% and the

bottom 99%. Tables 12 and 13 illustrate that the Gini Ratio is

near a 50 year high and lopsided income distribution is near a

90 year high.

Trends Impacting Habitation Alternatives

“Longevity has resulted in

more adult years without

children at home.”