CRE Finance World Autumn 2015

10

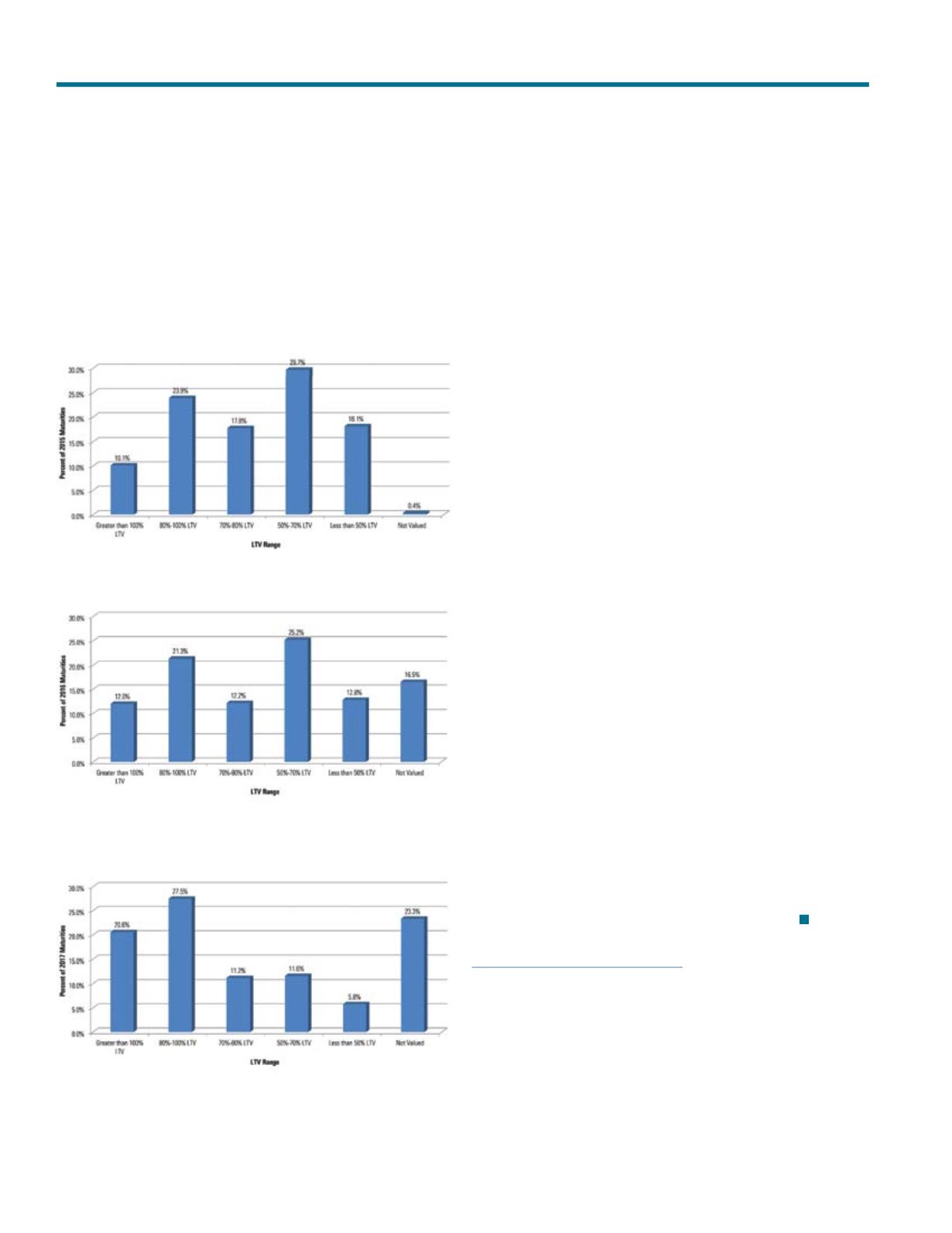

Figure 2

2015 (Morningstar)*

Figure 3

2016

Figure 4

2017

According to the report: “Based on Morningstar’s experience cov-

ering most of the CMBS universe, our historical analysis indicates

that an 80 percent LTV threshold is a reliable barometer of a loan’s

likelihood to successfully pay off on time.”

Using this 80 percent threshold, it can be concluded that

approximately $8 billion, or 34 percent of the remaining $24 billion

maturing this year, will not be able to pay off. In 2016, the number

of loans unable to pay off increases to just over $36 billion, or 33

percent, and in 2017, the number is a staggering $53 billion, or 48

percent. This means that just under $100 billion of maturing CMBS

loans will likely not be able to pay off between now and 2017.

What is not factored into these estimates is how the inevitable

increase in interest rates will affect the borrower’s ability to

refinance. And talk of a potential interest rate increase is quite

commonplace now.

So, what will happen to the loans where the borrower will not be

able to refinance at maturity? The only available options in this

situation are (1) for the borrower to fund the negative equity, (2) to

grant an extension on the loan when it is deemed that additional

time will cure the negative equity situation, (3) allow the borrower

to pay the loan off at its current value; which could result in a

discounted payoff, or (4) for the CMBS Trust to become the owner

of the property through a foreclosure or friendly borrower hand

back of the property. High leverage bridge lenders will provide a

critical component to these options by providing a unique funding

source for borrowers faced with extremely high leverage at maturity.

The final determination on how these maturing loans are handled

all resides with a few key industry players, special servicers and

controlling class certificate holders, so everyone in the industry is

carefully watching to see how the 2015 maturities are getting resolved.

It’s too early to predict the final casualties of the Great Wall of

CMBS maturities; however, borrowers should remain as proactive

and vigilant as ever about their own personal situation.

Click Here to Share Comments on this ArticleCountdown to 2017 — The Great Wall of Maturities