CRE Finance World Winter 2016

34

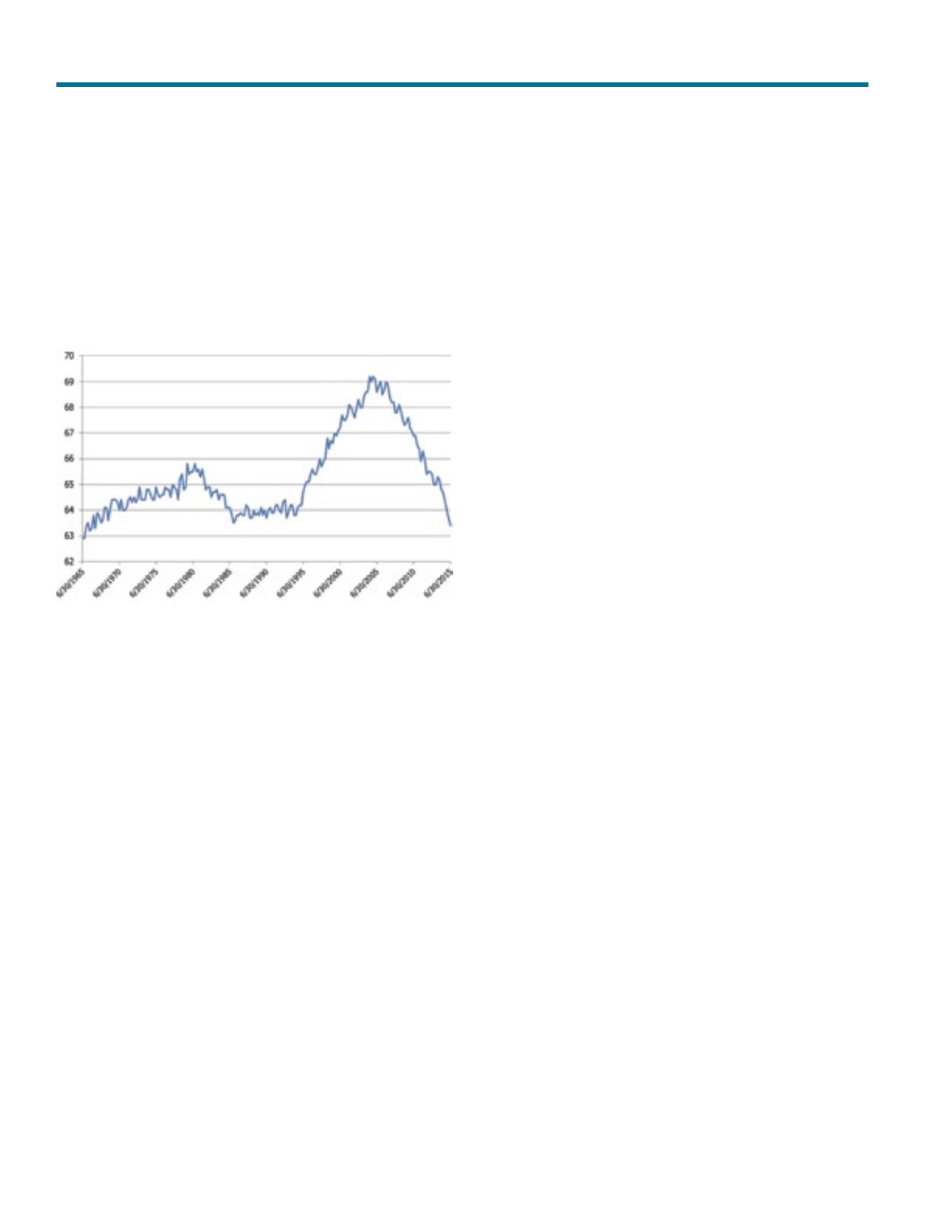

Table 14

Home Ownership Rate 1965–2015

Source: U.S. Census Bureau, Bloomberg.

The Urban Institute forecasts that homeownership will continue

to decline for at least 15 years. The downtrend would push

homeownership below 62% in 2020, and it would hold the rate

near 61% in 2030, below the lowest level since records began

in 1965. The lower home ownership rate has resulted in a larger

potential renting population.

New multifamily construction has been concentrated in the luxury

sector. Amongst the 370,000 multifamily rental units completed

from 2012 to 2014 in 54 U.S. metropolitan areas, 82% were in the

luxury category defined as attracting rents in the top 20% of the

market according to CoStar Group Inc. In certain US metros such

as Atlanta, Baltimore, Denver, Phoenix, and Tampa virtually all new

apartment construction has been in the luxury sector

6

.

Renting in America’s largest cities is becoming more expensive. In

many of the 11 largest US cities studied in a recent NYU Furman

Center/Capital One report, new rental units are not being added

as quickly as new rental households. This has caused considerable

apartment rental rate increases in these 11 markets and limited

affordability. Whereas in 2006 only Miami, Boston, San Francisco,

Los Angeles, and New York were majority renter markets, in

2013, Washington, DC, Dallas, Houston, and Chicago joined that

category as well.

There has been a surge in demand for moderately priced apartment

rental housing and because most of the new product is luxury,

older housing is not getting cheaper as newer housing is being

built. In fact rents in class B multifamily properties are growing

faster than those for class A multifamily

7

. Demand is not limited to

the prime renter age population. According to the Federal Reserve

of Kansas City, “Adults in their 50s and 60s accounted for most

of the increase in the actual number of occupied multifamily units

both before and after the housing crisis. Older adults (ages 50-69)

accounted for most of the increase in multifamily occupancy from

2000 to 2007 and from 2007 to 2013, and nearly all of the net

increase over the two periods combined”

8

.

Which Habitation Sectors Will Benefit from the Demographic,

Social and Economic Trends?

The combination of the growth in the size of the prime renter

age population, the growing prevalence of singlehood, the growth

in the 65 plus age segment, and the economic stagnation of

certain sectors of American society will lead to further demand

for multifamily housing.

Most multifamily subsectors should benefit from the current and

projected demographic social and economic changes in the United

States. The same economic changes that are inflicting pain on

the single-family home market are benefitting multifamily housing.

Demand should

continue to grow

in both the luxury

and moderately

priced segment

of the multifamily

housing sector.

The concentration of wealth in the upper income and wealth sectors

of American society is fueling demand in the luxury apartment

sector. The relative lack of construction in the moderate priced

multifamily segment proportionate to demand has resulted in

increased rent levels for the moderate priced sector as well.

Areas with Demographic Growth of Prime Renter

Age Population

As noted earlier in Table 3, there are certain metros that are

forecast for significant Compound Annual Growth Rates (CAGR)

in the prime renting age population over the next 15 years. These

metros include Raleigh (3.8%), Austin (2.7%), Charlotte (2.4%),

Orlando (2.4%), Phoenix (2.4%), Las Vegas (2.1%), Atlanta (1.9%),

Dallas-Ft. Worth (1.8%), Houston (1.8%), Palm Beach County

(1.7%), San Antonio (1.5%), Salt Lake City (1.4%), Denver (1.3%),

Nashville (1.2%), and Jacksonville (1.2%). These CAGRs are

significant when considering that the expected CAGR for the PPR

54 is 0.6%.

Trends Impacting Habitation Alternatives

“Real median household income...

has not recovered back to the level

achieved in 1996.”