CRE Finance World Summer 2015

60

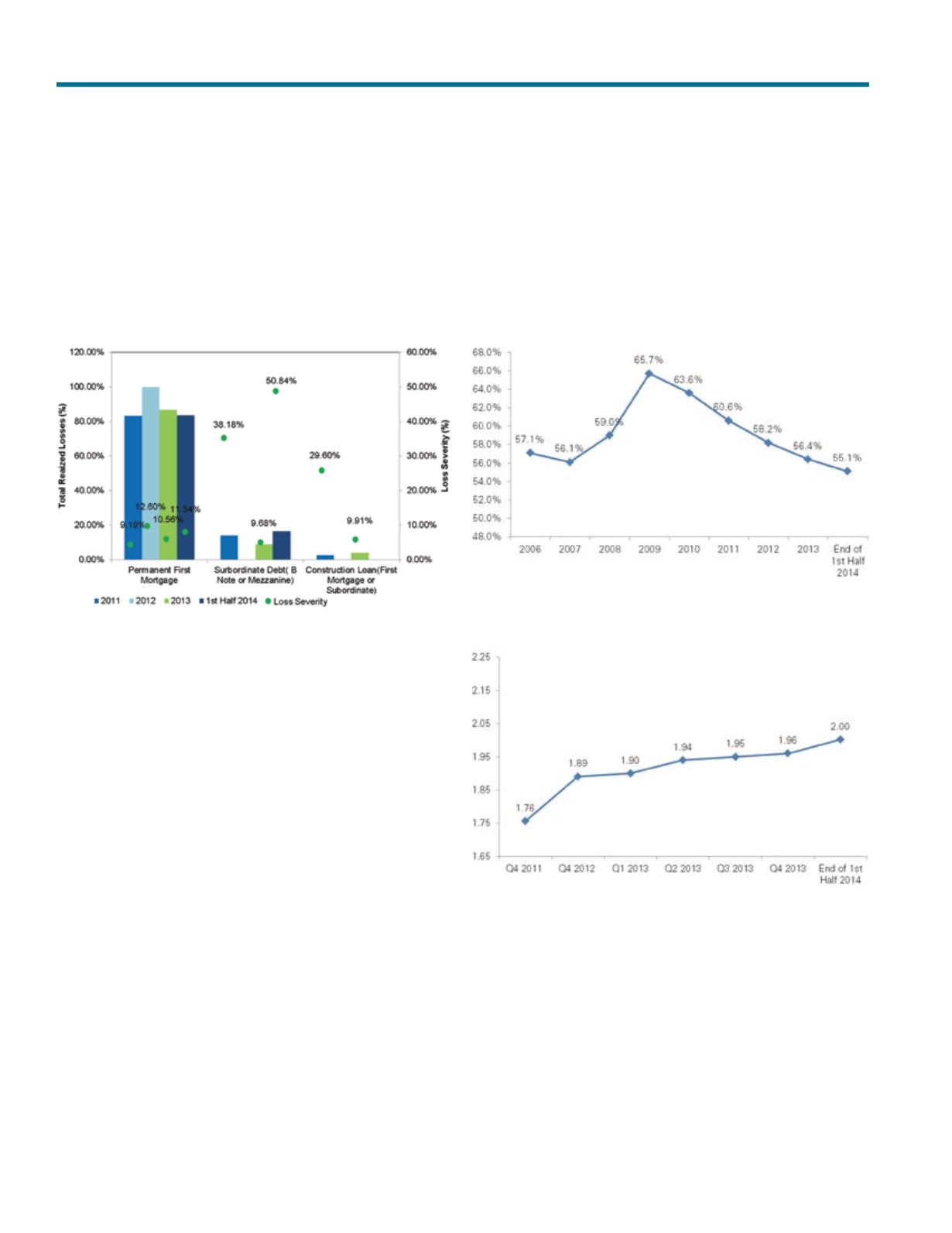

Exhibit 6

Realized Losses — Loss Severity by Investment Type

In line with recent trends, we expect mortgages to perform

strongly and losses to decline further in the coming quarters

with low impairments and delinquencies.

Improving LTVs & DSCRs

Over the last few years, the average reported portfolio loan-to-

value (LTV) and debt service coverage ratio (DSCR) have improved

for the commercial mortgages held by insurance companies. The

average commercial mortgage LTV held within participating company

portfolios was 55.1% as of mid-year 2014, with 1.19% of loan

exposure for all companies above a 100% LTV. The average DSCR

for the portfolios was 2.0x and approximately 95% of all exposure

held was above a 1.0x DSCR. Compared to year-end 2013, the

average portfolio LTV was down 1.3% and DSCR was up four

basis points. We expect the year-end data to show the same

continued decline in LTV and continued improved performance

of properties with DSCR increasing at a steady rate. However, it

will be interesting to see what these statistics will look like in the

coming quarters if interest rates rise in 2015.

Exhibit 7

Average Portfolio LTV

Exhibit 8

Average Portfolio DSCR

New Originations Growing

In search of better yields, life companies have increased their

focus on the commercial mortgage market, resulting in rising new

loan originations for insurance companies in recent years. New

originations reported by the 21 participants in the mid-year 2014

survey totaled $14.5 billion. We expect these numbers to more

than double in the year-end 2014 data.

Portfolio Lenders Survey: U.S. Life Insurers’ Mortgage Outlook