CRE Finance World Autumn 2015

16

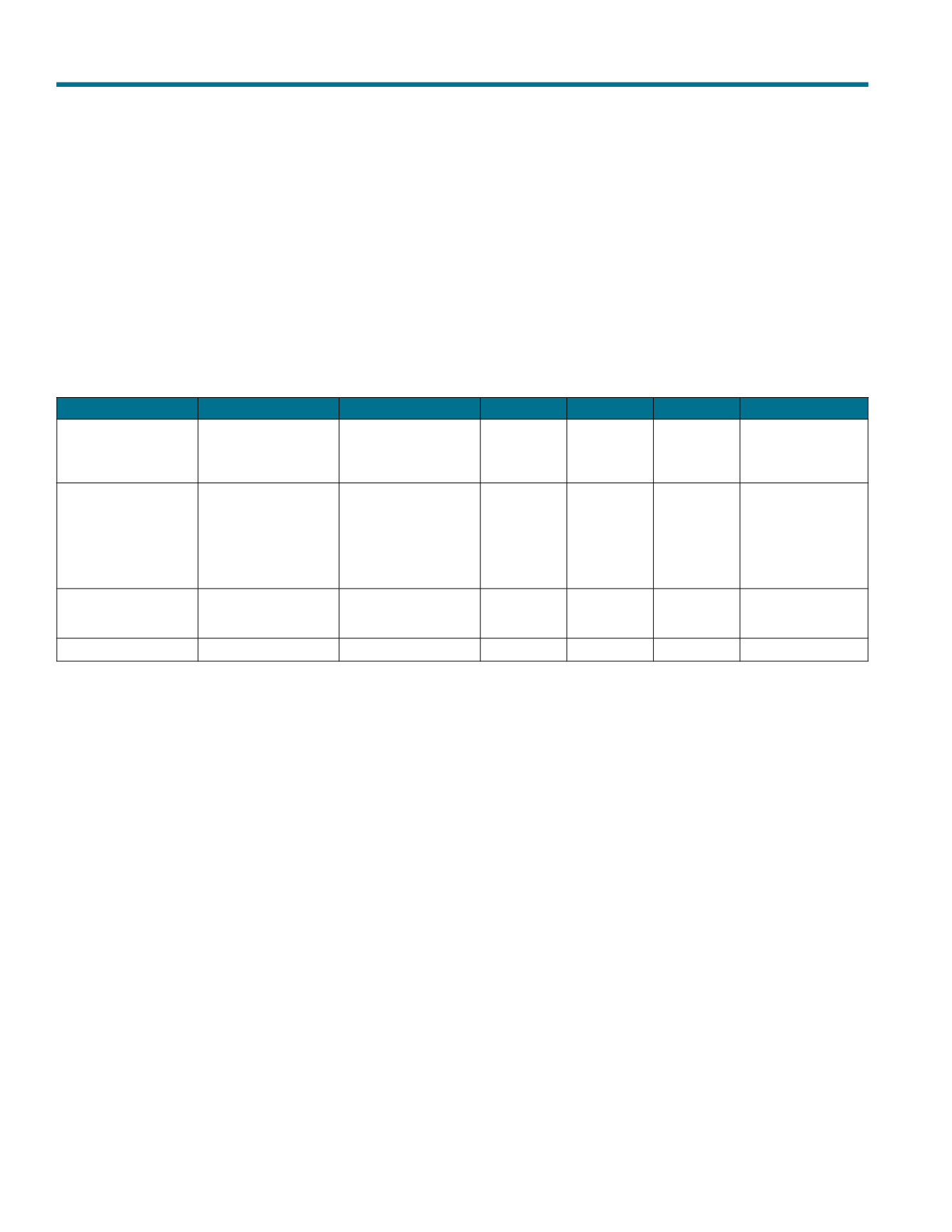

Pricing Comparisons

With relatively few transactions completing recently, useful direct

comparisons between rated and unrated CMBS are rare. Two

specific examples are:

It can be seen from the previous table that unrated CMBS prices

are at considerably higher levels than equivalent rated transactions.

This differential will vary with a wide range of loan and market related

factors and, depending on the size of this differential, arrangers will

have to weigh this against the cost savings of issuing unrated.

A Halfway House?

The expense and scarcity of providers of liquidity facility, hedges

and bank accounts for AAA/Aaa rated transactions has led to

some recent transactions issuing with maximum ratings of A/A2.

Rating criteria for A/A2 rated CMBS is more relaxed and generally

liquidity facilities are not required. Recent examples include

Debussy, Taurus CMBS UK 2014-1 and AYR Issuer S.A. These

transactions can be seen as compromise structures, avoiding the

most onerous ratings requirements but not suffering all of the

pricing disadvantages of issuing unrated (as described above)

while avoiding the most punitive regulatory capital treatment for

unrated tranched transactions.

A recent example of this is Antares 2015-1

17

, which is currently

being marketed. Commentators

18

have suggested that adding a

liquidity facility to the structure would increase transaction costs

by approximately 0.10 percent but this would allow the bonds to

achieve a AAA/Aaa rating which would decrease pricing on the

bonds by approximately 0.14 percent.

Privately Placed CMBS

The emergence of unrated CMBS gives rise to the question of

whether a true private placement market can be developed for

European CMBS. Arrangers could save considerable costs if

investors did not rely on arrangers for disclosure but instead

carried out their own due diligence.

European CMBS is generally listed because: (a) investors prefer

the added liquidity of listed bonds and (b) listed bonds qualify

for the “quoted Eurobonds” from withholding taxes. However,

most stock exchanges permit securities to trade on either a

regulated market or an unregulated market

19

, with lower disclosure

requirements applying to the unregulated market provided that the

offering meets the exemptions for disclosure required under the

Prospectus Directive.

20

Some recent European CMBS transactions

trade on unregulated markets (e.g. Mint Mezzanine 2014). However,

the offering circulars for these deals are as detailed as those

used for transactions trading on the main regulated markets

21

demonstrating a reluctance to reduce the disclosure even for

privately placed transactions.

Date

Name

Assets

Tranche

Size (M)

Rating

Margin

September 2013

Monnet Finance

German multi-family

Class A

Class B

Class C

Class D

€

289.4

€

57.7

€

38.6

€

20.4

Unrated

Unrated

Unrated

Unrated

1.92%

3.26%

5.50%

4.96% (fixed rate)

October 2013

German Residential

Funding 2013-2

German multi-family

Class A

Class B

Class C

Class D

Class E

Class F

Class G

€

431

€

83.6

€

53.7

€

59.7

€

23.9

€

47.8

€

36.9

AAA

AA

A

BBB

BBB-

BB

Unrated

1.00%

1.40%

1.90%

3.00%

3.75%

4.75%

6.50% (fixed rate)

December 2013

Gallerie 2013

Italian retail

Class A

Class B

Class C

€

271.0

€

50.0

€

42.0

A

A-

BBB-

2.25%

3.25%

4.55%

January 2014

Reni SPV

Italian retail

Single class

€

135.0

Unrated

5.162%

Unrated CMBS: A New European Asset Class