A publication of

Summer issue 2015 sponsored by

A publication of

Summer issue 2015 sponsored by

CRE Finance World Summer 2015

11

Considered individually, the factors may not establish future

demand growth. However, the confluence of several of these

attributes point to long-term economic expansion.

Once the markets are identified using the aforementioned criteria,

metros that benefit from those factors, but are major markets

are not included. Markets with demand generators that include

technology and energy are performing better than others. It

remains to be seen what effect plummeting oil prices will have on

energy dependent sectors. Accordingly, we did not including any

energy centric markets on our list

4

. Since there are few barriers to

entry in most American metro areas on the supply side, focus is

placed on long term sustainable demand.

Educational Attainment

Metro areas with high education attainment levels have experienced

much more economic growth than those with significantly below

average education rates. This trend will likely continue and reinforce

itself as college graduates self-sort to places with other college

graduates. This takes the form of a persistent cycle in which

“knowledge breeds knowledge”

5

. As the overall American population

grew more educated between 1970 and 2010, metro areas became

less alike in their rates of college degree attainment

6

. “A 10%

increase in the percentage of an area’s adult population with a

degree in 1980 predicts six percent more income growth between

1980 and 2000”

7

. “Differences in adults’ rate of bachelor’s degree

attainment are associated with nearly three-quarters of the variation

in per capita income among metro areas in 2010”

8

. “Metro areas

where more than 33% of adults were college-educated had an

average unemployment rate of 7.5 percent in early 2012, compared

with 10.5 percent for cities where less than 17% of adults had a

college degree”, according to Edward Glaeser

9

. Aside from serving

as a proxy for the overall economic health of a metro area, education

attainment rates point to more office-using jobs.

Some of the nation’s highest educational attainment levels are in

the major market metro areas. The highest is Washington, DC with

46.8% of residents having achieved a Bachelors Degree or higher.

The top 10 are rounded out by San Jose 45.3%, Stamford, CT

44%, San Francisco 43.4%, Madison, WI 43.3%, Boston 43.0%,

Raleigh 41%, Austin 39.4%, Denver 38.2% and Minneapolis

37.9%

10

. The national metro average is 32%.

Demographic Trends

A young growing population is important, as overall long-term

demographic trends are cause for concern for office space

demand. Once baby boomers leave the workforce in growing

numbers between 2015 and 2030, there will be fewer workers

to fill office buildings. Metros with a growing college educated

millennial population (born between 1980 and 2000) will have

a higher demand for office space.

Population growth alone is not sufficient to fill office buildings.

The focus needs to be on college educated population growth.

College educated millennials will occupy office buildings well in to

2030 and will not begin retiring until 2045 and beyond. Employers

favor locating and expanding operations in metro areas that have

a young, highly educated, and growing workforce. Accordingly, we

considered which metro areas have an increasing level of educated

young people.

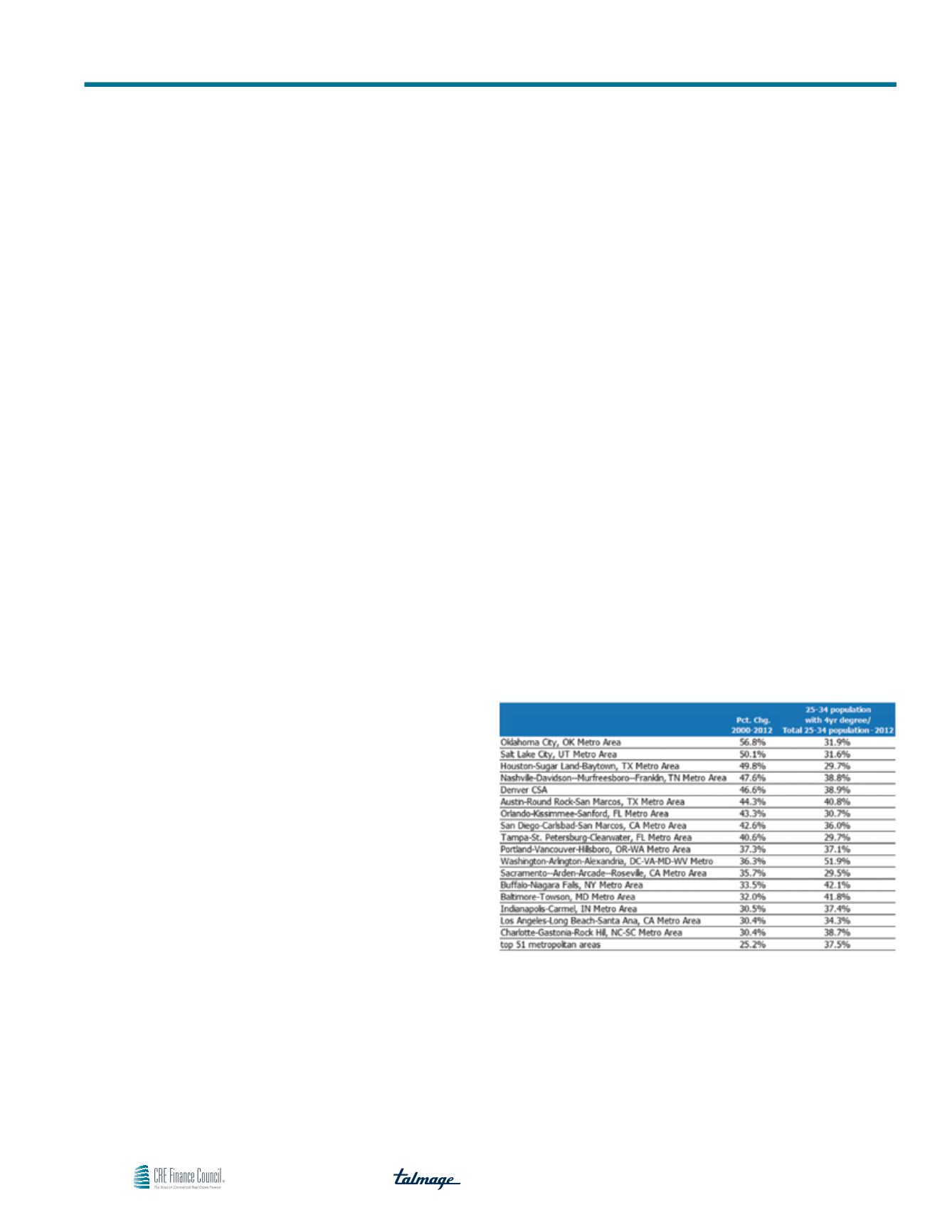

The number of YCEs has increased 25.2% from 2000 to 2012

in the 51 largest metro areas

11

. The share of the YCE population

with a 4yr degree in 2012 was 37.5% in the 51 largest metro

areas. Markets that exceed the top metro average growth of

25.2% between 2000 and 2012 portend future economic growth

and demand for office space relative to other markets. Seventeen

metro areas experienced growth of 30% or more and have an

existing share of YCEs equal to or greater than 30%. This is

highlighted in Table 2

12

.

Table 2

College Graduates Aged 25 to 34

Source: Joe Cortright, City Observatory

This list generally follows a pattern of self sorting in which college

educated Americans migrate to metros with economic growth

opportunities. This is causing certain metros to diverge significantly

from others. Oklahoma City and Houston benefited from a growing

energy sector. Greater Salt Lake City benefits from internal population

growth, in-migration, and a healthy high-tech sector. Nashville has

benefitted from a growing healthcare sector, successful entertainment

industry, relatively low cost housing, and no state income tax. Charlotte

Beyond The Big Six: Identifying Alternative Us Office Markets Based On Long Term Demand Generators