Proposed Section 899 Retaliatory Tax Withdrawn

June 27, 2025

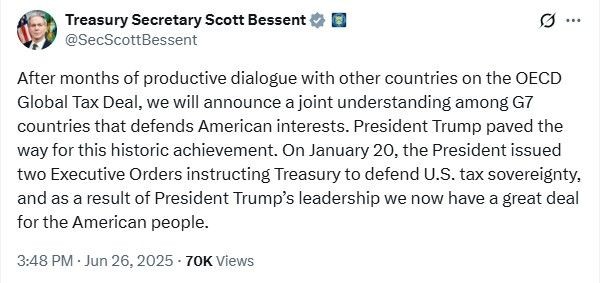

Treasury Secretary Scott Bessent on June 26 posted on X.com that he has asked Congress to remove the Section 899 retaliatory tax from the One Big Beautiful Bill Act (OBBB).

Chairmen of the congressional tax committees, Rep. Jason Smith (R-MO) and Sen. Mike Crapo (R-ID)

issued a statement shortly after confirming the removal of the provision: