A publication of

Autumn issue 2015 sponsored by

A publication of

Autumn issue 2015 sponsored by

CRE Finance World Autumn 2015

9

T

Countdown to 2017 — The Great Wall of Maturitieshe great “wall” of maturing commercial mortgage backed

securities (CMBS) loans has received so much attention

that it almost seems like a mythical creature. The sheer

volume of maturing loans is one reason for the attention.

In 2015, 2016 and 2017 alone there are more than $350

billion of CMBS loans maturing. Another reason these maturities

have everyone’s attention is because a significant portion of these

loans are not predicted to be able to be paid off by their due dates.

In 2013, there was speculation that this great wall of approximately

$350 billion of CMBS maturities would surely wreak havoc on

the whole commercial real estate industry. In the opinion of many

experts that year, approximately half of this $350 billion would not

be able to be refinanced. The main reasons for the refinancing

concern stemmed from the sheer volume of loans needing to be

refinanced, as well as the aggressive underwriting standards that

were utilized during the origination years of these 10 year loans —

2005, 2006, and 2007.

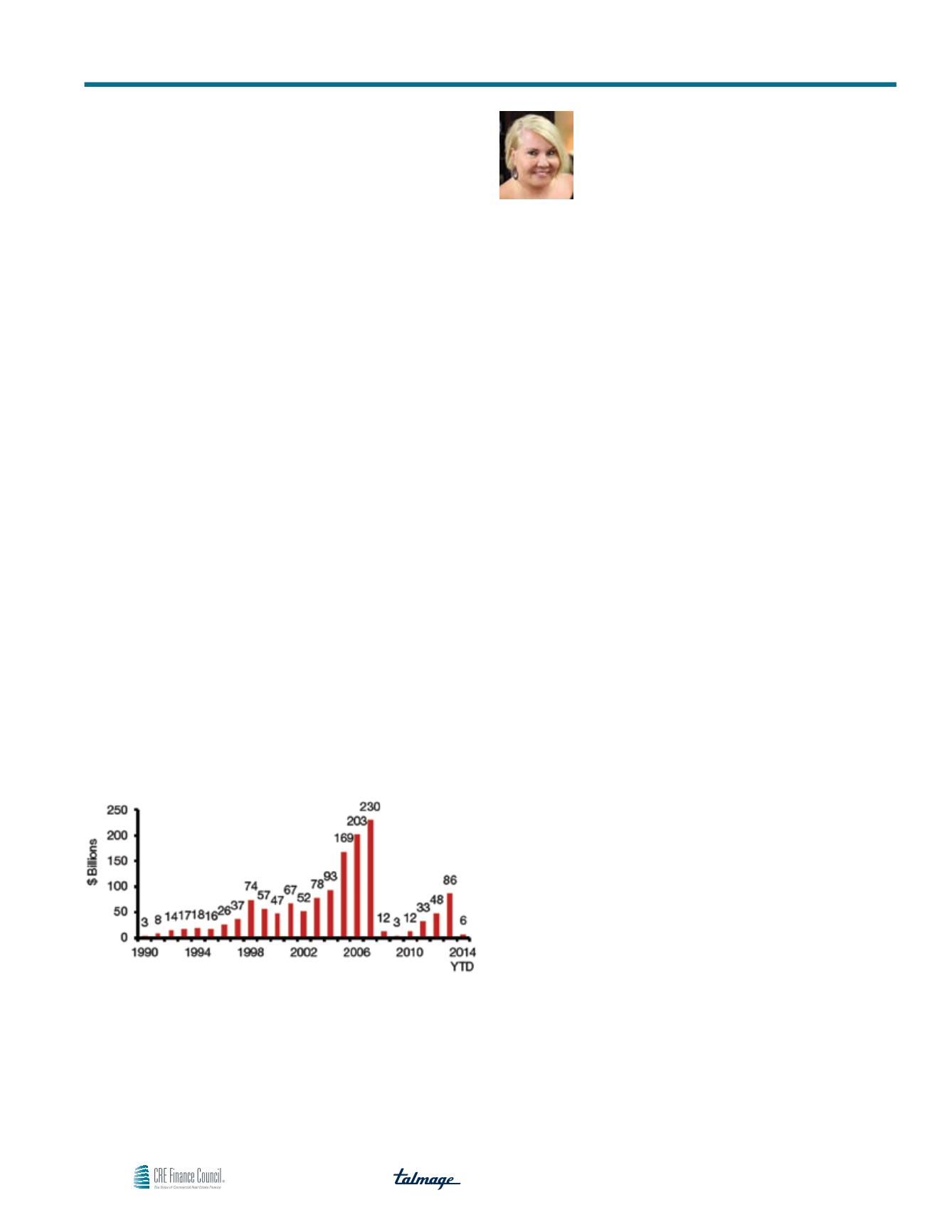

Annual CMBS issuance during the years 2005, 2006 and 2007

was off the charts from a historical perspective, totaling over $600

billion. The volume of CMBS loans originated during those three

years was about two times the average volume of CMBS loans

originated today. So, even if these maturing loans had no other

“issues,” there is still a shortfall in the funding available for this

huge volume.

Figure 1

Annual Historical U.S. CMBS Issuance

Source: Commercial Mortgage Alert

As the volume of CMBS issuance increased year over year in 2005,

2006 and 2007, the competition between originators became fierce.

To stay competitive in those years, it became standard to provide

high leverage loans that did not require amortization over the loan

term with minimal reserve requirements. Rental rates were also at

an all-time high. This combination of characteristics might be okay

if real estate prices had only increased during the last 10 years.

By year-end (YE) 2014, there was enough financial information

available for each property to get a better assessment of the

size of this mythical creature called the Great Wall of CMBS

maturities. Using YE 2014 Net Operating Income (NOI) numbers

supplied by owners, the various market constituents (including

the rating agencies) published estimated LTVs for the maturing

loans. To determine the value of the properties, these reporting

sources typically applied a market cap rate to the YE 2014 NOI to

determine the value of the property and then divided the value by

the loan balance to get the LTV.

Although there are various sources of this information and many an

article has been written on the subject, the general consensus by

late 2014 for the percentage of maturing loans anticipated at 80

percent or greater LTV at maturity date was 30 percent. The good

news is that it seemed less disastrous than the original prediction

of 50 percent! Contributing to the higher rate of loans predicted to

pay off at maturity was the all-time low interest rate environment.

By early 2015, the commercial real estate industry began celebrating

because it seemed that this large mythical creature would not

devour us after all. It would only devour 30 percent of us. So,

whether you are celebrating or not as a commercial real estate

owner is completely dependent on whether you are personally in

the 70 percent category of owners who can pay off their loan at

maturity — or the 30 percent who can’t pay off their loan at maturity.

Now that we are more than half way through 2015, let’s take a look

at reality.

According to the CMBS Surveillance Maturity Report for July

2015 published by Morningstar *: as of June 30, 2015, the total

remaining amount of loans still to mature in 2015, 2016 and

2017 is now just below $250 billion – approximately $24 billion

remaining in 2015, approximately $110 billion in 2016 and $112

billion in 2017. Here are the stratifications by LTV per year of those

maturing loans:

Ann Hambly

Founder and CEO

1st Service Solutions