CRE Securitized Debt Update

September 16, 2025

Private-Label CMBS and CRE CLOs

Five transactions totaling $3.5 billion priced last week:

- MAD 2025-11MD, a $1.4 billion SASB backed by a fixed-rate, five-year loan for a joint venture between SL Green and PGIM to refinance 11 Madison, a 30-story Class A office property totaling 2.3 million square feet in Manhattan.

- SCG 2025-SNIP, a $930 million SASB backed by a floating-rate, five-year loan (at full extension) for Starwood Capital to refinance 55 industrial properties totaling 8.2 million square feet in five states.

- BMARK 2025-V17, a $629 million conduit backed by 27 five-year loans secured by 145 properties from Deutsche, Citi, Goldman, BMO, and Barclays.

- WFCM 2025-HI, a $325 million SASB backed by a floating-rate, five-year loan (at full extension) for KSL Capital Partners to refinance two full-service, beachfront resorts in Hawaii.

- MAC 2025-801B, a $229 million SASB backed by a floating-rate, five-year loan (at full extension) for a joint venture between Monarch Alternative Capital and Tourmaline Capital Partners to refinance a 415,000 square foot office building in Miami.

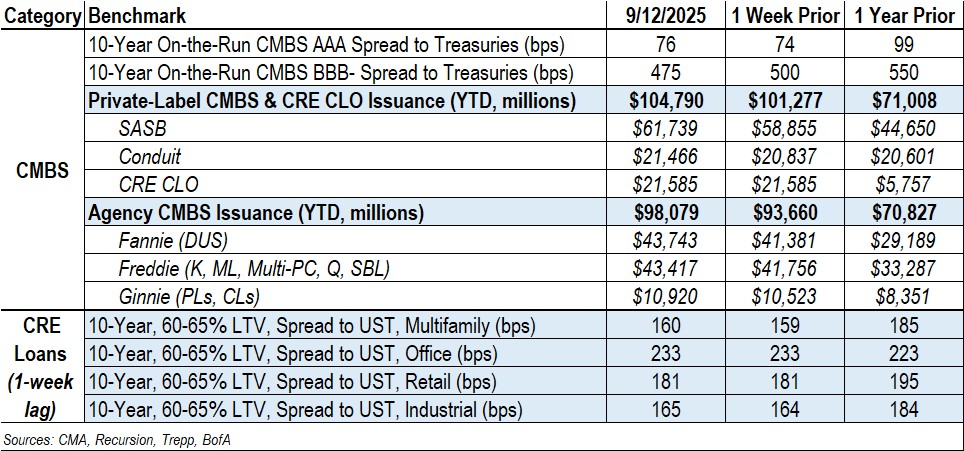

By the numbers: Year-to-date private-label CMBS and CRE CLO issuance totaled $104.8 billion, representing a 48% increase from the $71 billion recorded for the same period in 2024.

Spreads Mostly Unchanged

- Conduit AAA spreads were wider by 2 bps to +76 while A-S spreads were unchanged at +113. YTD, AAA and A-S spreads are wider by 1 bp and 8 bps, respectively.

- Conduit AA and A spreads were unchanged at +160 and +190, respectively. YTD, they are each wider by 25 bps.

- Conduit BBB- spreads were tighter by 25 bps to 475. YTD, they are wider by 50 bps.

- SASB AAA spreads were wider by 1 - 2 bps to a range of +105 to +128, depending on property type.

- CRE CLO AAA and BBB- spreads were unchanged at +130 and +335, respectively.

Agency CMBS

- Agency issuance totaled $4.4 billion last week, comprising $2.4 billion of Fannie DUS, $1.7 billion of Freddie K and Multi-PC transactions, and $396.6 million of Ginnie transactions.

- Agency issuance for the year totaled $98.1 billion, 38% higher than the $70.8 billion for the same period last year.

Contact Raj Aidasani (raidasani@crefc.org) with any questions.