CRE Securitized Debt Update

September 30, 2025

Private-Label CMBS and CRE CLOs

Nine transactions totaling $7.4 billion priced last week:

- ESA 2025-ESH, a $1.9 billion SASB backed by a floating-rate, five-year loan (at full extension) for a joint venture between Blackstone and Starwood to refinance a portfolio of 220 extended-stay hotels operated by Extended Stay America, Inc., totaling 24,560 rooms across 33 states.

- BSPRT 2025-FL12, a $1.1 billion CRE CLO sponsored by Benefit Street Partners. The managed transaction comprises 44 loans secured by 73 properties. The pool’s top three property types are multifamily (61.8%), hotel (22.3%), and industrial (12.1%).

- BANK5 2025-5YR17, a $1 billion conduit backed by 44 five-year loans secured by 66 properties from JPMorgan, Morgan Stanley, Wells, and BofA.

- NRTH 2025-PARK, a $900 million SASB backed by a floating-rate, five-year loan (at full extension) for NorthPark Management to refinance the 1.9 million square foot NorthPark Center super-regional mall in Dallas.

- BMO 2025-C13, an $814.2 million conduit backed by 47 10-year loans secured by 89 properties from BMO, Deutsche, Key, Citi, Goldman, JPMorgan, Zions, Benefit Street, LMF, Starwood, and Greystone.

- WFCM 2025-5C6, a $622.7 million conduit backed by 26 five-year loans secured by 51 properties from Wells, JPMorgan, LMF, Rialto, Argentic, Citi, Goldman, and UBS

- VTR 2025-STEM, a $475 million SASB backed by a fixed-rate, four-year loan for Ventas and GIC to refinance two life-science properties totaling 811,000 square feet in Pennsylvania.

- HAVN 2025-MOB, a $278.3 million SASB backed by a floating-rate, five-year loan (at full extension) for Welltower and Wafra to refinance 22 medical office properties in 13 states.

- WFCM 2025-AURA, a $275 million SASB backed by a floating-rate, five-year loan (at full extension) for BTG Pactual and Morning Calm Management to refinance a portfolio of 24 industrial properties totaling 4.8 million square feet across Ohio and Michigan.

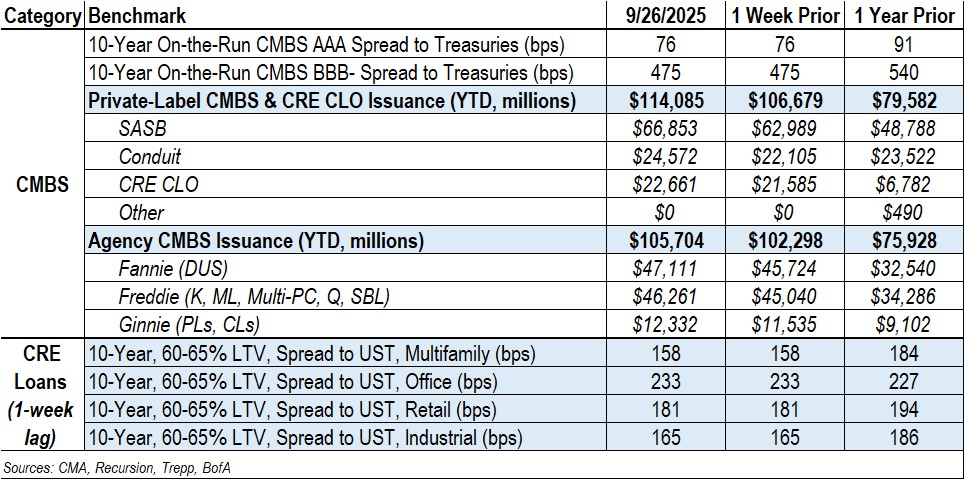

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totals $114.1 billion, representing a 43% increase from the $79.6 billion recorded for same-period 2024.

Spreads Unchanged

- Conduit AAA and A-S spreads were unchanged at +76 and +113, respectively. YTD, AAA and A-S spreads are wider by 1 bp and 8 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +190, respectively. YTD, they are each wider by 25 bps.

- Conduit BBB- spreads were unchanged at +475. YTD, they are wider by 50 bps.

- SASB AAA spreads held steady in a range of +105 to +132, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +130 and +335, respectively.

Agency CMBS

- Agency issuance totaled $3.4 billion last week, comprising $1.4 billion of Fannie DUS, $1.2 billion of Freddie K, Q, and Multi-PC transactions, and $797.3 million of Ginnie Mae Project Loan transactions.

- Agency issuance for the year totals $105.7 billion, 39% higher than the $75.9 billion for same-period 2024.