CRE Finance World Autumn 2015

36

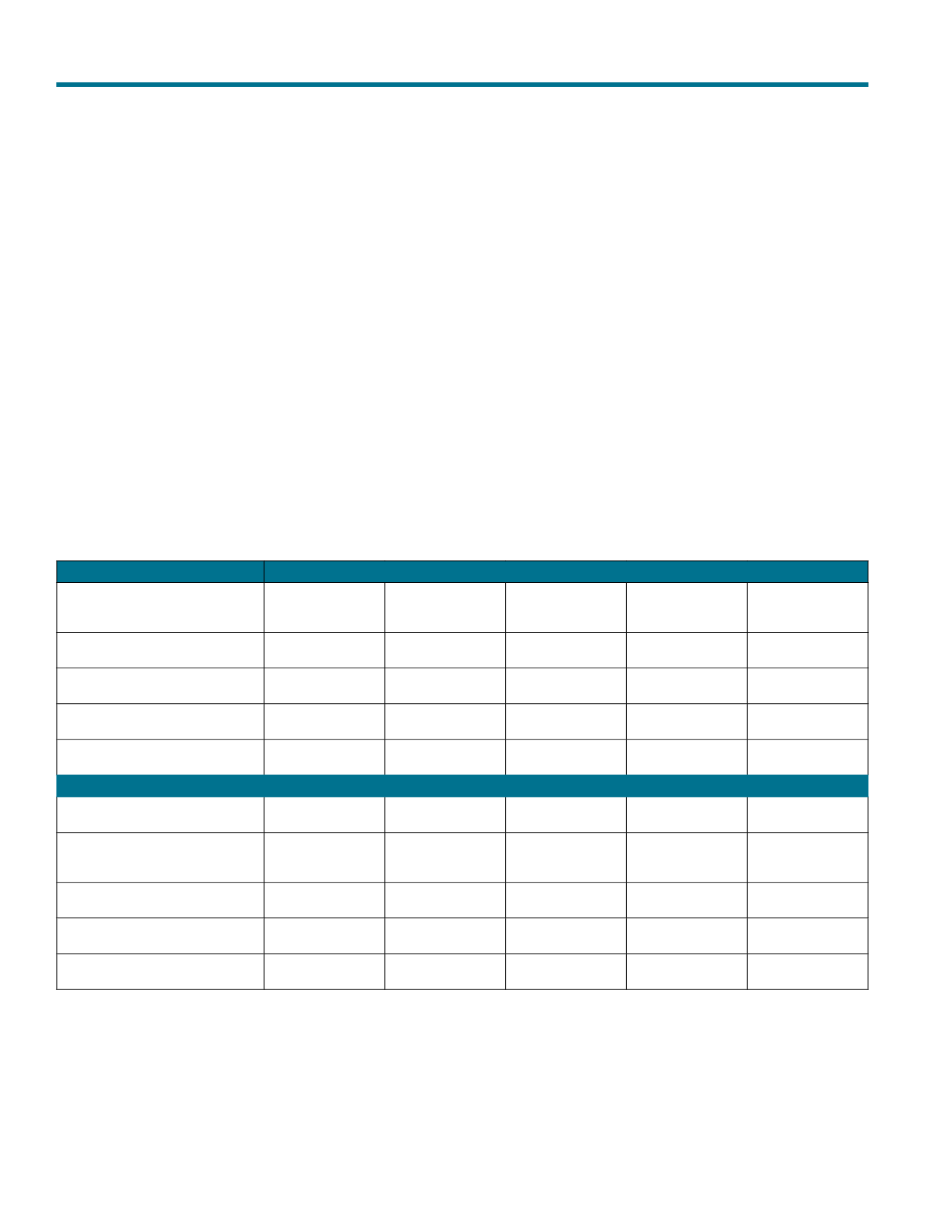

Appendix: Holdings of Major U.S. Asset Types

Table 2

Holdings Of Major U.S. Asset Types

Asset

Top five holders as of 2009

Treasury securities ($7.8 trillion)*

Foreign holdings

($3.7 trillion)

Household sector

($853 billion)

Monetary authority

($777 billion)

State and local

governments

($586 billion)

MM mutual funds

($406 billion)

Agency/GSE-backed securities

($8.1 trillion)

§

Domestic banks

($1.4 trillion)

Foreign holdings

($1.2 trillion)

Monetary authority

($1.1 trillion)

GSEs

($925 billion)

Mutual funds

($603 billion)

Municipal securities ($3.7 trillion)

Household sector

($1.8 trillion)

Mutual funds

($479 billion)

MM mutual funds

($440 billion)

P&C insurance cos.

($369 billion)

Domestic banks

($224 billion)

Corporate/foreign bonds

($10.4 trillion)

Foreign holdings

($2.5 trillion)

Life insurance cos.

($1.9 trillion)

Household sector

($1.5 trillion)

Mutual funds

($1.1 trillion)

Domestic banks

($668 billion)

Private-label MBS/ABS

($3.0 trillion)

†

Foreign holdings

($485 billion)

GSEs

($288 billion)

Domestic banks

($263 billion)

Asset

Top five holders as of Q1 2015

Treasury securities

($13.1 trillion)*

Foreign holdings

($6.2 trillion)

Monetary authority

($2.5 trillion)

Mutual funds

($795 billion)

Household sector

($640 billion)

MM mutual funds

($435 billion)

Agency/GSE-backed securities

($7.9 trillion)

§

Domestic banks

($1.8 trillion)

Monetary authority

($1.8 trillion)

Foreign holdings

($902 billion)

Mutual funds

($820 billion)

State and local

governments

($439 billion)

Municipal securities ($3.7 trillion)

Household sector

($1.6 trillion)

Mutual funds

($673 billion)

Domestic banks

($465 billion)

P&C insurance cos.

($320 billion)

MM mutual funds

($274 billion)

Corporate/foreign bonds

($11.7 trillion)

Foreign holdings

($2.9 trillion)

Mutual funds

($2.4 trillion)

Life insurance cos.

($2.3 trillion)

Household sector

($876 billion)

Private pension

funds ($588 billion)

Private-label MBS/ABS

($1.3 trillion)

Life insurance cos.

($433 billion)

Foreign holdings

($390 billion)

Domestic banks

($138 billion)

P&C insurance cos.

($91 billion)

GSEs

($80 billion)

Source: Federal Reserve Z1 Release.

*Incudes savings securities. §Agency- and GSE-backed securities include: issues of federal budget agencies such as those for the TVA; issues of GSEs such as Fannie Mae and FHLB; and agency-

and GSE-backed mortgage pool securities issued by GNMA, Fannie Mae, Freddie Mac, and the Farmers Home Administration. †Insurance company holdings of private-label MBS/ABS weren’t broken

out separately until 2011, therefore we only list the three-largest holders. GSE—Government-sponsored enterprise. MM—Money market. P&C—Property and casualty. TVA—Tennessee Valley Authority.

MBS—Mortgage-backed securities. ABS—Asset-backed securities.

which suggests that the most senior class could be a potential

candidate for level 2B LCR treatment, similar to the ABS/RMBS

products included in the EU regulation.

Further Clarity and Research May Be Warranted Before

Final Implementation

Overall, the trading data and market sizes that we were able to

examine suggest that the classification systems and haircuts

are generally appropriate, but may need to be further researched

and enhanced before being fully phased in. One particular topic

that may need to be addressed is the differences in rules by

jurisdiction because these new rules will likely influence global

investment decisions and which formats of financing will continue

to be available to borrowers in various markets. The current

international proposed rules appear to favor some bond products

while disfavoring others, and thus we may see further adjustment

before final implementation to avoid unintended consequences.

The Federal Reserve’s proposal to include certain municipal bonds

as level 2A HQLA in the U.S. regulations is one example of an

adjustment currently under consideration.

Basel III’s Recent Liquidity Guidelines