A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

47

recession. The general consensus is that Houston’s job market

will slow from being one of the fastest-growing in the nation, to

one that achieves just national average growth rates. For example,

Moody’s Analytics is forecasting that Houston’s 2015 job growth

will be about half of what was previously expected, but still viable

enough to produce an estimated 63,000 new jobs in 2015.

Commercial real estate data provider Axiometrics has a slightly

more optimistic forecast: 73,000 new jobs in 2015, down from

93,000 prior to the oil price decline, or about 20 percent fewer

jobs than was previously expected.

Prior to the recent decline in oil prices, the apartment supply surge

was well on its way in Houston. After several years of apartment

market tightening, Houston was already expected to see some

easing in rent growth and occupancy levels this year, as new

supply hits the market. Now, with the anticipated slowing down

of job growth, there is likely to be a short-term oversupply of units

over the next 12 to 24 months.

Previous Undersupply Will Help Houston Now

There are about 18,000 new apartment units underway in

Houston, with expected completions occurring over the next two

years. With job growth anticipated at about 2 percent, that should

produce demand for about 13,000 units, which would appear to

create a supply/demand imbalance. Mitigating this condition,

however, is the fact that Houston has been undersupplied over

the past several years: Only 22,500 units were completed since

2011 but more than 250,000 jobs were added, creating estimated

demand for about 50,000 multifamily rental units.

Worthy of note is that there are sections of Houston that will actually

benefit from low oil prices. The metro’s east side submarket has

been seeing a surge in construction of chemical and manufacturing

plants that are taking advantage of low natural gas prices. This is

expected to continue, and possibly expand, if oil prices remain low.

North Dakota: A Slippery Slope

North Dakota has been one of the primary beneficiaries of the

North American fracking boom and Williston, in particular, has

been the center of that activity. Williston has grown tremendously

over the past few years, to nearly 30,000 people, and is the nation’s

fastest growing micropolitan area. It has seen its population

increase by an average 7.0 percent per year since 2010, compared

to just 0.7 percent growth at the national level. Needless to say,

all this extraordinary growth has occurred specifically because of

drilling activity in the area.

Now with an extended period of low oil prices, the metro area, and

the entire state, could fall into a recession. While extraction costs

are estimated to be lower here than in some areas, the combined

cost of construction of new wells and transportation of crude oil to

refineries located on the coasts of the Gulf of Mexico and the Mid-

Atlantic will likely make new investments in the area uneconomical.

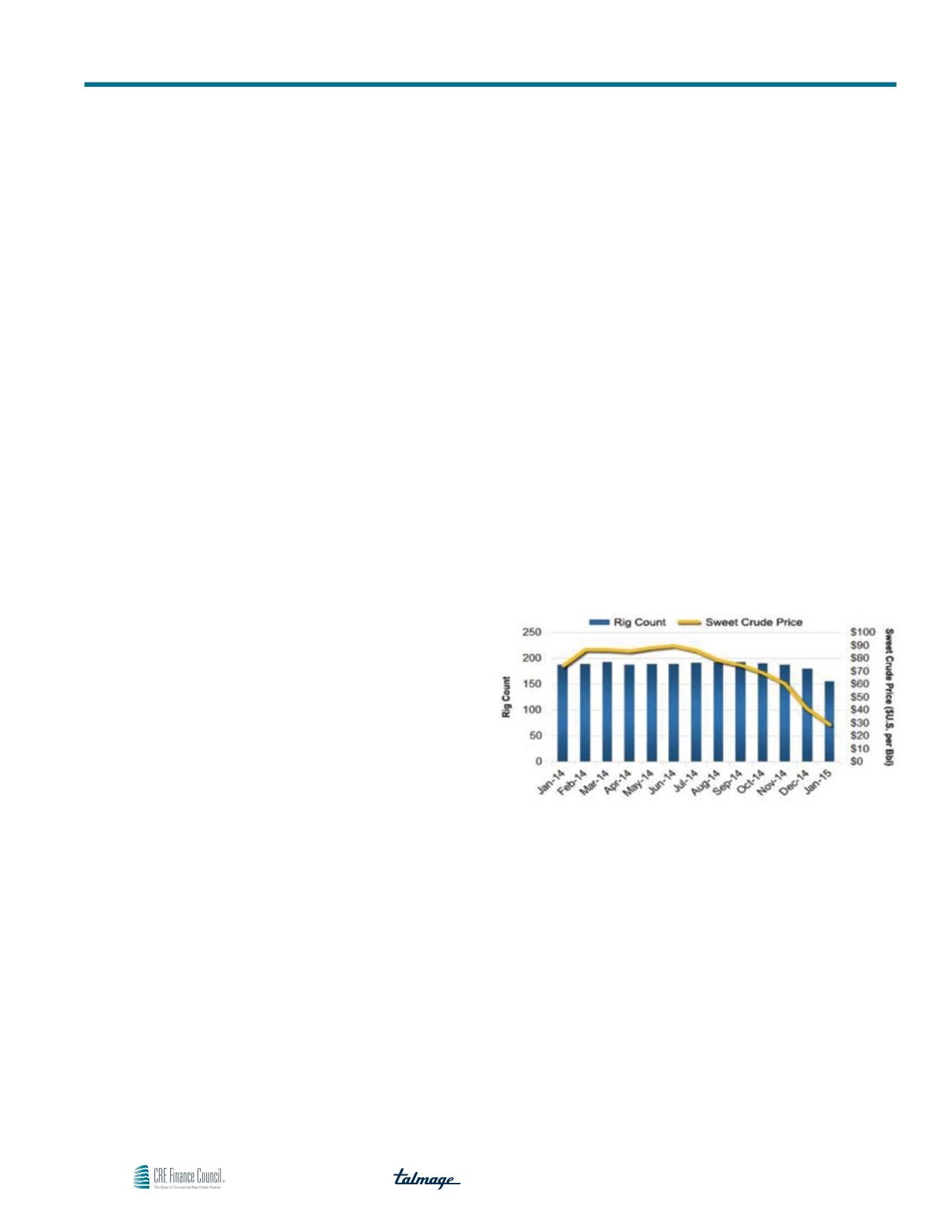

As seen in the chart below, as the price of oil declines, the state’s

active rig count also declines. And as of February 2015, it has only

worsened. The state’s active rig count has declined to 121, down

from 190 a year ago, according to data from the North Dakota

Department of Mineral Resources. This means that the state is

now unable to produce its previous output level of about 1.2 million

barrels per day. In addition, of these active rigs, 115 are concentrated

in just four counties: Dunn, McKenzie, Mountrail and Williams — all of

which are located in the most prolific section of the Bakken formation.

Exhibit 4

Monthly North Dakota Rig Count & Bakken Shale Sweet Crude Oil Prices

Jan. 2014–Jan. 2015

Source: Compiled by NGI’s Shale Daily from North Dakota DMR reports

Williston’s Multifamily Sector Likely Impacted

Williston has a fairly large multifamily inventory considering its rural

setting and relatively small population size. The influx of workers

coming to the oil fields has resulted in a significant housing shortage

and a sizeable inventory of temporary housing. As of 2013, there

were about 6,000 multifamily housing units in Williston, according

to a recent City of Williston/NDHFA Housing Study. Multifamily,

which likely includes this sizable inventory of temporary dwellings,

represents 49 percent of all housing stock, with about 9 percent

consisting of mobile homes and another 40 percent consisting of

single-family homes.

Rents already appear to be declining and concessions commonplace.

A review of one rental apartment website reveals concessions

of $550 being offered on a $1,800 monthly rental, or about -2.5

percent, significantly above the national average of just -0.9 percent.

Lower Oil Prices and Multifamily — More Winners than Losers