CRE Finance World Summer 2015

50

n late January 2015, crude oil prices hit a 52-week low

around $44.08 per barrel, capping off a staggering decline

from a 52-week high of about $108 in mid-2014. Prices

bounced back somewhat to above $50 in mid-February, fell

again, reaching a new 52-week low of $44.02 per barrel.

The massive decline in oil prices has already begun to reverberate

throughout the economy, with different effects for various firms,

industries, regions and, in the case of commercial real estate,

property types. Much of the coverage and analysis surrounding the

decline in oil prices has centered on Houston, the energy capital of

the U.S. and one of the hottest commercial real estate markets in

the country. But contrary to all of the doom and gloom underlying

much of that coverage, we expect the impact of low energy prices

on the multifamily sector in Houston to be minimal. On the other

hand, the Houston office market is likely to feel more pain and

indications are already pointing to that conclusion.

Not surprisingly, the decline in the price of oil will have a negative

impact on energy-oriented economies around the country. However,

at most this will slow growth in major metro areas, not drive them

into recession. Texas is the state that will be most directly impacted

by this. Other states that will be hit, but to a lesser extent, are

North Dakota, Oklahoma, Colorado, New Mexico, Wyoming and,

if oil prices remain depressed for a while, West Virginia (because

of the price substitution effect between natural gas and coal). The

areas in Texas that are under the most direct threat are smaller,

less diverse metro economies such as Midland and Odessa. And

yet even in the case of these two metros, any adverse effect

on employment has so far been unsubstantial. Year-over-year

employment growth in Midland was still 8.8% as of February and

down just 50 basis points from the peak last October. In Odessa,

year-over-year employment growth is down 130 basis points since

October, but still registered a 7.6% increase as of February.

Among larger metros, Houston and, to a lesser extent, Fort Worth

will be impacted because of the relatively high concentration of

exploration jobs in those metros. Even though the oil price decline

will mostly hit the exploration industry, there are also many professional

services firms in the area that rely on business from the energy

industry creating the potential for significant secondary employment

impacts. Job growth in the oil and gas extraction industry has certainly

slowed since mid-2014. As of February, oil and gas extraction

payrolls expanded by 1.9% year-over-year, compared with 3.1% as

of February 2014. Yet the rapid pace of job growth in this industry

was already in decline in Houston well before the downturn in oil

prices; after reaching a cyclical high of 12.6% in mid-2012, annual

increases in payrolls have gradually slowed through early 2014.

Since then, growth has been steady around 1%-2%. Overall, job

growth has still remained positive. Houston actually registered an

annual increase in payrolls of 3.4% as of February. This is down

from the 3.8% increase as of December, but in line with annual

job growth figures from late 2013 to early 2014. January did see

the first monthly job losses in the metro since 2011, but January

has been a weak month for job growth for several years. Moreover,

job growth has been muted across the country during the first few

months of the year.

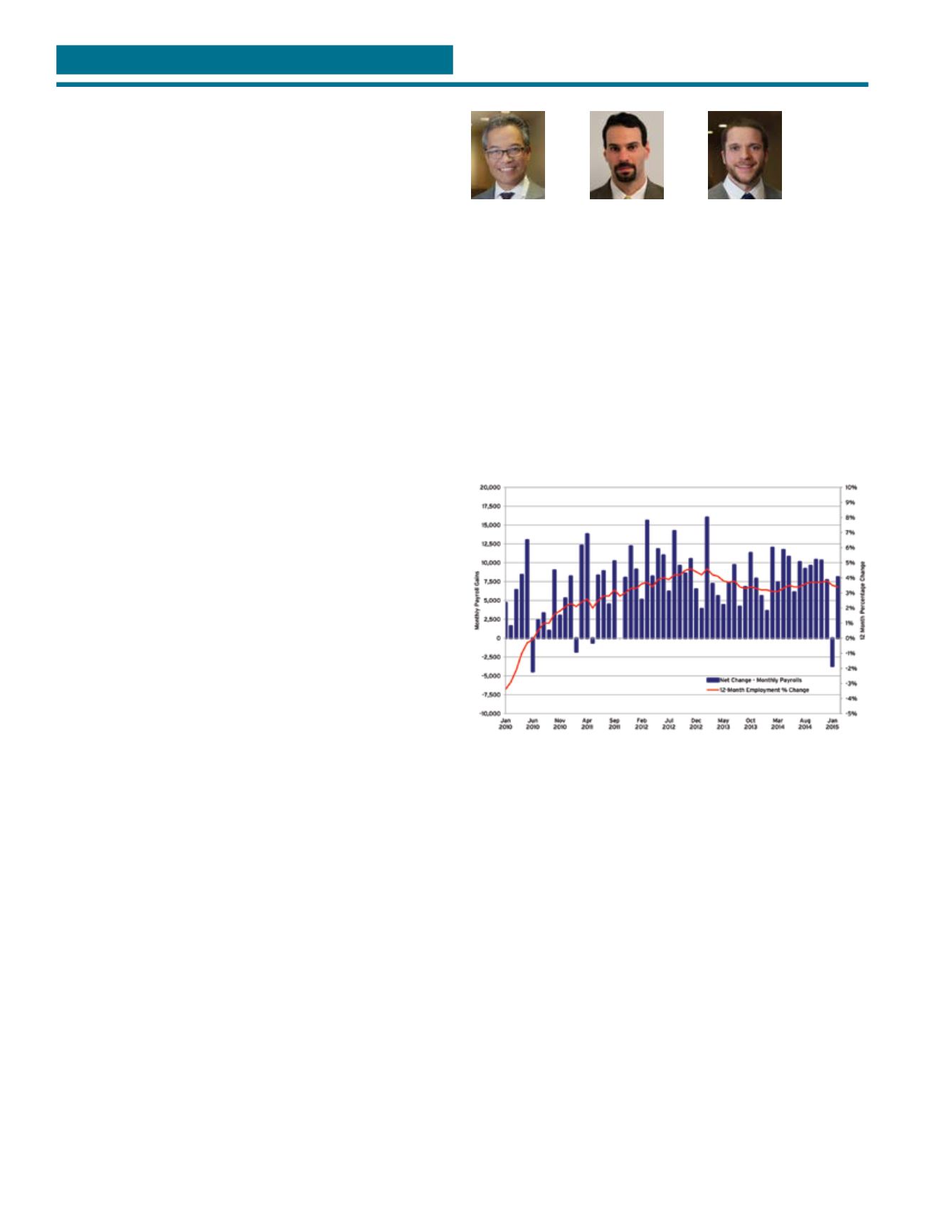

Exhibit 1

Houston Nonfarm Payroll Employment

Source: Bureau of Labor Statistics

On the bright side, the larger Texas metros are not as dependent

on the energy sector as they once were, such as during the 1980s

oil price decline, so they are better positioned to weather the

downturn. In Houston, a greater presence from healthcare, research

and professional services firms will help keep the metro’s economy

growing. And in fact, payroll gains within Education and Health

Services and Professional and Business Services has bolstered

Houston’s recent job gains. Employment in the Leisure and

Hospitality industry has also been solid. The state also benefits

from very positive demographic trends. Houston’s population is

projected to grow 8.7% over the next five years, driving an 11.0%

increase in households. This compares to expectations of 5.3%

and 7.5% growth in each respective category for the nation as a

whole. This strong population growth should continue to support

household formation and the demand for apartments.

As such, low energy prices have had little effect on our multifamily

outlook for Houston. Let us be clear — we are not saying that the

metro’s market will continue to do incredibly well. We are already

calling for increasing vacancies and a moderation in rent growth

I

Low Energy Prices’ Impact Mixed, Multifamily May Be Least PronouncedRyan Severino, CFA

Senior Economist and

Director of Research

Reis

Bradley Doremus

Associate, Research

& Economics

Reis

Dr. Victor Calanog

Chief Economist and

Senior Vice President

Reis

Boomtowns: The Knock on Effects of Oil Prices