CRE Finance World Autumn 2015

12

Europe

W

Alternative Real Estate Lenders in Europe: Here for Goode all know the story: following the 2008 systemic

crisis, liquidity was scarce and there was an

established credit crunch across the whole economy,

which was particularly acute in the real estate sector.

The European CMBS market came to a halt, banks

lost appetite for property lending on their balance sheet, and the

post-crisis capital allocation requirements compounded this further.

In the wake of this new era, sensing an opportunity, a number

of new players entered the devastated property lending market

such as real estate professionals, former bankers, asset and fund

managers backed by family offices, off-shore capital and some

institutions, attracted by the opportunity to set-up boutique lending

operations, often with very-focused strategies. They were eager

to grow fast and their presence relieved some of the pressure in

the market by offering an alternative source of finance, which was

supported by the beginnings of a recovery in some markets. In the

UK in 2010, the alternative lenders’ market share across all sectors

was 11 percent, which grew to about 25 percent by 2014, with a

similar trend witnessed in continental Europe. Alternative lenders

are now present across the entire real estate lending market

providing senior, mezzanine and development finance, although

most tend to specialise in certain markets and products to match

their risk/return requirements.

We entered this market in 2008 with the launch of our first fund

focussed on commercial real estate mezzanine. We have since

launched a senior commercial loan fund (European) and a UK

development finance fund, supported by the growing appetite

from both investors and borrowers (property developers, asset

managers, real estate institutions, UHNWI). In total we have raised

over

€

600m, across four funds, and have provided 125 loans for a

total of

€

1.5bn, consistently delivering returns in the low teens.

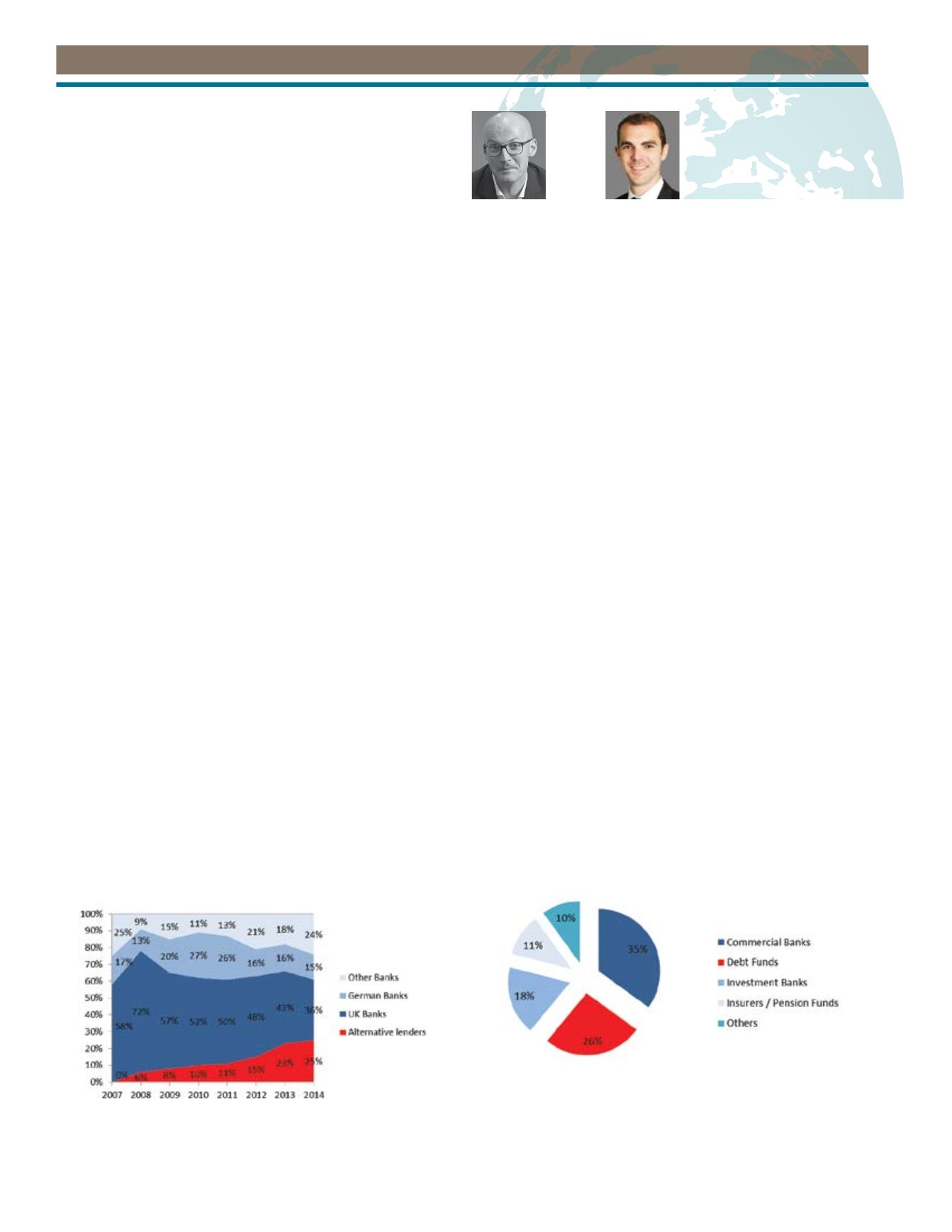

Figure 1

UK Real Estate Lending (2007–2014)

Source: De Montfort

The Market Recovery

During the past 24 months, the liquidity situation in Europe has

evolved substantially: base rates are at a record low, banks have

found a renewed interest in real estate lending (at least for the

prime and core assets) and CMBS is slowly reappearing, albeit in

a less aggressive format and in more modest volumes. As a result,

margins offered to borrowers are eroding, loan-to-value (LTV)

is going up, and real estate developers and investors often have

several financing options to choose from. This obviously creates

a new conundrum for the alternative lenders who were initially

attracted by higher margins and a reduced competition. Is the

party over?

We don’t think so. Alternative lenders are standing up to the

renewed competition and banks are not winning back the market

shares lost during the crisis years as easily or quickly as they

thought. Debt funds are still widely present in core European

markets, the UK, France, and Germany, mainly in residential, retail

and logistic sectors, but also in alternative sectors such as hotels,

self-storage and student accommodation. Their offering also tends

to focus more on mezzanine (tranches above 60 percent LTV),

development finance and short term bridges (before planning,

sale or a longer term refinancing). These are the areas where

mainstream lenders are typically less competitive due to regulatory

capital constraints.

To remain competitive at the higher end of the market, for larger

transactions (£50M +), debt funds are also increasingly keen

on loan syndications, where they syndicate the loan among

themselves or by teaming up with banks (using pari-passu

structures or senior/junior splits). This allows them to deliver

a comprehensive offering to their borrowers.

Figure 2

Real Estate Lending, European Market Shares (2014)

Source: C&W Corp Fi

Mikaël Limpalaër

Associate Director

Aeriance

Seb Sims

Associate Director

Aeriance