A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

61

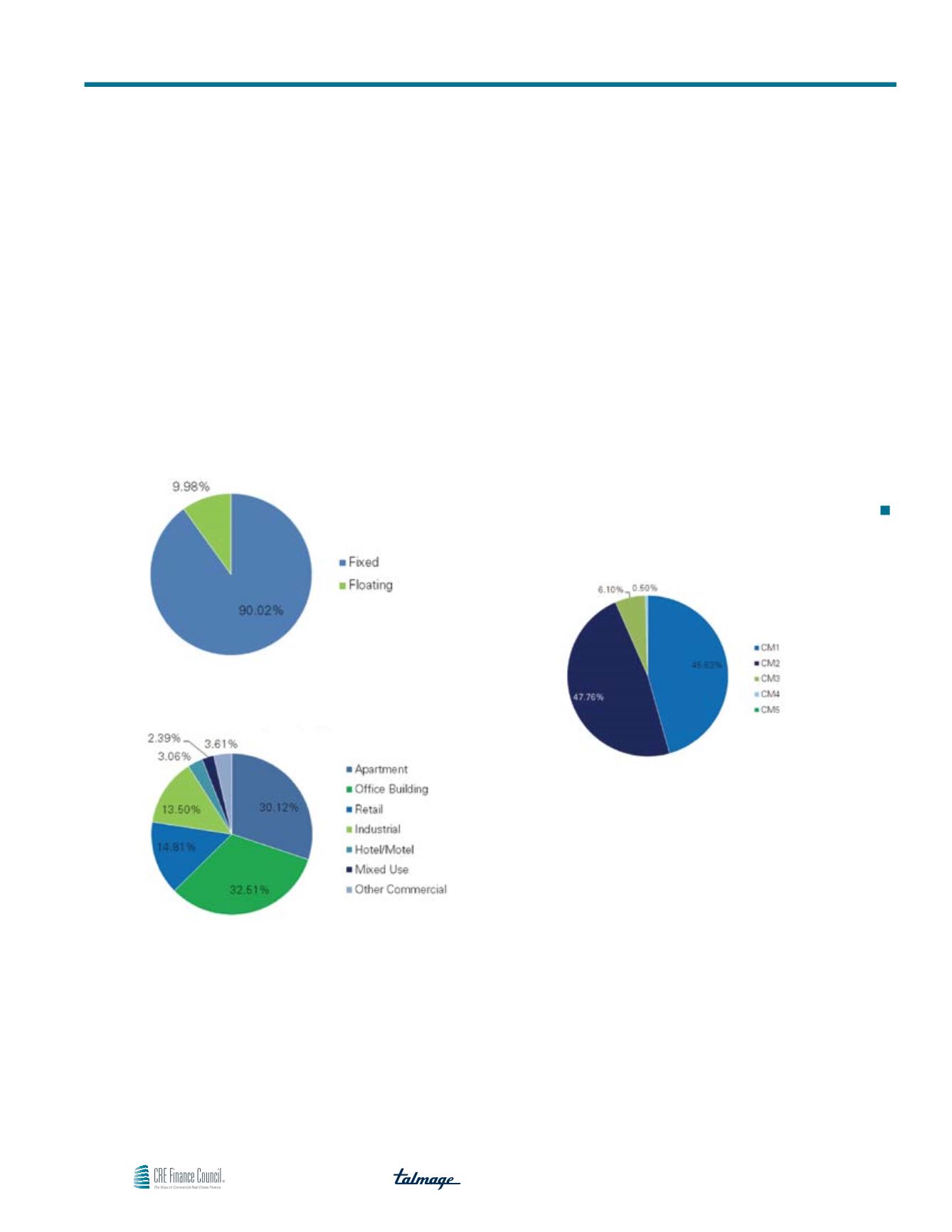

The top states in which participants originated new loans were

California, Texas, Illinois, and New York. Ninety percent of new

originations were fixed-rate loans and the remaining 10% were

floating rate loans. Among the various real estate product types,

multifamily and office properties led originations, at 30% and 32%

of the dollar volume total, respectively. Retail and industrial each

represented about 15% of total dollar volume.

Exhibit 9

Loan Type

Exhibit 10

Property Type

The credit quality of insurance companies’ mortgages, as measured

by the new mortgage designations Commercial Mortgage (CM)

Test Scores, appears to be good. Not all of the 21 survey respondents

provided this information. Data was available for about half of the

new originations, approximately $7 billion. The majority of insurers

that reported this data had strict lending requirements and maintained

very high allocations to both CM1 and CM2 scores, totaling a

combined 90% or greater. These insurers would be less affected

by increased capital requirements if their portfolios became

stressed. Three of the insurance companies had exposure to CM3

mortgages, two of which had exposures greater than 17% and the

third had an exposure slightly over 6%. Exposure to CM4 mortgages

was de minimis, and no firm had allocations in CM5 mortgages.

Exhibit 11

CM Test Score

Portfolio Lenders Survey: U.S. Life Insurers’ Mortgage Outlook