CREFC's December 2025 Monthly CMBS Loan Performance Report

January 30, 2026

CRE Finance Council has released a report on CMBS loan performance for December.*

Key takeaways:

DELINQUENCY RATE CLIMBS AGAIN TO END 2025

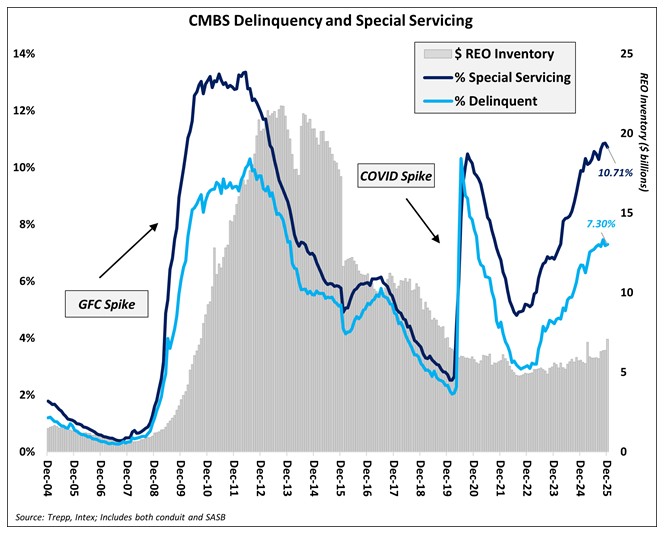

- Conduit/SASB CMBS combined delinquency rate of 7.30%

- Delinquency rate increased 4 bps in December and in eight of 12 months in 2025; On a YOY basis, the overall combined delinquency rate rose 73 bps (7.30% vs. 6.57% in December 2024)

- Office stabilization gains traction, but retail emerges as the new stress leader

- Office posted large improvements in both delinquency (−37 bps to 11.31%) and special servicing (−52 bps), marking its second consecutive month of improvement

- Retail displaced office as the top contributor to new SS transfers, accounting for nearly half of December's $1.9B in new transfers

- The maturity wall remains the elephant in the room

- When including performing matured balloons (loans current on payments but past maturity), the effective delinquency rate rises to 8.75%—signaling that extension and modification activity is masking underlying refinancing stress

*Source: Trepp. CMBS data in this report reflect a total outstanding balance of $637.1B: 53.1% ($338.5B) conduit CMBS, 46.9% ($298.6B) single-asset/single-borrower (SASB) CMBS.

Click here to download the full report. Contact Raj Aidasani for more information on CMBS loan performance.