CRE Finance World Summer 2015

58

he Trepp/CREFC Portfolio Lenders Survey for the U.S.

insurance company sector was launched in 2011 to

collect investment performance and trend-line data on

commercial mortgages held by life companies. Trepp

updates the format of the survey to keep the content

current and make it more meaningful to the participating firms.

Twenty-one insurance companies participated in the most recent

survey, which covered the first half of 2014. With $160 billion in

combined commercial mortgage assets, the participants represented

nearly half of the industry’s total mortgage exposure.

Survey participants submit data from their General Account on a

semi-annual basis. The companies also submit data from subsidiaries

in order to fully capture the performance of any sub-performing

or non-performing loans in these entities. Trepp then analyzes the

data and publishes detailed results.

Each participating firm receives a report containing a detailed analysis

of all the survey responses. The firm’s results are benchmarked

against its peer group, which is based on the CRE portfolio asset

size and industry data. Peer group categories are defined as: large

firms with assets > $10 billion, medium firms with assets of $5

-$10 billion, and small firms with assets < $5 billion.

Participating firms use the survey results for general benchmarking

purposes as well as for relative performance measurement. The

survey results enable the insurance companies to assess the

investment performance of portfolio lenders and limit the need

for severe stress testing by rating agencies and other parties.

Trepp will present the results of the latest iteration of the survey

at the June CREFC Conference in New York during the Portfolio

Lenders Forum Session on Monday, June 8.

Key Mid-Year 2014 Highlights:

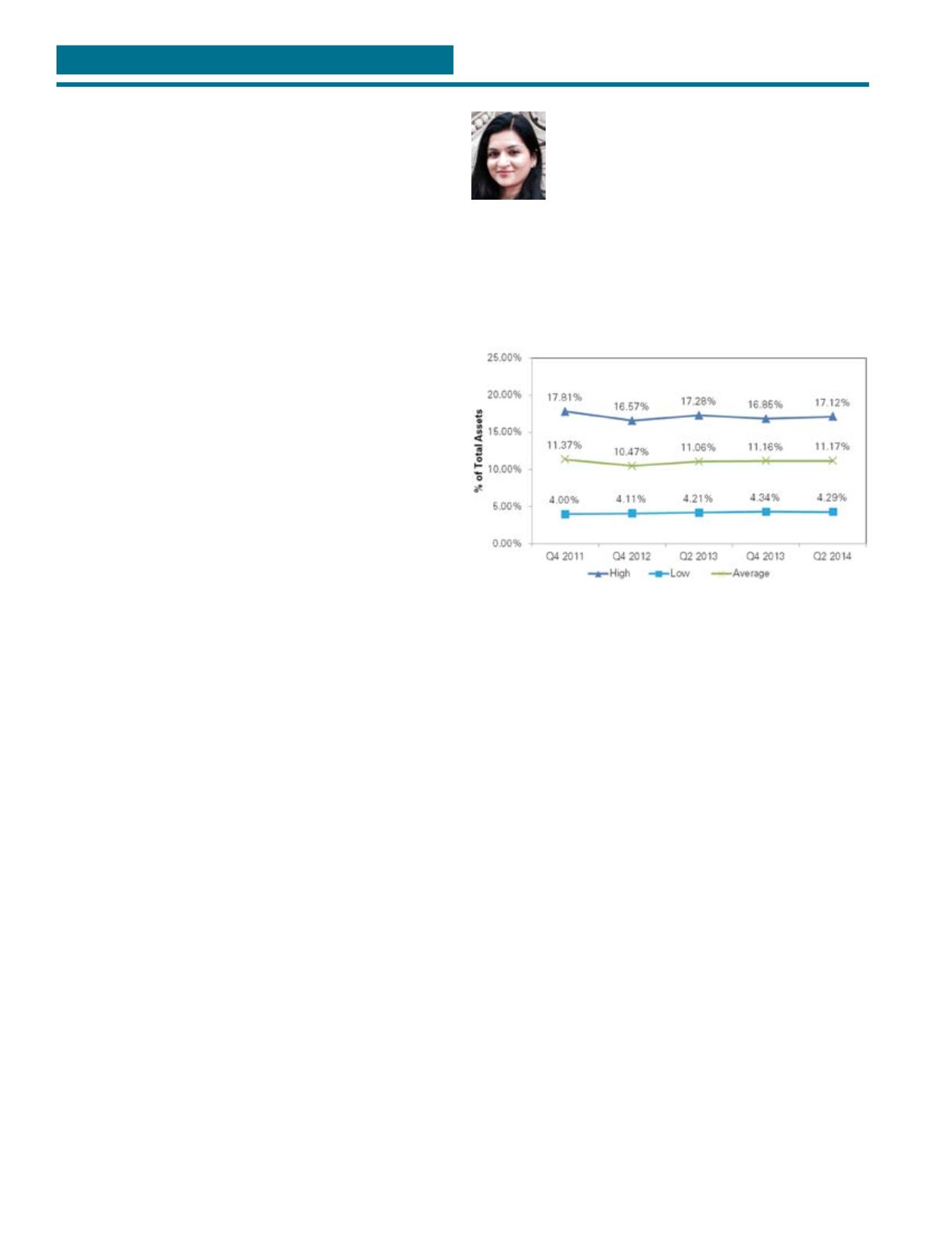

Stable Mortgage Portfolio Allocations

The First Half 2014 Portfolio Lenders survey showed stability in

mortgage investments. Mortgage holdings represented an average

of 11.17% of survey participants’ total invested assets during the

first half of 2014. This average was little changed from the year-end

2013 average of 11.16%, and was up only slightly compared to the

mid-year 2013 average of 11.06%. Mortgage holdings among the

participants ranged from 4.29% to 17.12%. Large firms continue

to dedicate greater allocations to commercial mortgages, in the

11%-17% range.

Exhibit 1

Mortgage Activity, % of Total Invested Assets

As of Q2 2014, six life companies boosted their mortgage portfolio

allocation by more than 1%, with two making changes of greater

than 6% and one over 15%.

Continued Superior Performance

Life insurers experienced their fourth consecutive year of strong

mortgage performance. Total realized net losses were 0.04% as

of mid-year 2014, a decrease of six basis points from the 0.10%

net losses reported in 2013. Life insurers compared favorably

to the other two lending markets, CMBS and commercial banks,

whose recorded losses measured 0.84% and 0.09%, respectively.

Even as CMBS and commercial banks posted sizeable improvements

from 2013, insurance firms still managed to outperform the

other markets.

Compared to year-end 2013, reported problem loans (which

includes loans currently 90+ days delinquent) increased by four

basis points to 0.10% as of mid-year 2014. However, delinquency

rates for insurance firms stayed well below CMBS (5.86%) and

commercial banks (1.80%).

T

Portfolio Lenders Survey:

U.S. Life Insurers’

Mortgage Outlook

Sonal Paradkar

Assistant Vice President

Trepp

FORUM SPOTLIGHT